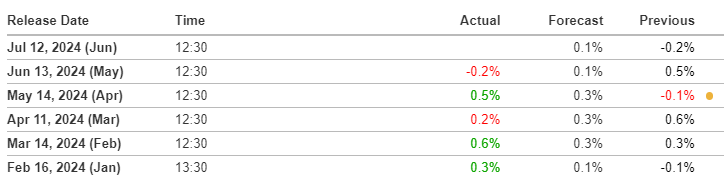

Today’s US PPI data release is critical for gold traders. Higher PPI suggests rising inflation, which can boost gold prices, while also prompting potential Federal Reserve policy changes that might strengthen the dollar and impact gold negatively. Stay informed to navigate these market dynamics effectively.

Today’s Given Signal » https://t.me/calendarsignal/13699

The US Producer Price Index (PPI) is a key economic indicator that measures inflation at the wholesale level. Changes in PPI data can significantly impact gold prices through various channels:

- Inflation Expectations: Higher-than-expected PPI indicates rising inflation, increasing demand for gold as a hedge, and pushing prices higher. Conversely, lower-than-expected PPI suggests lower inflation, potentially reducing gold demand and prices.

- Federal Reserve Policy: Rising PPI may prompt the Federal Reserve to consider tightening monetary policy, leading to higher interest rates. Higher rates can lower gold prices by increasing the opportunity cost of holding non-yielding assets like gold.

- US Dollar Strength: Higher PPI data can strengthen the US dollar due to expectations of tighter monetary policy. A stronger dollar makes gold more expensive for foreign buyers, potentially lowering demand and prices.

- Market Sentiment: Higher inflation from rising PPI can increase market volatility and boost demand for safe-haven assets like gold.

Check last given signal : https://t.me/calendarsignal/12976

Signal Performance link » https://t.me/calendarsignal/13019

In summary, today’s PPI data can influence gold prices through its impact on inflation expectations, monetary policy, and currency strength. Understanding these dynamics helps traders anticipate potential movements in gold prices.

WHERE TO CONTACT US

Website: https://forextrade1.co

Twitter: www.twitter.com/forextrade11

Telegram: telegram.me/ftrade1

Facebook: www.facebook.com/Forextrade01

Instagram: www.instagram.com/forextrade1

YouTube: www.youtube.com/ForexTrade1

Skype: forextrade01@outlook.com

Email ID: info@forextrade1.com