On 22nd November 2024, gold faced selling pressure due to a combination of positive economic indicators and overbought levels. The S&P Service PMI and the Michigan number both released stronger-than-expected data, which contributed to the bearish sentiment surrounding gold in the market. Additionally, the precious metal had reached overbought levels, signalling a potential correction. This document will explore the reasons behind the selling pressure on gold that day.

Today’s given signal : https://t.me/calendarsignal/16070

Positive S&P Service PMI and Higher Michigan Number

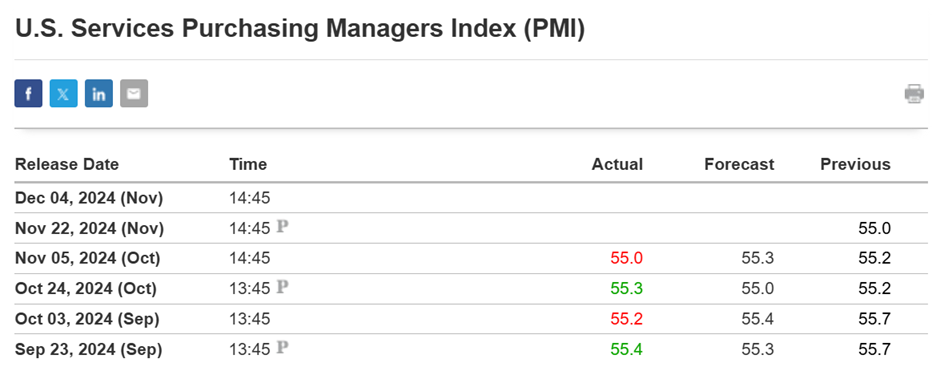

On 22nd November 2024, the S&P Service PMI, a gauge of sentiment towards the services sector, showed a strong reading. The index indicated expansion, indicating robust economic activity and increasing demand for services and commodities. This positive economic news had a direct impact on the gold market, as it weakened the allure of gold as an inflation hedge. Investors who view gold as a safe-haven asset tend to sell it in Favor of other assets when economic optimism is high.

Moreover, the Michigan number, an index of consumer confidence, also rose unexpectedly on 22nd November 2024. Higher consumer confidence typically leads to increased spending, which can have a negative impact on gold demand. When consumers are optimistic, they are more likely to allocate their funds towards other assets such as stocks or commodities. This shift in investment preferences further contributed to the selling pressure on gold.

Overbought Levels for Gold

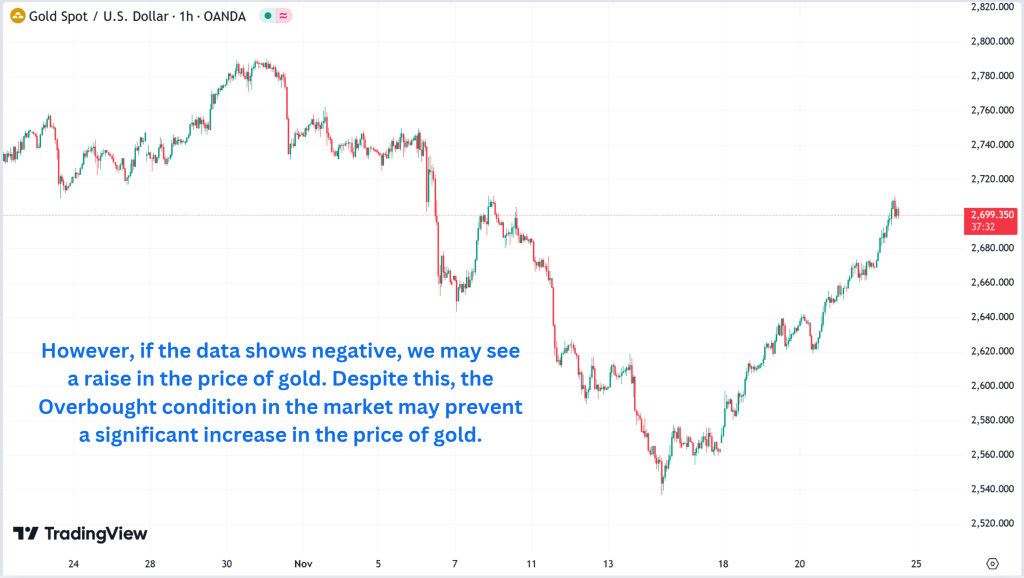

Another contributing factor to the selling pressure on gold on 22nd November 2024 was the technical indicators. Gold had reached overbought levels, suggesting a period of excessive buying and a potential correction. Overbought levels are often followed by a period of consolidation or correction, as investors take profits or wait for a retracement before continuing their bullish positions.

Previous released data results :

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11