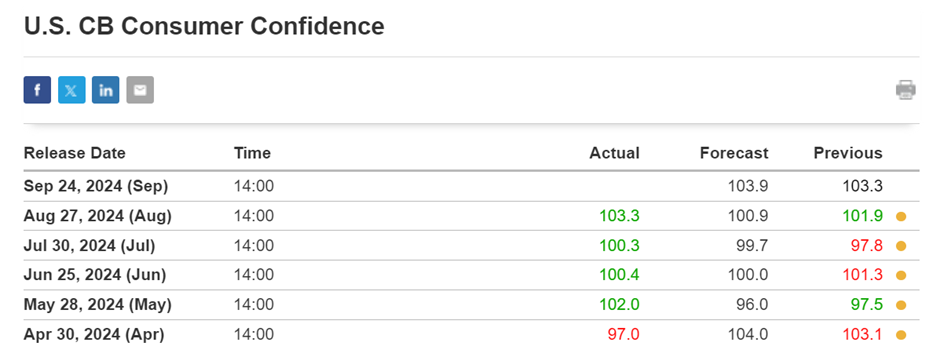

On 24th September 2024, the market witnessed a significant bearish movement in the gold pair, specifically Gold/USD. This movement was triggered by the good US Consumer Confidence data which was released on the same day. The release of this data had a significant impact on the gold market, resulting in a downward trend for the gold pair.

Today’s given signal : https://t.me/calendarsignal/15221

The positive US Consumer Confidence data was a surprise to the market as it indicated that Americans are feeling more optimistic and confident about the current state of the economy. This optimism, combined with expectations of stronger economic growth, caused the US dollar to strengthen against other currencies.

USDX has gained around 0.09% to 0.14% in value each day since Friday, signaling a moderate recovery for the US dollar. A key report that could impact the Fed’s future monetary policies has investors on the sidelines. On Friday, the PCE price index data, the Fed’s preferred inflation gauge, are due, and could provide more clues about interest rates while inflation remains well above 2%.

The CME’s FedWatch indicates that the market is pricing in a 50.9% probability of 0.25% rate cuts in November. Currently, 49.1% of bets are on a 50 bps rate.

Monday’s primary indexes closed above record levels in a relatively quiet session and ahead of the Federal Reserve’s announcements later this week. A number of key inflation data are due on Friday, as well as speeches from Fed officials and rate-setting committee members, which may influence price action for the remainder of the week. Jerome Powell’s speech on Thursday is the most notable.

It is important to note that this bearish movement in the gold pair was an isolated event, driven by specific market factors. The long-term outlook for gold remains positive, as it is seen as a safe-haven asset during times of economic uncertainty. Investors often turn to gold as a hedge against inflation and market volatility.

However, in the short term, the bearish movement in the gold pair may continue as the US dollar remains strong and economic data from other parts of the world also impacts the gold price. Traders and investors should monitor these factors closely and adjust their strategies accordingly.

Gold prices saw a slight uptick on Monday, reaching a new all-time high above $2,630, as growing expectations of a potential US Federal Reserve (Fed) rate cut in November boosted the metal.

Moreover, escalating tensions in the Middle East, particularly between Israel and Hezbollah, could dampen risk appetite and push gold prices higher. The Pentagon confirmed on Monday that the US is deploying additional troops to the region, as reported by the Associated Press.

Previous released data results :

On last CB Consumer confidence data (27-8-2024) we predict to BUY XAUUSD as for BAD data, GOLD price was raised.

Check the previous blog : https://blog.forextrade1.co/how-do-consumer-confidence-and-housing-numbers-affect-gold-prices-today/

Check last given signal : https://t.me/calendarsignal/14706

Performance : https://t.me/calendarsignal/14736

WHERE TO CONTACT US

Website: https://forextrade1.co/

Twitter: www.twitter.com/forextrade11

Telegram: telegram.me/ftrade1

Facebook: www.facebook.com/Forextrade01

Instagram: www.instagram.com/forextrade1

YouTube: www.youtube.com/ForexTrade1

Skype: forextrade01@outlook.com

Email ID: info@forextrade1.com