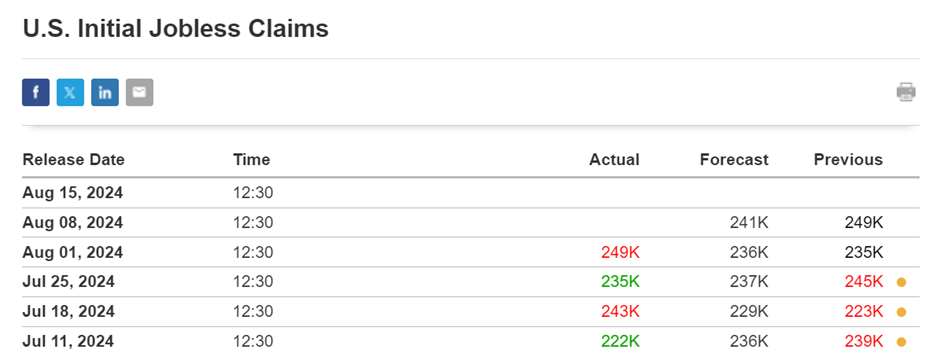

The United States releases its monthly jobless data to the public, providing crucial insights into the overall health of the job market. On 8th August 2024, the release of bad US jobless data had a significant impact on today’s gold prices. This document explores the various factors that led to this impact and examines the implications for the gold market.

Today’s given signal : https://t.me/calendarsignal/14362

The release of bad US jobless data can have far-reaching consequences for various financial markets, including gold. Gold, as a safe-haven asset, is often seen as a safe haven during times of economic uncertainty. Investors often flock to gold as a hedge against inflation and market volatility. Therefore, any negative developments in the job market can directly impact gold prices.

Impact of Bad US Jobless Data on Gold Prices

1. Increased Demand for Gold as a Safe Haven: Bad US jobless data often triggers a flight to safety among investors. When investors are unsure about the economic outlook, they often turn to gold as a hedge against inflation and uncertainty. As a result, the demand for gold tends to increase, pushing up its price.

2. Market Uncertainty: Bad US jobless data creates market uncertainty, leading to increased volatility in various financial markets. This uncertainty can spill over into the gold market, causing its price to fluctuate more than usual. Traders and investors may buy or sell gold based on speculations about the potential impact on the broader economy.

3. Currency Effects: Bad US jobless data can also impact the gold market through its influence on the US dollar. When the US dollar weakens against other currencies, it becomes cheaper for foreign investors to purchase gold. This increased demand from foreign buyers can drive up gold prices, as the demand for gold outweighs the supply.

4. Market Psychology: Bad US jobless data can influence market psychology, affecting investor sentiment and market psychology. If investors perceive the economy to be weakening, they may become more cautious and allocate more of their assets to gold, perceiving it as a safe haven. This shift in investor psychology can drive up gold prices.

Previous released data results :

WHERE TO CONTACT US

Website: https://forextrade1.co/

Twitter: www.twitter.com/forextrade11

Telegram: telegram.me/ftrade1

Facebook: www.facebook.com/Forextrade01

Instagram: www.instagram.com/forextrade1

YouTube: www.youtube.com/ForexTrade1

Skype: forextrade01@outlook.com

Email ID: info@forextrade1.com