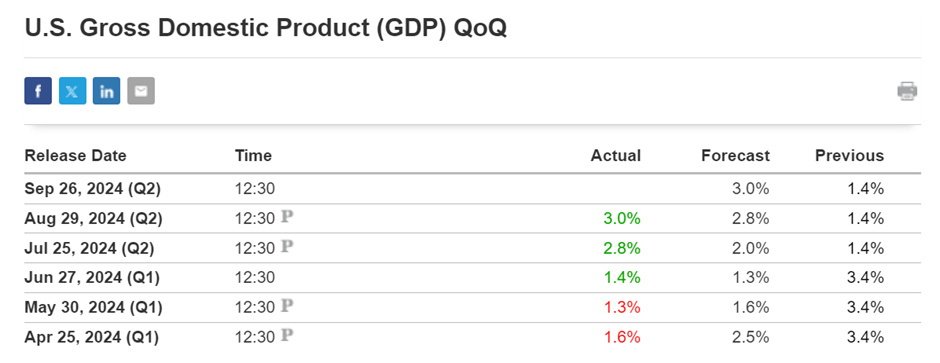

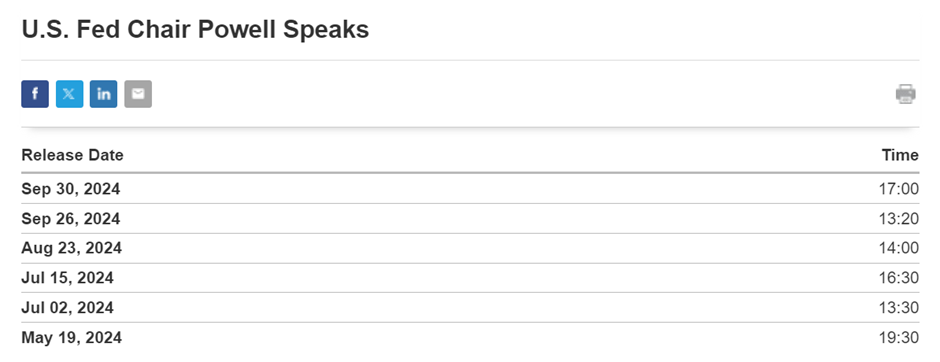

On 26th September 2024, gold prices are expected to decrease significantly due to a combination of higher US GDP data and hawkish speech by Federal Reserve chair Jerome Powell. The release of higher US GDP data indicates a positive economic outlook, which can weigh on gold prices as it reduces the appeal of safe haven assets like gold.

Powell’s hawkish speech signals the potential for higher interest rates, which can also negatively impact gold prices.

Today’s given signal : https://t.me/calendarsignal/15261

Gold is often considered a safe haven investment, attracting investors during times of economic uncertainty or rising inflation. However, when economic conditions improve and interest rates rise, gold typically loses its appeal as an investment alternative. This is because higher interest rates increase the opportunity cost of holding non-yielding assets like gold, making other assets more attractive.

As higher US GDP data suggests a growing economy, investors are more inclined to invest in assets that are expected to generate returns, such as stocks or bonds. This shift in investor sentiment can exert downward pressure on gold prices, as demand for the precious metal decreases.

A higher-than-expected U.S. GDP on September 26, 2024, can put downward pressure on the price of gold (XAU/USD) for several reasons:

- Stronger Economy = Higher Interest Rates: A strong GDP reading suggests the U.S. economy is performing well, increasing the likelihood that the Federal Reserve will either maintain or raise interest rates. Since gold does not yield interest or dividends, higher interest rates make U.S. bonds and the U.S. dollar more attractive, reducing demand for gold.

- Strengthening U.S. Dollar: A positive GDP report often boosts the value of the U.S. dollar. As gold is priced in dollars, a stronger dollar makes gold more expensive for holders of other currencies, which typically leads to a decline in demand and, consequently, a drop in gold prices.

- Risk Appetite: Higher GDP growth reflects a robust economy, encouraging investors to shift toward riskier assets like equities. This decreases the demand for safe-haven assets like gold, pushing its price lower.

Therefore, today’s higher U.S. GDP likely pressured XAU/USD downward due to the anticipation of tighter monetary policy and a stronger dollar.

Powell’s Hawkish Speech: If Powell emphasizes the need for further tightening or high interest rates for an extended period, it will increase the attractiveness of interest-bearing assets like bonds. This leads to higher bond yields, which make gold less attractive by comparison, as gold doesn’t generate interest or dividends. This, combined with a stronger dollar, would push gold prices lower.

Moreover, Powell’s hawkish speech reinforces the likelihood of higher interest rates. When interest rates rise, the opportunity cost of gold increases further, making it less attractive to investors. This, combined with the aforementioned investor sentiment, can contribute to a significant decline in gold prices on 26th September 2024.

It is important to note that gold prices are influenced by various factors, and a single event such as higher US GDP data and hawkish speech by Powell may not completely determine its price movement. However, these two factors together are expected to have a notable impact on gold prices on that day.

Previous released data results :

On last GDP data (29-8-2024) we predict to SELL XAUUSD as for higher GDP Data, GOLD price was fall.

Check the previous blog : https://blog.forextrade1.co/impact-of-us-gdp-data-on-xauusd-pair-29-8-2024/

Check last given signal : https://t.me/calendarsignal/14774

Performance : https://t.me/calendarsignal/14809

On last GDP data (23-8-2024) we predict to SELL XAUUSD as for Less dovish speech, XAUUSD price was fall.

Check the previous blog : https://blog.forextrade1.co/the-impact-of-powell-speech-on-gold-prices-what-to-watch-today-23-8-2024/

Check last given signal : https://t.me/calendarsignal/14665

Performance : https://t.me/calendarsignal/14686

WHERE TO CONTACT US

Website: https://forextrade1.co/

Twitter: www.twitter.com/forextrade11

Telegram: telegram.me/ftrade1

Facebook: www.facebook.com/Forextrade01

Instagram: www.instagram.com/forextrade1

YouTube: www.youtube.com/ForexTrade1

Skype: forextrade01@outlook.com

Email ID: info@forextrade1.com