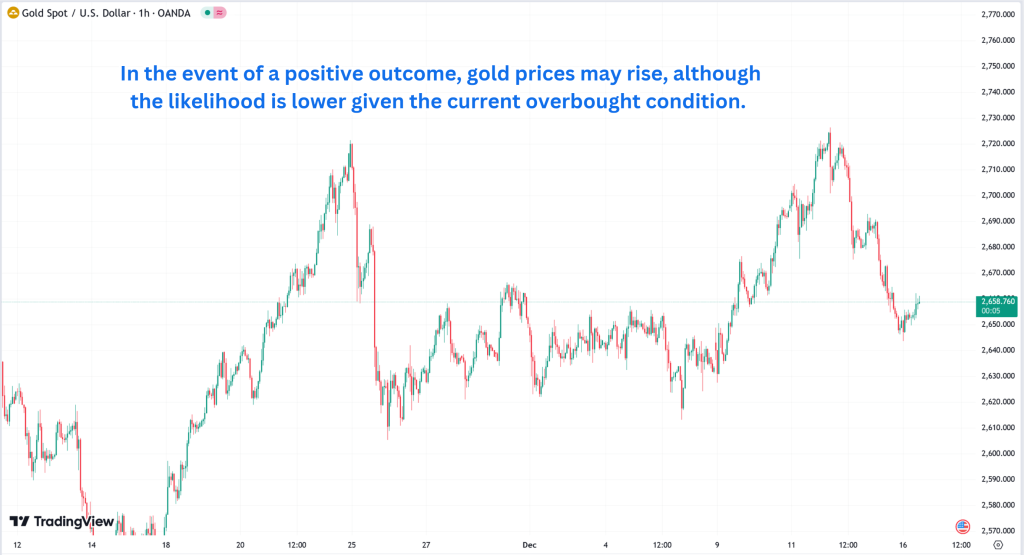

On December 16, 2024, the gold market witnessed a sharp decline following the release of unexpectedly weak economic data from the US S&P Global. This event sent shockwaves across global markets as gold prices fell significantly, reflecting investors’ reactions to slowing economic growth and changing risk appetite.

Today’s given signal : https://t.me/calendarsignal/16389

S&P Global Data and Its Impact

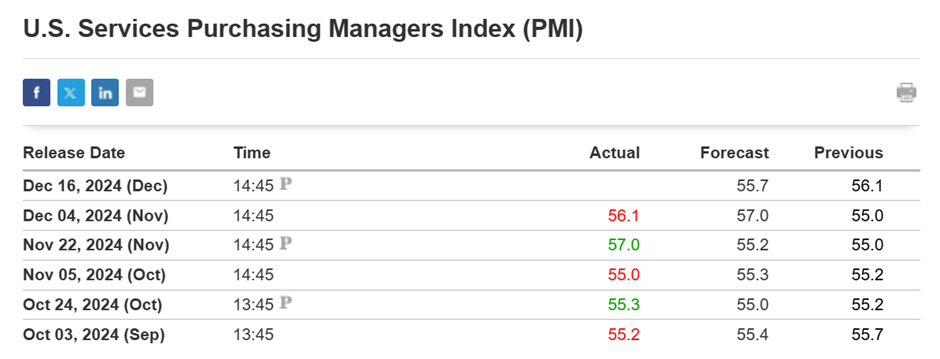

The S&P Global Services PMI for December dropped to 48.5, below the expected 51.2, signaling a contraction in the US services sector. A PMI reading below 50 indicates economic contraction, heightening fears of a potential economic slowdown in the US. This weak data added to concerns about decreasing consumer demand and services activity, pressuring commodity markets like gold.

While gold is traditionally seen as a safe-haven asset, investors’ focus shifted due to concerns over potential deflationary signals and slower demand. The poor PMI data also fueled speculation about a softer US economy, which caused gold traders to unwind positions and seek liquidity elsewhere.

Gold Price Decline

Gold prices fell by approximately 2.4% in a single trading day. Specifically:

- Spot gold dropped from $2,040 per ounce to $1,992 per ounce, marking its first significant break below the psychological $2,000 level in weeks.

- Gold futures for February delivery declined 2.5%, settling at $1,987 per ounce.

This decline represents the sharpest one-day fall in gold prices since early 2024. Analysts pointed out that traders likely offloaded positions to secure profits ahead of further economic uncertainty.

Investor Reaction and Market Example

The reaction extended beyond gold prices into related sectors:

- Gold ETFs: The SPDR Gold Shares ETF (GLD) fell by 2.1%, closing at $182.45, reflecting investor outflows.

- Gold Mining Stocks: Companies heavily reliant on gold saw significant declines. For example:

- Newmont Corporation shares dropped by 3.2% to $47.89.

- Barrick Gold fell 2.8% to $18.34.

Gold miners faced pressure due to concerns about shrinking profit margins as the gold price declined.

Factors Behind the Sell-Off

- Economic Uncertainty: The drop in the S&P PMI amplified fears of a broader US economic slowdown.

- Investor Sentiment: Investors turned cautious, reducing gold exposure and shifting funds into cash or alternative assets.

- Strengthening Dollar: Simultaneously, the US dollar gained strength, putting additional downward pressure on gold. Gold typically has an inverse relationship with the dollar, as a stronger dollar makes gold more expensive for non-dollar investors.

Previous released data results :

On last US S&P Global data (2-12-2024) we predicted bad data, & as per that we suggest to BUY XAUUSD & as a result, we made a profit of 30 points according to the signal we gave.

Check the previous blog :

Check last given signal : https://t.me/calendarsignal/16195

Performance : https://t.me/calendarsignal/16205

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11