On 23rd September 2024, the S&P Manufacturing and Good Service PMI data are scheduled to be released, and analysts expect these releases to be good. However, based on historical trends and market sentiment, it is anticipated that the price of GOLD will fall on that day.

Today’s given signal : https://t.me/calendarsignal/15201

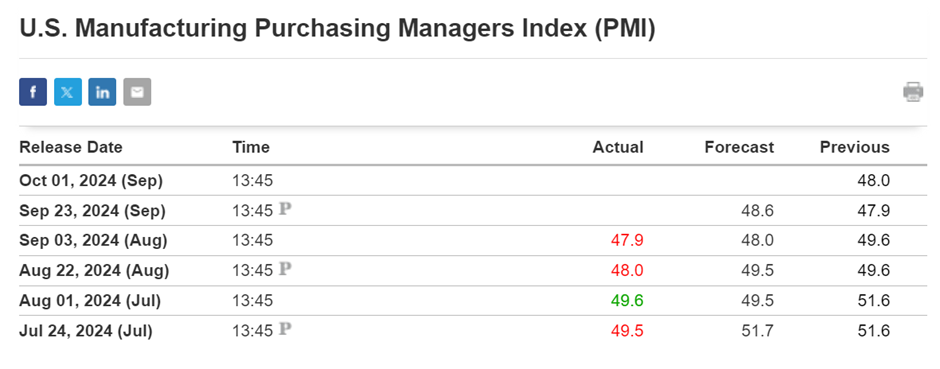

The S&P Manufacturing PMI, which measures the overall health of the manufacturing sector, is expected to post a strong reading above 50, indicating a continued expansion in manufacturing activity. This positive news will enhance confidence in the economy, prompting investors to abandon gold in favor of stocks and other risk-on assets.

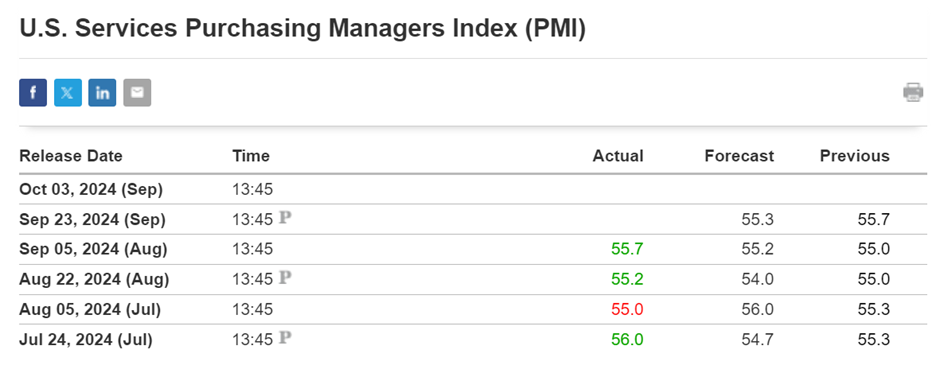

The Good Service PMI, which measures the performance of the services sector, is also expected to indicate a strong expansion in activity. This data will provide further confirmation of the economic resilience of the U.S. economy, further weakening the appeal of gold as an investment option.

The combination of strong manufacturing data and favorable services PMI data will reinforce the perception that the economic recovery is on track, potentially leading to a decline in gold prices. Investors may seek to capitalize on growth opportunities in other sectors, rather than maintaining positions in gold, which has been seen as a safe-haven asset during times of economic uncertainty.

It is important to note that gold prices can be influenced by a variety of factors, including geopolitical tensions, central bank policies, and overall market sentiment. While today’s positive PMI data is expected to have a significant short-term impact on gold prices, it is important to note that the gold market can be highly volatile and subject to fluctuations. Long-term investors should consider a combination of factors when making investment decisions.

Previous released data results :

WHERE TO CONTACT US

Website: https://forextrade1.co/

Twitter: www.twitter.com/forextrade11

Telegram: telegram.me/ftrade1

Facebook: www.facebook.com/Forextrade01

Instagram: www.instagram.com/forextrade1

YouTube: www.youtube.com/ForexTrade1

Skype: forextrade01@outlook.com

Email ID: info@forextrade1.com