Today’s given signal : https://t.me/calendarsignal/11199

Employment Outlook

One of the key factors affecting the gold price is the perception of the employment outlook. The JOLTS report provides insights into the job market, including the number of job openings and the level of hiring activity. A higher number of job openings typically suggests a strengthening job market, which can lead to increased confidence in economic growth and reduced demand for safe haven assets such as gold.

Consumer Sentiment

The release of JOLTS job openings also affects consumer sentiment. When the job market is strong and unemployment is low, consumers tend to have higher levels of confidence and are willing to take on more risk, including investing in stocks and other assets. This reduced demand for safe haven assets like gold can lead to price declines.

Interest Rate Expectations

The JOLTS report can also influence interest rate expectations. When the labor market is strong and unemployment is low, the Federal Reserve may tighten monetary policy and raise interest rates. This increase in interest rates can make holding non-yielding assets like gold less attractive, leading to a correction in prices.

Technical Factors

In addition to the economic factors, technical factors can also play a role in the gold price correction following the release of the JOLTs job openings. Market participants often analyze the release of economic data for signs of buying or selling opportunities. If investors interpret the JOLTs report as indicating a stronger job market, they may sell their gold positions in order to allocate capital to other assets. This selling pressure can contribute to the price decline.

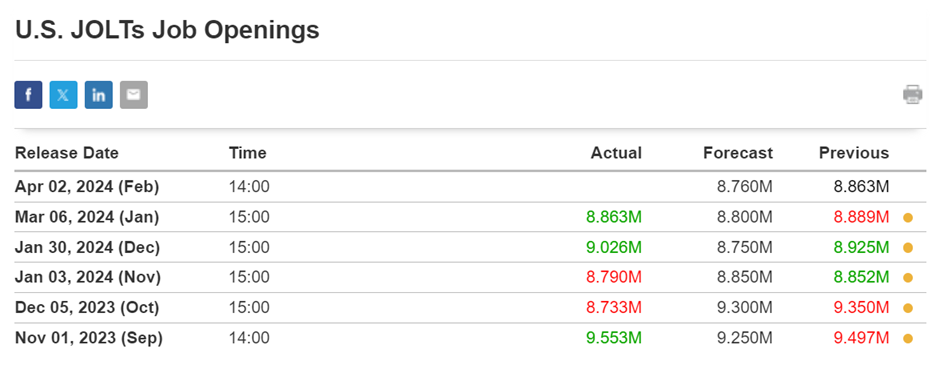

Previous released data results :