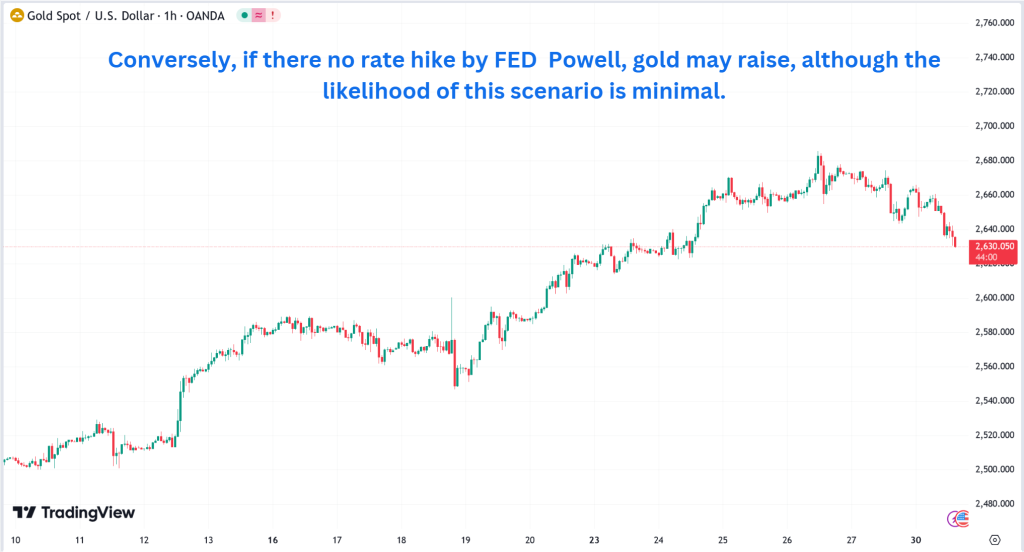

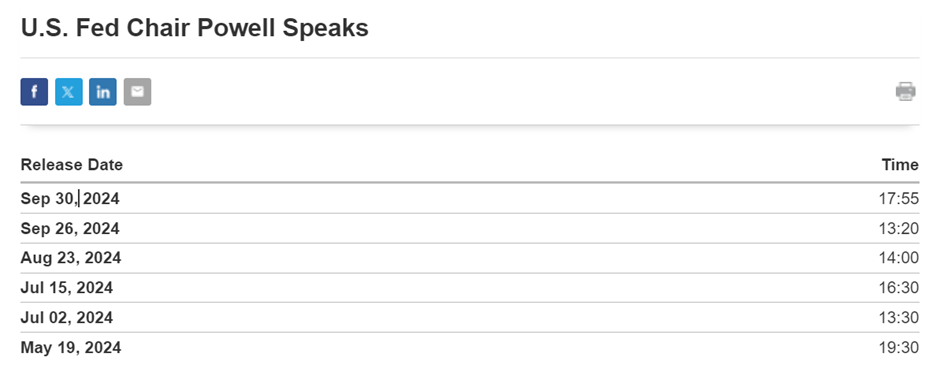

On September 30th, 2024, the price of gold witnessed a significant decline due to several factors. The most prominent factor was the hawkish speech delivered by FED Chair Powell, which heightened expectations for a rate hike in November. This expectation of a rate hike had a bearish impact on gold prices, as investors favored other assets that offered higher yields. As a result, gold prices fell in today’s trading session.

Today’s given signal : https://t.me/calendarsignal/15318

Hawkish Speech by FED Chair Powell

During the speech, FED Chair Powell emphasized the central bank’s commitment to maintaining price stability and reducing inflationary pressures. He expressed confidence in the resilience and flexibility of the U.S. economy, indicating that the FED is ready to take decisive action to address inflationary concerns. This hawkish tone triggered concerns about higher interest rates, which typically have a bearish effect on gold prices.

Expectation of Nov rate hike

The Fed opted for a 50 basis points (bps) interest-rate cut following the September policy meeting, bringing the fed funds rate to the range of 4.75%-5.0%. The revised Summary of Economic Projections (SEP), the so called dot-plot published alongside the policy statement, showed that projections imply 50 bps of additional rate cuts in 2024 from current level, 100 bps more in 2025 and another 50 bps in 2026.

The market interpreted Powell’s speech as signaling the likelihood of a rate hike in November. This expectation spooked investors who were considering investing in gold as a haven asset. Higher interest rates tend to increase the opportunity cost of holding gold, as alternative assets such as bonds offer higher yields. As a result, gold prices declined, reflecting the shift in investor sentiment.

Impact on Gold Prices

The bearish impact of Powell’s hawkish speech and the expectation of a rate hike were evident in today’s trading activity. Gold prices experienced a sharp decline in value, reflecting the shift in investor sentiment. The prospect of higher interest rates made gold less attractive, as investors sought higher returns elsewhere.

Previous released data results :

Following Powell’s hawkish speech on September 26, 2024, we recommended selling XAUUSD, and the gold price subsequently dropped as predicted.

Check last given signal : https://t.me/calendarsignal/15261

Performance : https://t.me/calendarsignal/15278

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11