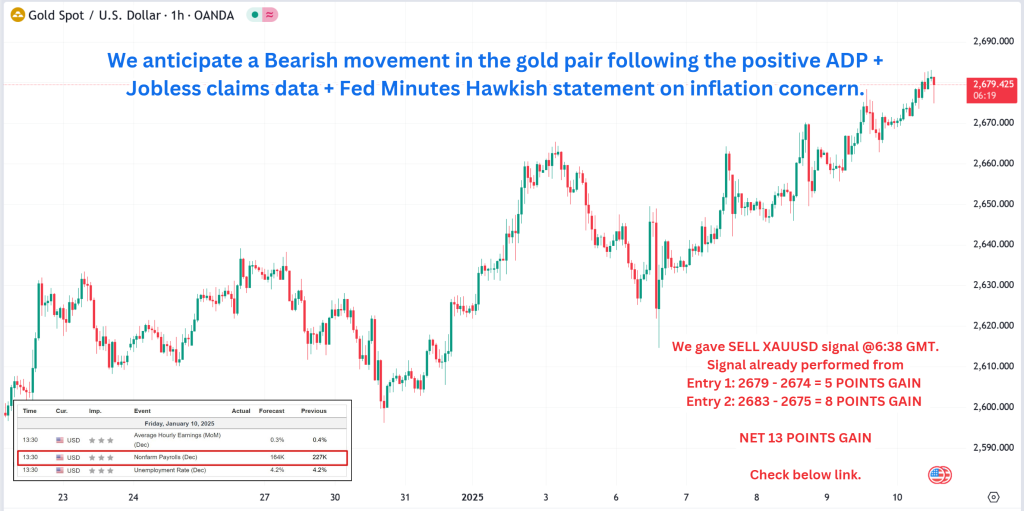

On January 10, 2025, gold prices (XAUUSD) are expected to decline following the release of better-than-expected US Non-Farm Payrolls (NFP) data, which signals continued strength in the US labor market. A strong NFP report reinforces economic optimism, reduces recession fears, and raises expectations for tighter monetary policy, leading to downward pressure on gold prices.

Today’s given signal : https://t.me/calendarsignal/16552

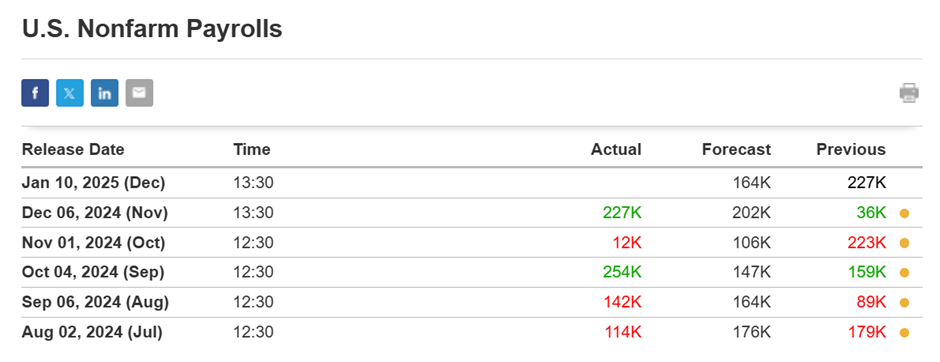

1. November Recap

● Actual Jobs Added: 227K (vs. expectations of ~170K).

● October Revision: Increased to 36K from 12K, impacted by hurricanes and strikes.

2. December Projections

● Expected Jobs Added: 150K

● This “Goldilocks” figure suggests the economy is not overheating (reducing rate hike fears) or showing signs of a slowdown (avoiding recession worries).

_______________________________________

Mathematical Scenarios for December NFP

Scenario 1: Strong NFP (>200K)

● Impact:

● USD and Equities: Rise due to optimism about the economy’s resilience.

● Gold: Bearish due to reduced safe-haven demand.

● Reason: Higher-than-expected job creation signals a strong economy, supporting risk-on assets.

_______________________________________

Scenario 2: Moderate NFP (~150K)

● Impact:

● USD and Gold: Neutral to slightly volatile depending on exact alignment with expectations.

● Reason: A balanced outcome aligns with forecasts, minimizing market surprises.

_______________________________________

Scenario 3: Weak NFP (<100K)

● Impact:

● USD and Equities: Bearish as fears of economic slowdown grow.

● Gold: Bullish as investors seek safe-haven assets.

● Reason: A significant miss raises concerns about the economy and reduces risk appetite.

Additional Considerations

● Whipsaw Movements:

Markets may initially react in one direction before reversing due to speculative trades or recalibrations based on broader expectations.

● Example: A 175K report might cause USD spikes before retracing, as markets realize it does not strongly shift Fed expectations.

● Fed Rate Policy:

● Current expectations: No rate change in the first 2025 meeting.

● Massive surprises (>250K or <50K) could influence these expectations, but smaller deviations are unlikely to alter the Fed’s stance.

Investors should remain cautious, as the knee-jerk reactions may reverse after further analysis of the Fed’s likely stance.

Previous released data results :

On last NFP Data (6-12-2024) we predicted good data, as per that we suggest to SELL XAUUSD & as a result, we made a profit of 53 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/analysis-based-on-us-non-farm-payrolls-data-6-12-2024/

Check last given signal : https://t.me/calendarsignal/16268

Performance : https://t.me/calendarsignal/16285

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11