- August’s nonfarm payrolls are expected to rise by 160,000.

- If the jobs report is disappointing, gold will likely react more strongly than if it is upbeat.

- After the release of NFP data, gold’s inverse correlation weakens slightly.

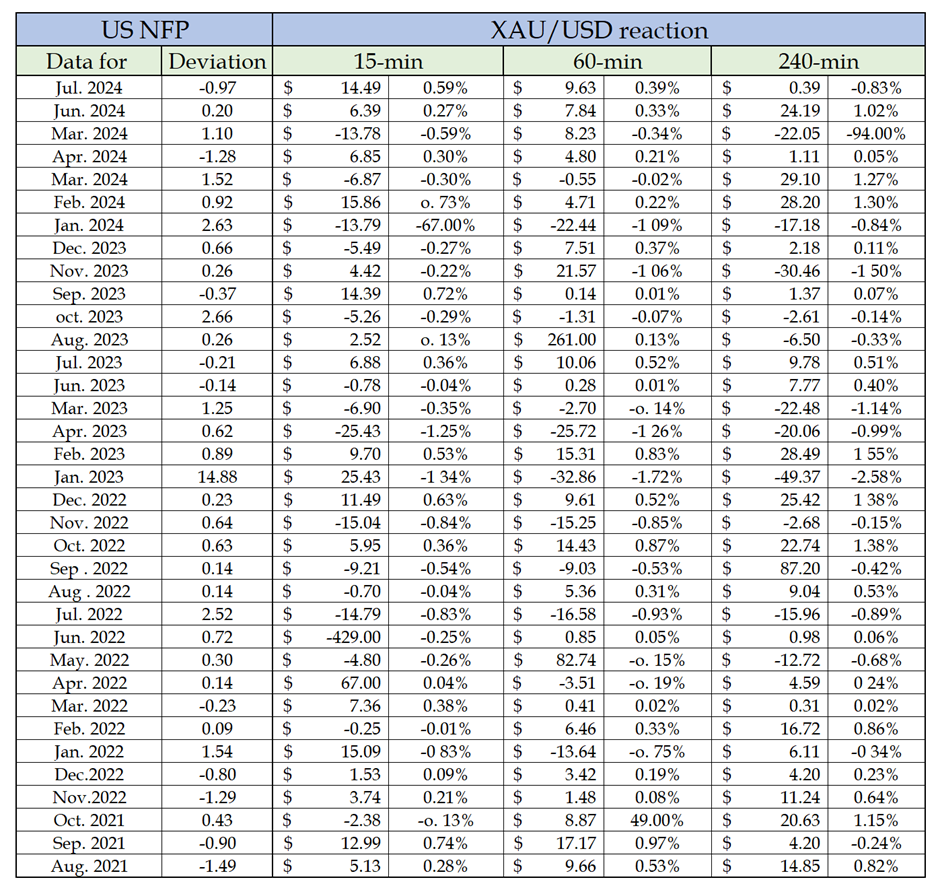

How has the US jobs report affected gold’s valuation historically? XAU/USD’s reaction to the previous 35 NFP prints was analyzed in this article.

In preparation for the US Bureau of Labor Statistics (BLS) August jobs report being released on Friday, September 6, we present our findings. A 160,000 increase is expected in Nonfarm Payrolls following July’s disappointing 114,000 increase.

Methodology

The gold price was plotted at 15-minute, one-hour, and four-hour intervals after the NFP report was published. In order to compare the gold price reaction to the actual NFP release result, we divided the expected result by the actual release result.

FXStreet Economic Calendar provides deviation points for each macroeconomic data release, allowing us to assess how much divergence there was between the actual print and market consensus. As an example, August’s (2021) NFP print of 750,000 against the market expectation of 750,000 was a negative surprise with the deviation posting 1.49. As a result, the NFP print for September (2023) of 246,000 against the market expectation of 170,000 was a positive surprise, with a deviation of 2.66. NFP prints that are better than expected are generally seen as USD-positive developments.

Our final step was to calculate the correlation coefficient (r) to determine at what time frame gold was most correlated with NFP surprises. The greater the r, the more negative the correlation will be, and the greater the r, the more positive the correlation will be. XAU/USD is defined as gold, so an upbeat NFP result should cause it to edge lower.

Previous released data results :

In the last 35 releases, excluding March 2023, 10 negative surprises have occurred and 25 positive surprises have occurred. A disappointing print resulted in an average deviation of -0.77, while a strong print resulted in an average deviation of 1.4. A disappointing NFP reading would cause gold to rise by $7.26 on average 15 minutes after the release. On the flip side, gold declined by $4.86 on average on positive surprises. This finding suggests that investors’ immediate reaction is likely to be more significant to a weaker-than-forecast print.

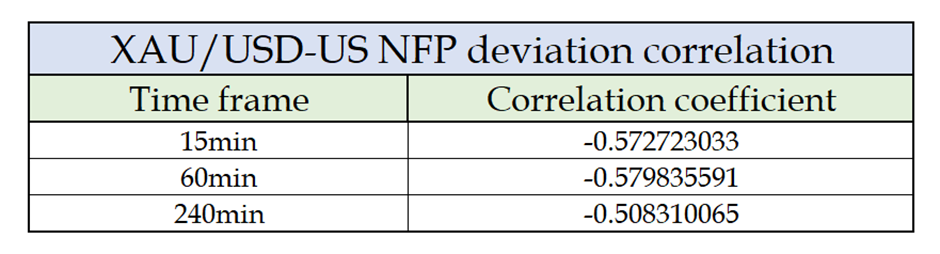

The correlation coefficients we calculated for the different time frames mentioned above are not close enough to -1 to be considered significant. The strongest negative correlation is seen 15 minutes and one-hour, with r standing at around -0.57. Four hours after the release, r edges higher toward -0.5.

Gold’s inverse correlation with NFP surprises may be weakening due to a number of factors. In the hours following Friday’s release of the NFP report, investors may attempt to book profits toward the London fix, causing gold to reverse direction.

The market’s reaction may be influenced by the underlying details of the jobs report, including wage inflation as measured by Average Hourly Earnings and Labor Force Participation. In light of these other data points and the headline NFP print, the Fed is likely to make a decision about its next policy move based on market pricing of these other data points.

Furthermore, revisions to previous readings could distort the impact of the recently released data. In February 2024, NFP rose 275,000, well above the market expectation of 200,000. February’s upbeat print, however, did not help the USD as January’s 335,000 increase was revised downward to 229,000.

What to expect in the this Nonfarm Payrolls report?

Adding 160,000 jobs to the US economy in August, after 114,000 jobs were created in July, according to the Nonfarm Payrolls report.

In the same period, unemployment is likely to fall to 4.2% from 4.3% in July. As a result, Average Hourly Earnings increased 3.7% over the past year through August, following a 3.6% gain in July.

The August employment data will offer significant insights into the strength of the US labor market, which are critical to shaping the Fed interest-rate outlook at the September 17-18 policy meeting and beyond.

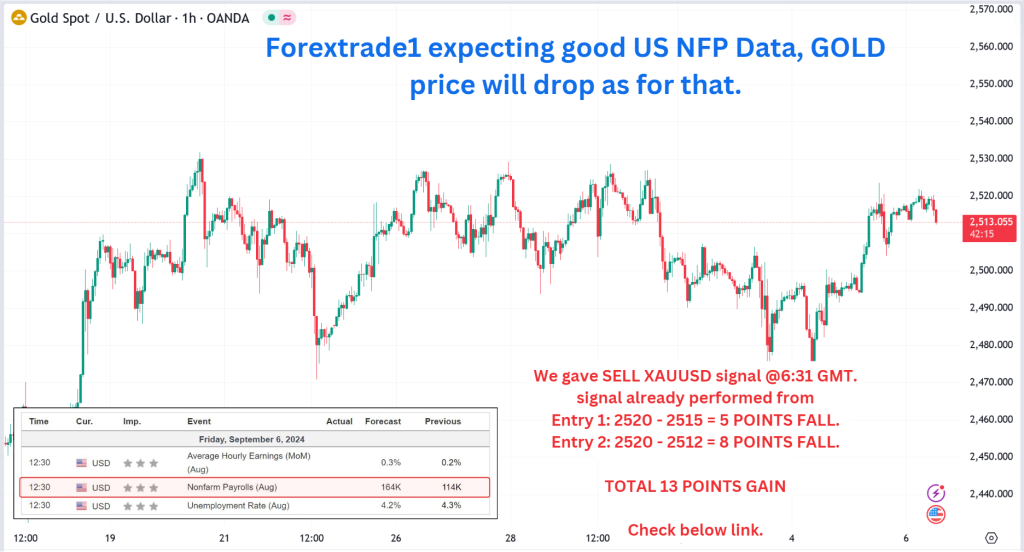

FOREXTRADE1’S PREDICTION FOR TODAY’S NFP DATA

Today’s given signal : https://t.me/calendarsignal/14943

Market Outlook:-

NFP Impact:- (First Reaction Imp1)

- Investors hope for a 150-200K jobs outcome to avoid recession fears and allow rate cuts.

- A positive surprise would:

– Boost US Dollar

– Weigh on Gold

- Jobs outcome scenarios:

– 200-250K: lowers 50-bps cut expectations, US Dollar up, Gold down

– Above 250K: doubts Fed’s rate-cutting cycle, Gold down, US Dollar up

– 100-150K: increases double-dose rate cut chances, Gold up, US Dollar down

– Unemployment Rate impact: (Second Reaction Imp2)

– Worse than expected: (Above 4.2%) Gold rises, US Dollar declines

– Positive surprise: (Below 4.2%)

US Dollar boosts, stocks supported, Gold hurt

Forextrade1’s Previous released data results :

On last NFP data (2-8-2024) we predict to SELL XAUUSD as for good NFP Data, GOLD price was fall.

Check the previous blog : https://blog.forextrade1.co/understanding-the-relationship-between-us-nfp-data-and-xauusd-fluctuations-2-8-2024/

Check last given signal : https://t.me/calendarsignal/14213

Performance : https://t.me/calendarsignal/14243

Our entire NFP signal performance till august 2024

WHERE TO CONTACT US

Website: https://forextrade1.co

Twitter: www.twitter.com/forextrade11

Telegram: telegram.me/ftrade1

Facebook: www.facebook.com/Forextrade01

Instagram: www.instagram.com/forextrade1

YouTube: www.youtube.com/ForexTrade1

Skype: forextrade01@outlook.com

Email ID: info@forextrade1.com