Inflation has been a significant concern worldwide, particularly in the United States. As inflation rates continue to rise, the impact on various sectors and assets can be significant. One area where the impact of inflation is particularly noticeable is in the market for precious metals, such as gold. This document aims to analyze the impact of higher inflation rates on the Consumer Price Index (CPI) and the resulting panic selling in gold.

Today’s given signal : https://t.me/calendarsignal/15020

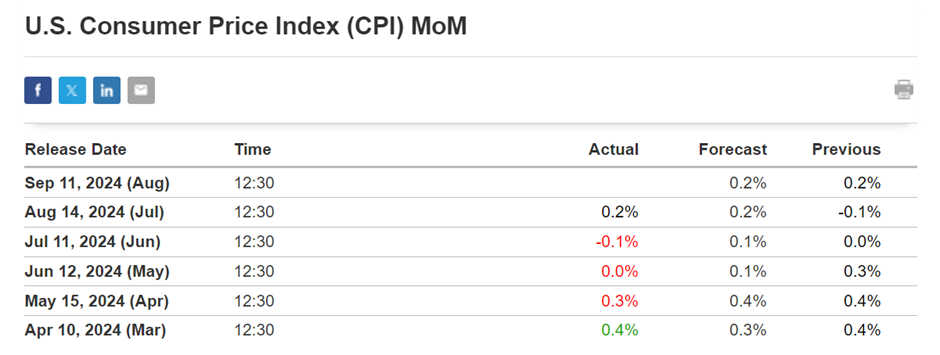

CPI Data and Inflation Rates

The Consumer Price Index (CPI) is a key measure of inflation that measures the average change in prices paid by consumers for a basket of goods and services over time. Each month, the Bureau of Labor Statistics (BLS) releases data on various CPI categories, including food and energy costs, housing, and transportation.

Higher CPI data typically indicates a rising inflation rate. This rise in inflation can have various implications for the economy, including rising prices for goods and services, a decrease in purchasing power for consumers, and increased pressure on central banks to adjust monetary policy.

The Impact on Gold

Gold is often seen as a hedge against inflation due to its intrinsic value and its ability to hold its value over time. When inflation rises, investors often turn to gold as a safe-haven asset to protect their wealth. However, higher CPI data can also trigger selling in gold.

Panic Selling in Gold

Panic selling occurs when investors sell off their holdings in a panic, often in response to a sudden event or change in the market. In the case of higher CPI data and the subsequent inflationary pressures, investors may feel compelled to liquidate their gold positions to mitigate the potential loss of purchasing power.

Panic selling in gold can be driven by several factors. Firstly, when inflation rises, the Federal Reserve (Fed) may implement policies such as interest rate hikes or quantitative tightening to control inflation. This tightening of monetary policy can make gold less attractive as an investment, as investors may opt for higher-yielding assets.

Secondly, higher inflation rates may lead to a decrease in consumer sentiment and confidence in the stability of the economy. This decrease in confidence can result in investors selling gold in favor of other assets they perceive as more stable or liquid.

Lastly, higher inflation expectations and concerns about the future value of fiat currencies can also trigger panic selling in gold. Investors may perceive gold as a more reliable store of value during times of inflation, and they may sell their gold positions to secure higher returns in other currencies or assets.

Previous released data results :

Check the previous blog : https://blog.forextrade1.co/how-to-trade-gold-ahead-of-us-cpi-and-middle-east-issues/

Check last given signal : https://t.me/calendarsignal/14477

Performance : https://t.me/calendarsignal/14499

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn: https://www.linkedin.com/company/forextrade11