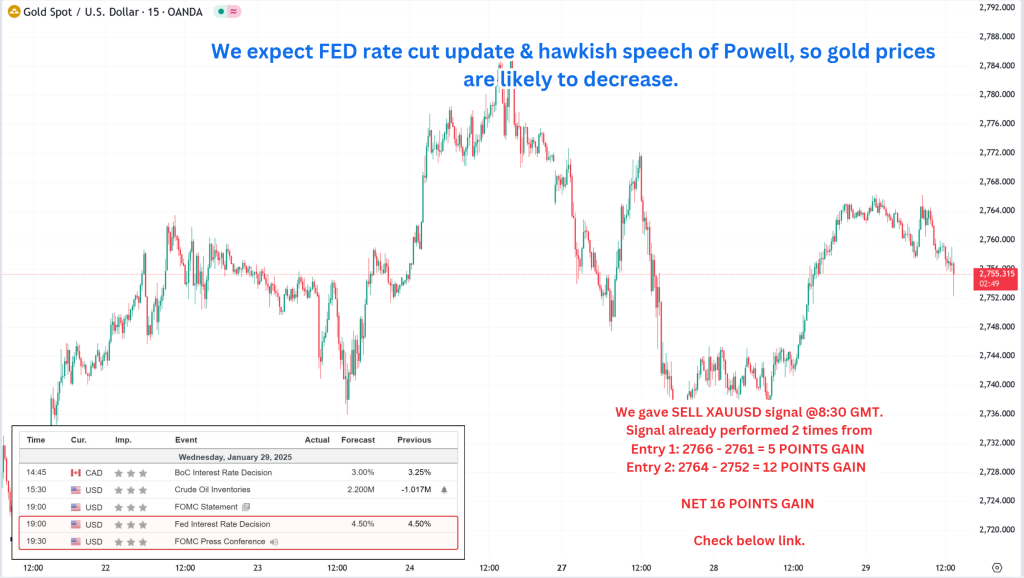

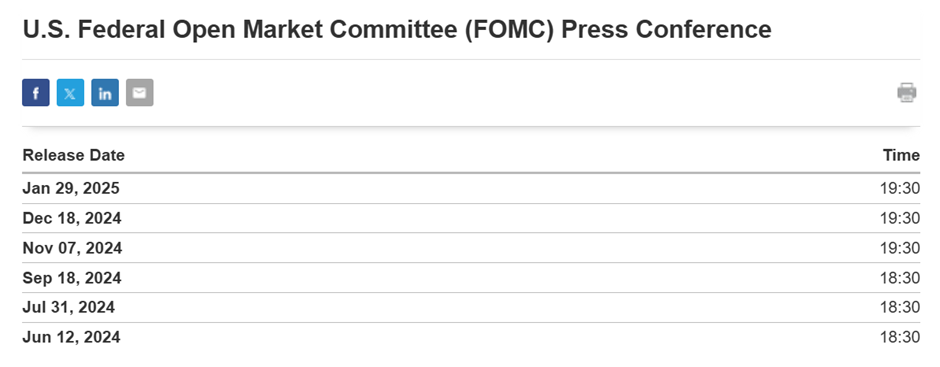

On January 29, 2025, gold prices (XAUUSD) are expected to face downward pressure following the Federal Reserve’s rate cut update and Fed Chair Jerome Powell’s hawkish speech. While markets anticipated a potential rate cut, Powell’s cautious tone regarding future monetary policy has led to expectations of a slower pace of easing, strengthening the US dollar and Treasury yields, which negatively impact gold prices.

Today’s given signal : https://t.me/calendarsignal/16787

Key Variables & Definitions:

▪️r = Fed Interest Rate Decision (Current: Unchanged)

▪️d = Dot Plot Rate Cut Expectations

▪️p = Powell’s Tone (Hawkish or Dovish)

▪️m = Market Expectations (Current: 2 rate cuts in 2025)

▪️L = Labor Market Strength (Based on NFP Data)

▪️I = Inflation Trends (Based on CPI Data)

▪️X = Market Reactions (Gold, Stocks, USD)

Scenario 1: Hawkish Tone (Likely)

▪️Current Expectations: m=2 cuts

▪️Fed’s Revised Stance: d=1 cut

Market Impact:

▪️Gold (G) = Bearish (G↓)

▪️US Dollar (D) = Bullish (D↑)

Mathematical Adjustment:

m=f(d,p)=2−1=1

If d=1 (only one cut), investors will revise expectations downward, causing pressure on risk assets.

Scenario 2: Dovish Tone (Less Likely)

▪️Current Expectations: m=2 cuts

▪️Fed’s Reinforced Stance: d=2 cuts (as expected)

Market Impact:

▪️Gold (G) = Bullish (G↑)

▪️US Dollar (D) = Bearish (D↓)

Mathematical Adjustment:

m=f(d,p)=2−0=2

If d remains at 2, expectations remain stable, leading to positive sentiment for risk assets.

Probability of Both Scenarios is given below:-

Hawkish Fed (1 Cut):- 60%

Dovish Fed (2 Cut):- 40%

Key Takeaways:-

▪️Market’s reaction depends on how Powell shifts expectations (m).

▪️If prediction of a hawkish shift is correct, risk assets (Gold & Stocks) will fall, while USD will rise.

▪️The most significant factor is the Fed adjusting its 2025 rate-cut outlook (d).

This Fed meeting will reset expectations for the entire year 2025 .

Previous released data results :

On last FED Rate cut and Powell speech (18-12-2024) we predicted Dovish speech, as per that we suggest to BUY XAUUSD & as a result, we made a profit of 15 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/impact-on-xauusd-price-to-amid-fed-rate-cut-and-powells-dovish-speech-18-12-2024/

Check last given signal : https://t.me/calendarsignal/16422

Performance : https://t.me/calendarsignal/16435

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11