The price of gold has often been influenced by various factors, including economic data from various countries. Recently, the release of negative ADP and ISM manufacturing data in the United States has caused concern among investors and analysts, raising questions about its impact on the price of gold. This document explores the implications of economic data releases on the price of gold, with a focus on the period between May 1st and May 5th, 2024.

Today’s given signal : https://t.me/calendarsignal/11804

Impact of negative ADP and ISM manufacturing data on the Price of Gold

The negative ADP and ISM manufacturing data in the United States have the potential to impact the price of gold. When economic data disappoints, investors tend to flock to safe-haven assets such as gold as a hedge against market volatility and potential inflation. The uncertainty generated by the negative employment data and contracting manufacturing activity is perceived as a threat to the economic recovery, leading investors to seek protection in gold.

Historically, negative economic data has shown a positive impact on gold prices. Investors often turn to gold during times of economic uncertainty or downturns as a hedge against potential inflation or currency devaluation. In this scenario, the negative ADP and ISM manufacturing data could further boost demand for gold, leading to an increase in its price.

It is important to note that the impact of these economic data releases on the price of gold may vary across different timeframes. The May 1st to May 5th, 2024 period provides a snapshot of the potential influence, but the overall trend and magnitude of the impact can vary depending on various other factors, including global economic developments and investor sentiment.

impact on GOLD

The release of negative ADP and ISM manufacturing data in the United States on May 1st and May 3rd, 2024, raised concerns about the overall health of the US economy. These economic data releases have the potential to impact the price of gold, as investors may turn to gold as a safe-haven asset during times of economic uncertainty. While the exact impact of the data releases on the gold price may vary, the negative sentiment surrounding these economic indicators could support an increase in the price of gold during this period.

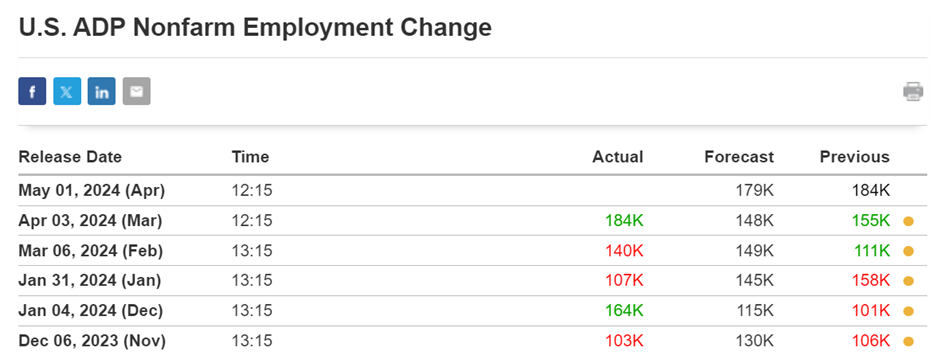

Previous released data results :

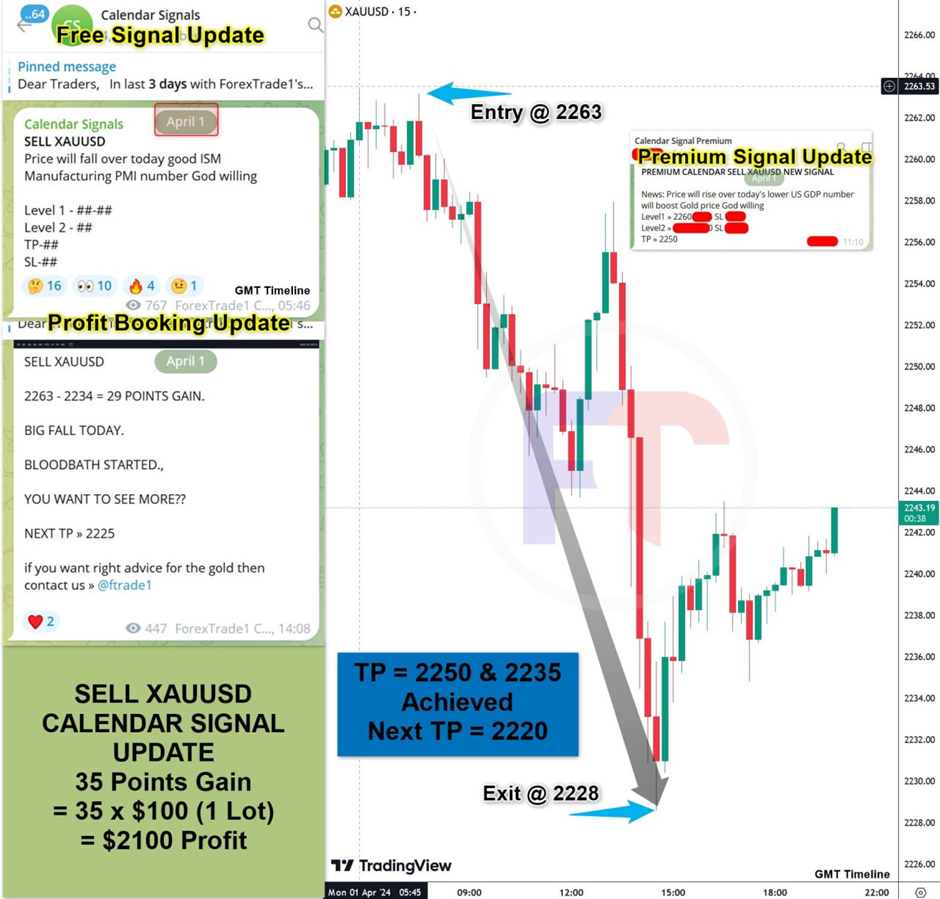

On last data (1-4-2024) we predict to SELL XAUUSD as for ISM Manufacturing PMI number, GOLD price was fall.

Check the previous blog :

https://blog.forextrade1.co/bloodbath-in-the-gold-market-today-following-the-release-of-the-ism-manufacturing-pmi-data-1-4-2024/

Check last given signal : https://t.me/calendarsignal/11178

Performance :

On last data (3-4-2024) we predict to SELL XAUUSD as for good ADP Data price was fall.

Check the previous blog : https://blog.forextrade1.co/unpacking-the-impact-of-adp-nonfarm-employment-sp-global-service-pmi-ism-non-manufacturing-data-on-gold-prices-3-2-2024/

Check last given signal : https://t.me/calendarsignal/11219

Performance :

WHERE TO CONTACT US

Website: https://forextrade1.co/

Twitter: www.twitter.com/forextrade11

Telegram: telegram.me/ftrade1

Facebook: www.facebook.com/Forextrade01

Instagram: www.instagram.com/forextrade1

YouTube: www.youtube.com/ForexTrade1

Skype: forextrade01@outlook.com

Email ID: info@forextrade1.com