The price of Bitcoin continues to climb up to the magic limit of $10,000. This weekend the price easily broke $9,000 and at the time of writing a Bitcoin is worth $9,400. That means, knowing that Bitcoin could still be purchased in January 2017 for less than $1000, a value increase of 1000% in one year.

Lost Bitcoins

Bitcoin was launched in 2009. In the first years

There are many ways in which Bitcoins can get out of circulation. For example, someone can lose the private key of his wallet, send a transaction to the wrong address, or have died in the meantime. Bitcoins can also be lost due to hardware problems, for example because a hard disk crashed or was carelessly discarded or replaced because the owners simply forgot their purchase over the years.

It is therefore not difficult to understand that a number of Bitcoins are no longer in circulation today.

No inflation

By the end of 2040 all Bitcoins will have been mined and in theory some 21 million should have been put into circulation. Because the Bitcoin blockchain does not allow inflation, that is the maximum number of Bitcoin that can ever exist.

According to estimates, some 6 million Bitcoins are currently actively traded via active Bitcoin addresses. That is a much smaller number than the 16.7 million Bitcoins that should currently be in circulation. The question is what happened to those other Bitcoins, and whether they will ever come into circulation again.

Blockchain analysis

To investigate this, the respectable technology company Chainalysis, that conducts research for its clients in the context of the protection of digital assets, analyzes and monitors the Bitcoin blockchain on a daily basis.

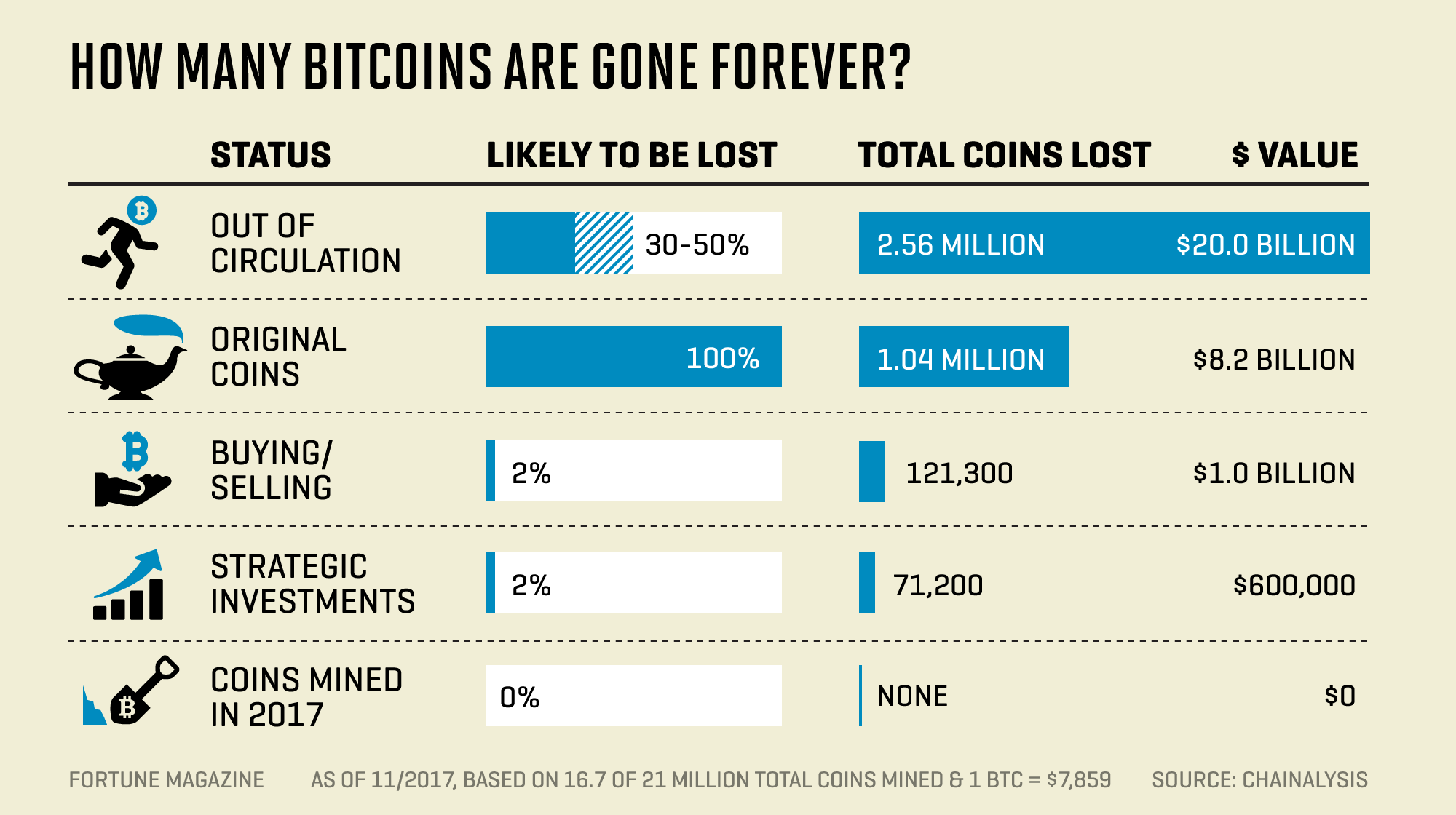

The results of their most recent analysis, published last weekend in the American magazine Fortune, show that a lot of Bitcoins were probably lost. The company estimates that it is between 2.78 million and 3.79 million Bitcoins, or about 17% to 23% of the total number of Bitcoins in circulation. With a value of € 7.880 for one Bitcoin today, this number represents a value between 22 billion and 32 billion Euro.

Chainalysis has some big clients, like the US tax authorities ISR and European Europol. Last summer it also became apparent that the company had found the 650,000 Bitcoins that had been stolen in 2014. (the famous Mt.Gox hack)

Categories

Of course, the company cannot say with certainty how many bitcoins have been lost, but it uses detailed empirical analyzes of the Bitcoin blockchain and statistical extrapolation of a number of other assumptions to get the best possible picture of the Bitcoin market.

The research splits the number of Bitcoins in 4 categories:

- The mined bitcoins. These are considered as not lost.

- The traded bitcoins represent the number of bitcoins traded in the past year.

- The strategic investment capital represents Bitcoin addresses where no transactions have taken place for more than a year.

- Satoshi coins that were managed by the anonymous maker of Bitcoin, Satoshi Nakamoto.

Assumptions

The study uses a number of assumptions:

• The loss of Bitcoins that are not in circulation because they are kept by long-term holders is estimated to be between 30% and 50%.

• The original Bitcoins, owned by the Bitcoin designer, Satoshi, have all been lost

Methods

The analysts largely keep the procedure secret for their analysis

- Hard forks

One of the ways to conduct research on the different addresses on a blockchain is by using hard forks on the Bitcoin network, such as Bitcoin Cash last summer. Such forks can encourage the Bitcoin holders to carry out a transaction on long inactive addresses, which can be used for statistical analysis. This provides insight into the capital of these long-term holders, the category with the greatest uncertainty. - Internet

The company assumes that around 2% of the number of actively traded Bitcoins has been lost. This figure was calculated by skimming the internet to messages from users and companies that lost Bitcoins by carelessness or carelessness, for example by entering a wrong address. This percentage is therefore not based on statistical extrapolation and can be further refined in the coming years. - Satoshi coins

From Nakamoto Satoshi, the anonymous developer of Bitcoin, nothing has been heard since 2011. The Bitcoin addresses that belong(ed) to him represent just over 1 million Bitcoins, and the company assumes that none of these coins will come into circulation. If the assumption that these Bitcoins will remain out of circulation is correct, this can cause a shock effect on the market price. - Mt.Gox

On the 8th of June this year, an American hearing announced that the company also had found the 850,000 bitcoins that were stolen in 2014 during the Mt. Gox crisis, the biggest hack in the history of Bitcoin. The hack made sure that Mt. Gox, one of the first major Bitcoin exchanges, had to close the books and all customers saw their crypto capital go up in smoke.

Influence on the stock market value

The question now is whether the market has already calculated these lost bitcoins in the current market value, the answer is yes and no.

On the one hand, the direct calculation of the market value does not take into account lost coins. This market value can be used in economic models that have an impact on the expenses and exchange transactions. On the other hand, the market has in the meantime adapted to the current situation of supply and demand and we can clearly see this on the online cryptocurrency exchanges, which have to adjust their reserves to Fiat coins.

Buy Bitcoin

According to some technical analysts, it is certainly not too late to invest in Bitcoin. According to their most recent forecasts, the price for Bitcoin will reach more than $10,000 before the end of 2017, and will rise further in 2018 to $14,000. Moreover, the interest in blockchain technology and in Bitcoin in particular has never been greater.

WHERE TO CONTACT US

Website : www.forextrade1.com

Twitter : twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

You Tube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Mail ID : info@forextrade1.com