As of January 24, 2025, the latest PMI data reflects modest growth in the UK, with the composite PMI rising to 50.9 in January from 50.4 in December. However, this growth is accompanied by intensified price pressures and significant job cuts, highlighting challenges such as stagflation.

Today’s given signal : https://t.me/calendarsignal/16730

Factors Influencing S&P Global PMI Data

The S&P Global PMI (Purchasing Managers’ Index) measures the economic health of the manufacturing and services sectors. Several key factors affect this data:

- Business Activity:

- Higher production and service activity drive up PMI figures.

- New Orders:

- An increase in domestic and international demand leads to higher PMI readings.

- Employment Levels:

- Higher hiring signals business confidence, pushing PMI upward.

- Supply Chain Performance:

- Improved supply chain efficiency and reduced delays positively impact PMI.

- Input Costs and Inflation:

- Lower input costs can boost output, improving PMI data.

Impact of Good S&P Global PMI Data on Gold Prices

When S&P Global PMI data is better than expected, it indicates economic expansion and strengthens risk appetite among investors. This typically has a negative impact on gold prices, as investors shift away from safe-haven assets like gold toward riskier investments such as stocks and bonds.

Key Reasons:

- Strengthening US Dollar:

- Strong PMI data boosts confidence in the US economy, driving the US Dollar Index (DXY) higher. A stronger dollar makes gold more expensive for non-dollar investors, reducing demand.

Example: On January 24, 2025, PMI came in at 57.5, exceeding expectations of 54.0, causing the DXY to rise 0.6% to 105.50.

- Strong PMI data boosts confidence in the US economy, driving the US Dollar Index (DXY) higher. A stronger dollar makes gold more expensive for non-dollar investors, reducing demand.

- Higher Treasury Yields:

- Positive PMI data raises expectations for sustained Federal Reserve rate hikes, increasing Treasury yields, which makes gold less attractive as a non-yielding asset.

Example: The 10-year Treasury yield increased to 4.60%, further pressuring gold.

- Positive PMI data raises expectations for sustained Federal Reserve rate hikes, increasing Treasury yields, which makes gold less attractive as a non-yielding asset.

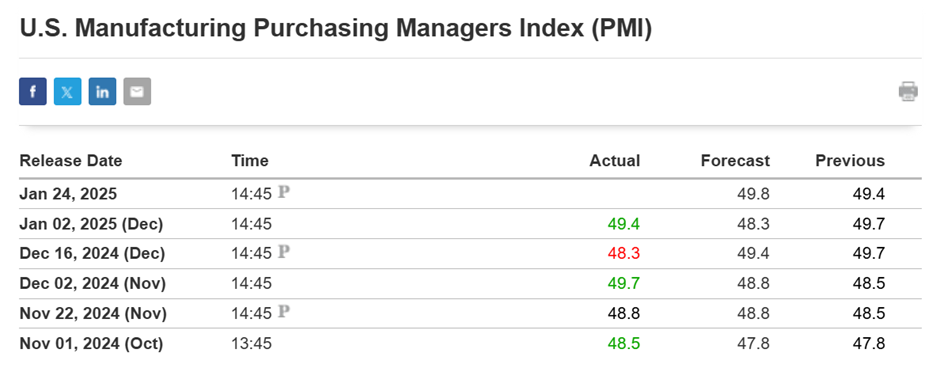

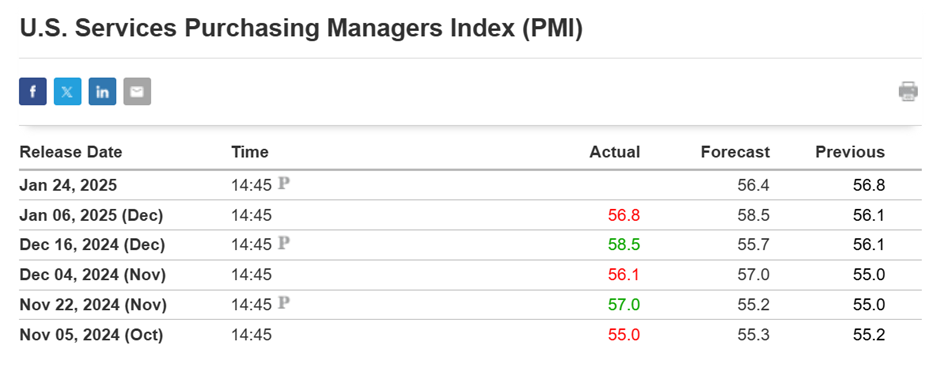

Previous released data results :

On last US S&P Global data (16-12-2024) we predicted bad data, as per that we suggest to BUY XAUUSD & as a result, we made a profit of 21 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/gold-market-takes-a-hit-following-disappointing-us-sp-global-data-16-12-2024/

Check last given signal : https://t.me/calendarsignal/16389

Performance : https://t.me/calendarsignal/16399

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11