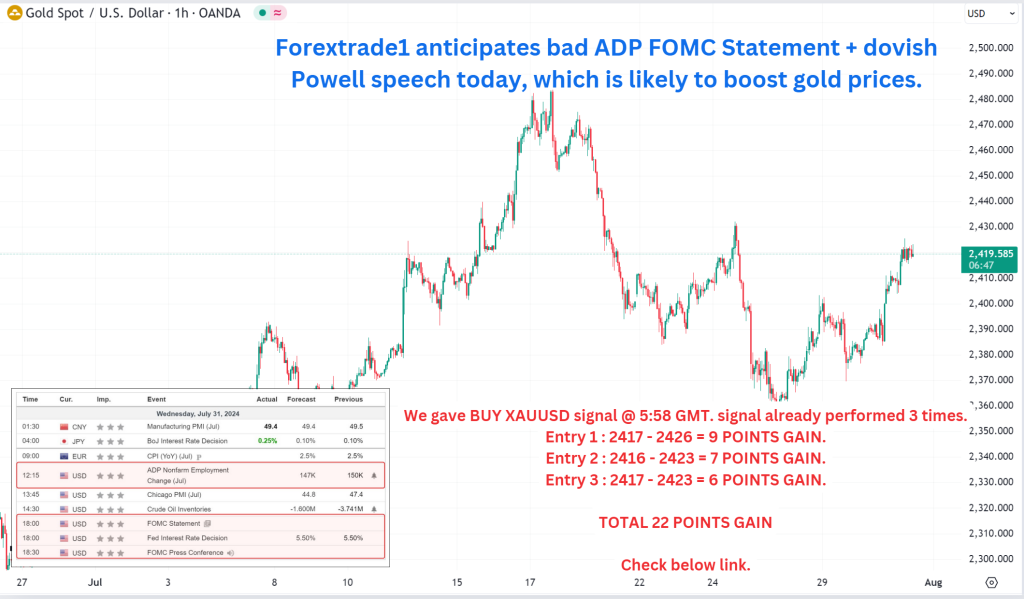

On 31st July 2024, the gold market will experience a significant boost due to a combination of factors. The release of bad ADP data, a hawkish FOMC statement, and a dovish speech by Federal Reserve Chairman Jerome Powell all contribute to the precious metal’s price surge. Additionally, indications of a rate cut in September further fuel the price increase. This document explores the impact of these factors on the gold market on 31st July 2024.

Today’s given signal : https://t.me/calendarsignal/14136

Bad ADP Data:

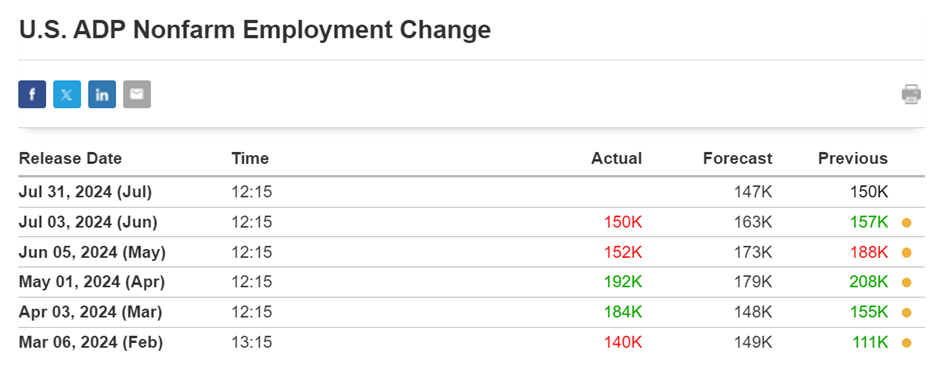

On 31st July 2024, the ADP Employment Report releases disappointing numbers, indicating a weak labor market. The ADP data serves as a leading indicator of the official Non-Farm Payrolls (NFP) report, which is released a few days later. When the data is weak, it raises concerns about the strength of the U.S. economy and prompts investors to seek safe havens such as gold. The bad ADP data on 31st July 2024 serves as a catalyst for the gold price to rise.

Hawkish FOMC Statement:

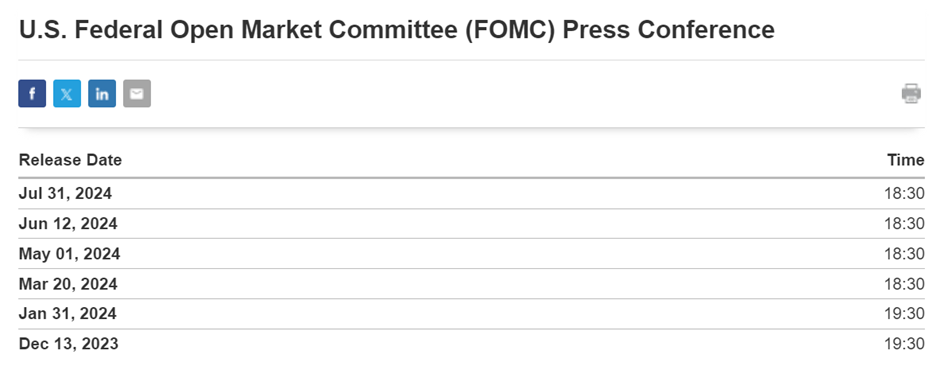

On the same day, the Federal Open Market Committee (FOMC) issues a statement regarding monetary policy. The statement suggests that the Federal Reserve is considering raising interest rates to combat inflation. However, the hawkish tone disappoints investors who had hoped for a more accommodative stance. The hawkish FOMC statement weakens confidence in the economy, further boosting demand for gold as a safe-haven asset.

Dovish Speech by Jerome Powell:

Later in the day, Federal Reserve Chairman Jerome Powell delivers a speech that echoes a more dovish tone. Powell emphasizes the Fed’s commitment to supporting the economy and maintaining price stability. This dovish stance is in contrast to the previous day’s hawkish FOMC statement, creating confusion and uncertainty in the market. Investors interpret Powell’s dovish remarks as an indication that the Federal Reserve may be open to cutting interest rates in the near future. This news further fuels the upward trend in gold prices on 31st July 2024.

Indication for Sep Rate Cut:

In addition to the bad ADP data, hawkish FOMC statement, and dovish speech, there are indications on 31st July 2024 that the Federal Reserve may cut interest rates in September. This speculation arises from earlier signals and discussions among policymakers. If the Federal Reserve signals the possibility of a rate cut, it enhances the appeal of gold as an investment, as it is considered a hedge against lower interest rates. The possibility of a rate cut adds fuel to the gold price rally on 31st July 2024.

Previous released data results :

On last FED Statement & Powell speech (12-6-2024) we predict to BUY XAUUSD, GOLD price was raised as we predict.

Check the previous blog : https://blog.forextrade1.co/the-impact-of-us-consumer-price-index-and-federal-reserve-statement-today-on-gold/

Check last given signal : https://t.me/calendarsignal/12942

Performance : https://t.me/calendarsignal/12971

On last ADP data (3-7-2024) we predict to BUY XAUUSD as for weak Data, GOLD price was raised.

Check last given signal : https://t.me/calendarsignal/13487

Performance : https://t.me/calendarsignal/13515