The release of the latest US S&P Global Services PMI and ISM Non-Manufacturing prices on 5th August 2024 has significantly impacted the gold pair. Investors and traders have been closely monitoring these indicators to gauge the economic health of the US and its impact on financial markets. In this document, we will explore the implications of the good US S&P Global Services PMI and ISM Non-Manufacturing prices on the gold pair.

Today’s given signal : https://t.me/calendarsignal/14253

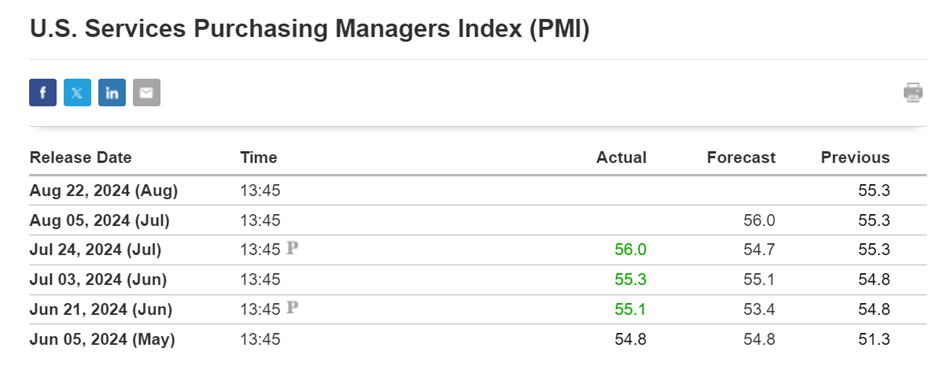

S&P Global Services PMI

The S&P Global Services PMI is an indicator of the overall health of the services sector in the US. It measures the activity level, output, new orders, and employment in the services industry. On 5th August 2024, the US S&P Global Services PMI reported a strong reading, indicating expansion in the services sector.

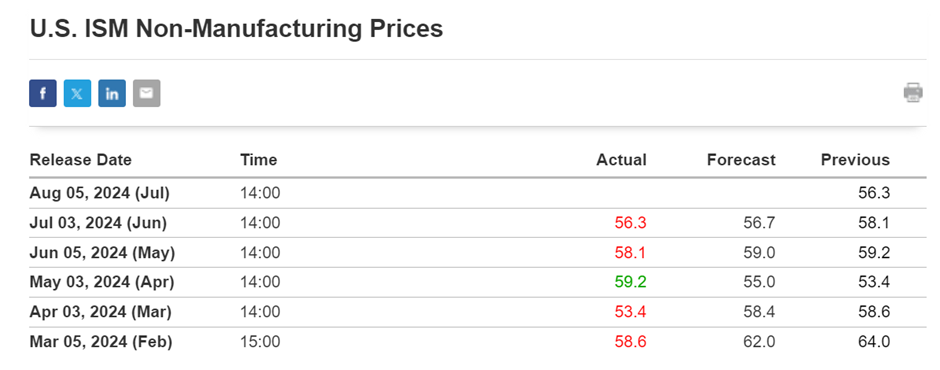

ISM Non-Manufacturing Prices

The ISM Non-Manufacturing Prices Index is a monthly indicator of changes in prices for the non-manufacturing sector. It measures the input prices, output prices, and selling prices of service providers. On 5th August 2024, the ISM Non-Manufacturing Prices Index also indicated positive results, suggesting an increase in prices.

Impact on Gold Pair

The positive readings for both the S&P Global Services PMI and ISM Non-Manufacturing Prices on 5th August 2024 had a significant impact on the gold pair. The gold market is influenced by several factors, including interest rates, inflation expectations, and the US dollar. When the US economy shows signs of strength, including strong service sector growth and rising prices, it typically leads to an increase in the US dollar, which in turn weakens the gold price.

In this case, the good US S&P Global Services PMI and ISM Non-Manufacturing Prices resulted in a rise in the US dollar. As the US dollar strengthened, it depreciated the value of the gold pair, causing a decline in the gold price. This reaction was due to the positive economic data indicating that the economic conditions in the US were improving, which diminished the appeal of gold as a safe-haven asset.

Previous released data results :

On last ISM data (29-9-2023) we predict to BUY XAUUSD as for weak Data, GOLD price was raised.

Check last given signal : https://t.me/calendarsignal/13487

Performance : https://t.me/calendarsignal/13515

On last S&P data (24-7-2024) we predict to BUY XAUUSD as for bad S&P Global service PMI data, GOLD price was raised.

Check the previous blog : https://blog.forextrade1.co/gold-forecast-over-the-sp-global-services-pmi-data-today/

Check last given signal : https://t.me/calendarsignal/13960

Performance : https://t.me/calendarsignal/13990

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11