The market is expected to experience higher home sales data on today’s trading day, September 25th, 2024. Additionally, the gold market is exhibiting overbought conditions, suggesting a potential decrease in prices. This document aims to discuss the key factors influencing these market movements and their potential impact on prices.

Today’s given signal : https://t.me/calendarsignal/15237

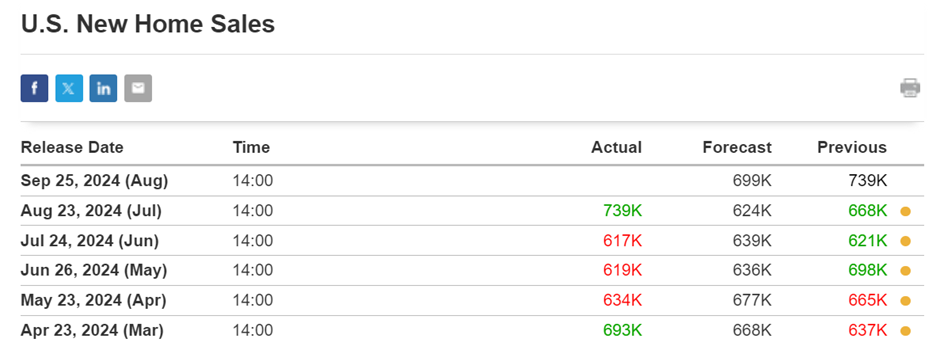

Higher Home Sales Data

Today, home sales data is expected to show a significant increase in transactions compared to previous months. This positive trend can be attributed to several factors, including a stable economy, low-interest rates, and pent-up demand for residential properties. The surge in home sales suggests that the housing market is performing well, providing investors and home buyers with favorable market conditions.

Overbought Conditions in Gold Market

The gold market, on the other hand, is currently facing overbought conditions. This indicates that prices have climbed significantly and are potentially due for a correction. The overbought condition is often a result of excessive buying activity, which pushes prices above their fundamental value. In this case, the gold market may be experiencing speculation-driven price rises rather than genuine demand.

Potential Price Decline in Gold

Given the overbought condition in gold, prices are expected to decrease today. This anticipated decline can be attributed to several factors, including profit-taking by investors, increased availability of gold in the market, and a reassessment of risk appetite. Selling pressure could mount as market participants book profits and reassess their gold holdings.

Previous released data results :

WHERE TO CONTACT US

Website: https://forextrade1.co/

Twitter: www.twitter.com/forextrade11

Telegram: telegram.me/ftrade1

Facebook: www.facebook.com/Forextrade01

Instagram: www.instagram.com/forextrade1

YouTube: www.youtube.com/ForexTrade1

Skype: forextrade01@outlook.com

Email ID: info@forextrade1.com