Gold, known for its role as a safe-haven asset, often experiences fluctuations in price in response to various economic indicators and factors. Among these, the release of positive data on employment, services, and manufacturing can have an influence on gold prices. This document will discuss the implications of good ADP Nonfarm employment data, higher S&P Global service PMI, and positive ISM Nonmanufacturing data on gold prices.

Today’s given signal : https://t.me/calendarsignal/11219

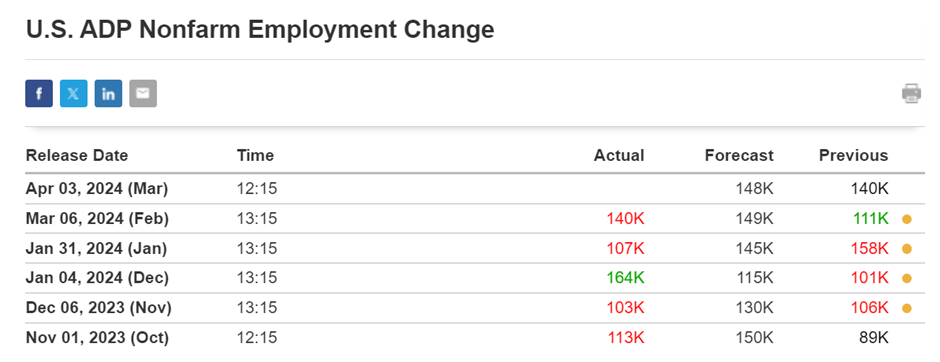

1. ADP Nonfarm Employment Data: ADP Nonfarm Employment data is a monthly release that provides an estimate of private-sector employment in the United States. When this data shows strong employment growth, it suggests that the economy is expanding and that the demand for goods and services is increasing. This positive news can have an indirect impact on gold prices as it suggests that investors may be less concerned about the risks associated with economic downturns.

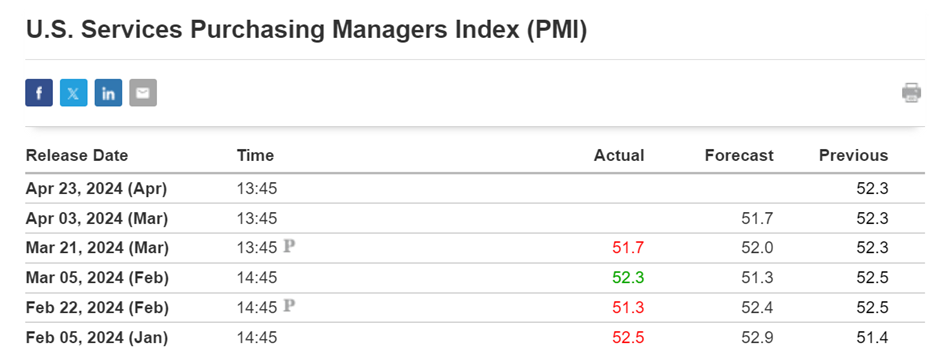

2. S&P Global Service PMI: S&P Global Service PMI, also known as the Purchasing Managers’ Index (PMI), is a monthly survey that measures the performance of the services sector in economies around the world. A higher PMI reading indicates expansion, indicating increased business activity and expansion within the service sector. When this data is positive, it suggests that the economy is growing, which can weigh on gold prices as investors may shift their focus away from safe haven assets.

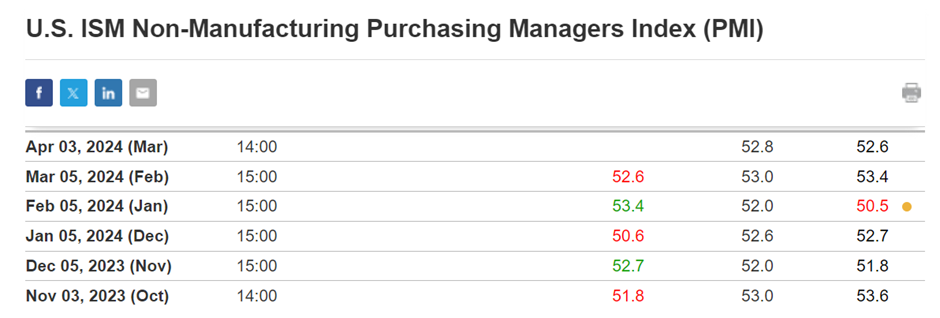

3. ISM Nonmanufacturing Data: ISM Nonmanufacturing data is a monthly release that measures the health of the non-manufacturing sector, which includes industries such as healthcare, retail, and transportation. A positive reading suggests that activity is improving within the non-manufacturing sector, which can drive economic growth and reduce investor demand for gold as a safe-haven asset.

When ADP Nonfarm Employment, S&P Global Service PMI, and ISM Non-Manufacturing Data exhibit positive trends, it may cause gold prices to decrease. Investors may perceive less need for a safe haven asset and shift toward other investments, such as stocks or bonds, that perform well in a growing economy. Additionally, a decrease in gold prices can be attributed to increased confidence in the stability of the financial markets and a decline in demand for gold as a hedge against inflation.

Previous released data results :

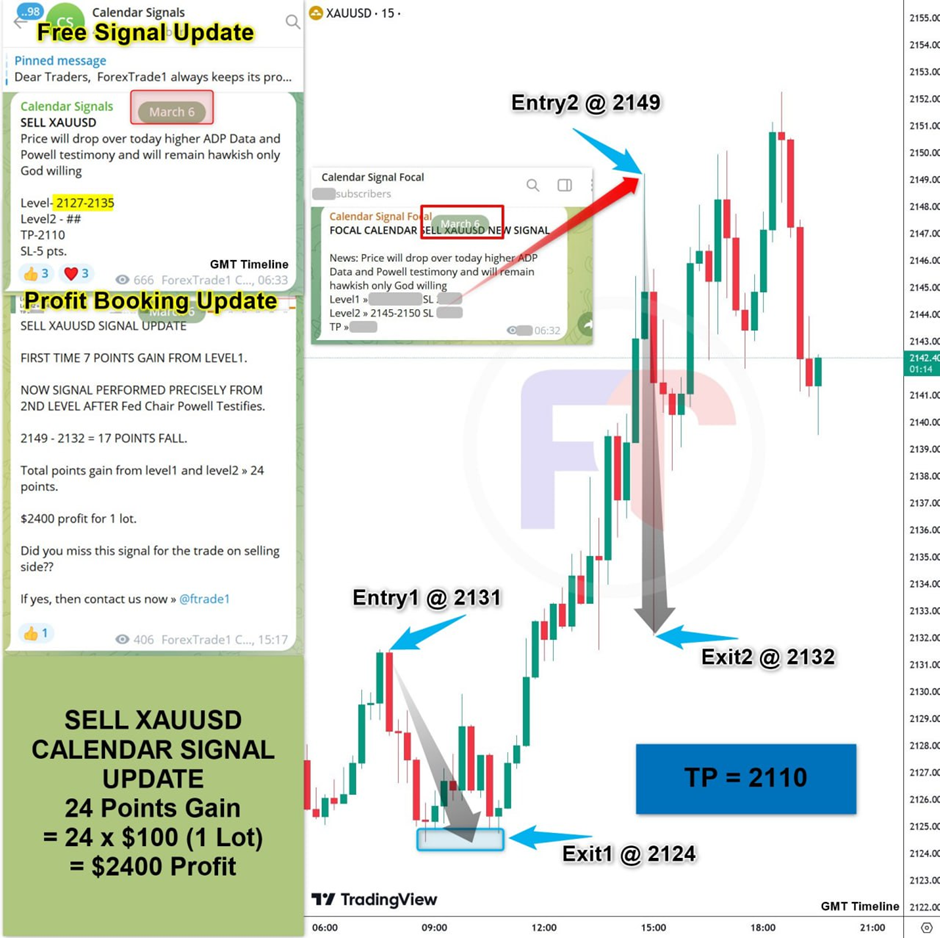

On last ADP data (6-3-2024) we predict to SELL XAUUSD as for higher ADP Data GOLD price was fall.

Check the previous blog : https://blog.forextrade1.co/impact-of-powells-speech-and-adp-data-on-the-gold-pair-6-3-2024/

Check last given signal : https://t.me/calendarsignal/10796

Performance :

On last S&P Global data (21-3-2024) we predict to SELL XAUUSD as for Surprising Data, GOLD price was fall.

Check last given signal : https://t.me/calendarsignal/11025

Performance :

On last ISM Non-Manufacturing data (5-3-2024) we predict to SELL XAUUSD as for good data was created selling pressure on Gold.

Check the previous blog : https://blog.forextrade1.co/breaking-down-the-impact-of-positive-us-ism-non-manufacturing-data-on-gold-prices-5-3-2024/

Check last given signal : https://t.me/calendarsignal/10779