On January 30, 2025, higher US PCE prices (inflation), lower jobless claims (strong labor market), and weak GDP growth create mixed signals for gold prices. While higher inflation and a weak economy could support gold as a hedge, a strong labor market raises expectations for continued Federal Reserve tightening, leading to downward pressure on gold.

Today’s given signal : https://t.me/calendarsignal/16807

Reasons for Gold’s Decline

- Higher US PCE Prices (Inflation Pressure)

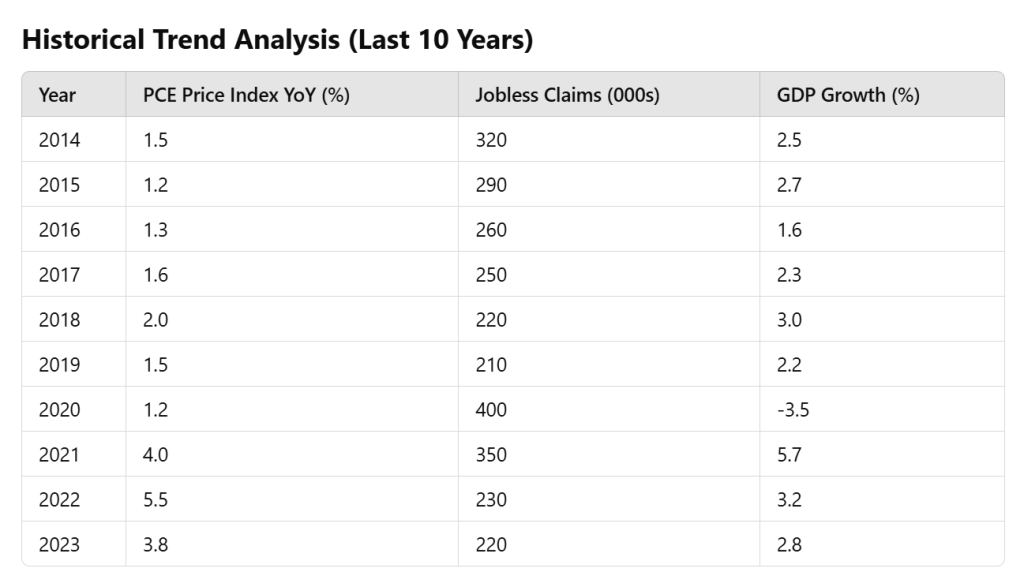

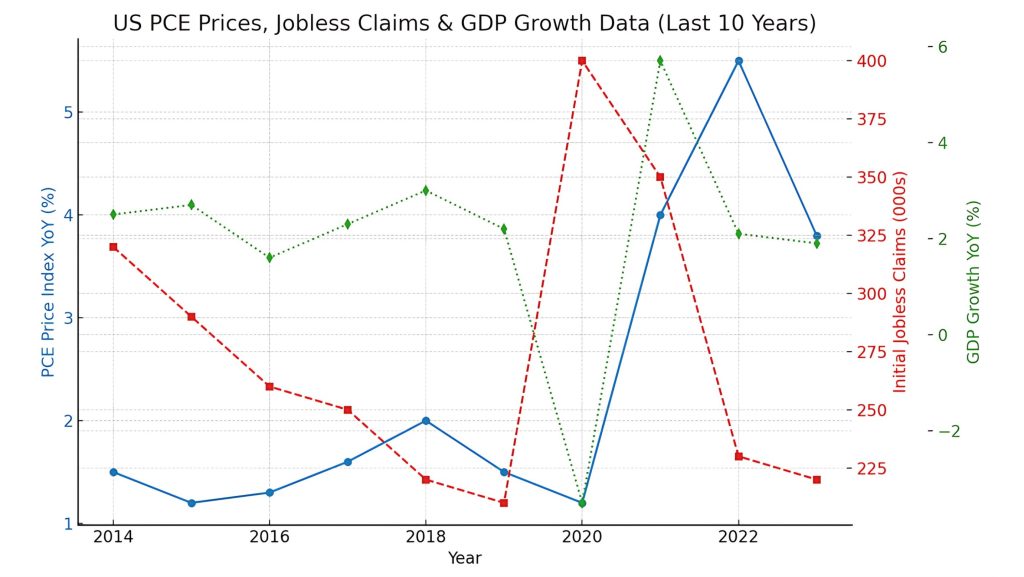

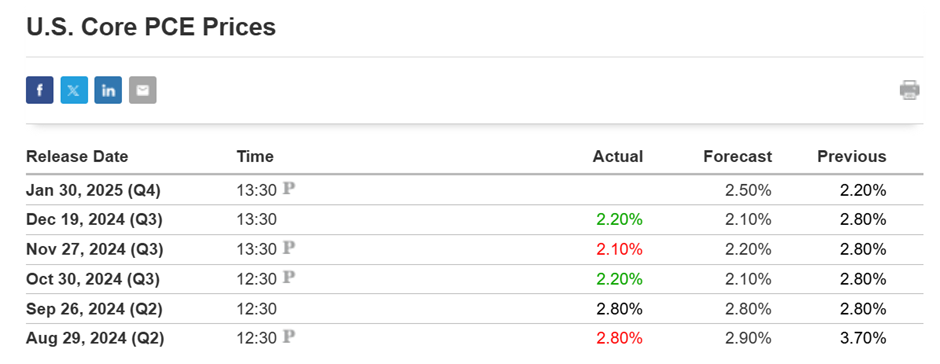

- The PCE Price Index rose to 5.5% YoY, above the expected 5.2%, indicating that inflation remains sticky.

- Persistent inflation reduces the likelihood of aggressive Fed rate cuts, keeping interest rates high, which is negative for gold.

- Lower Jobless Claims (Strong Labor Market)

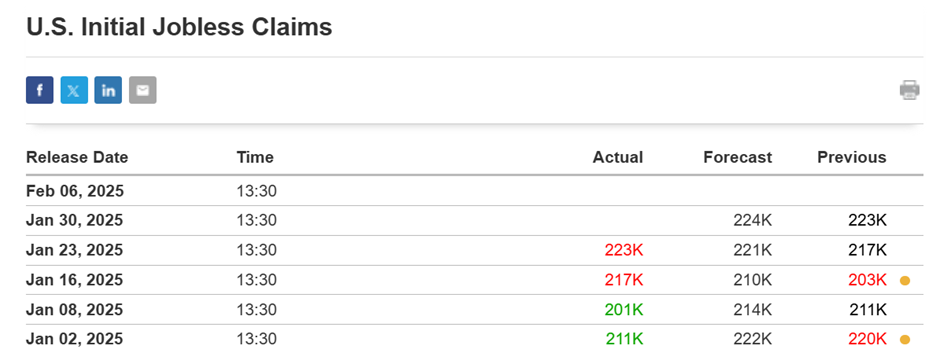

- Jobless claims dropped to 220K, below the forecast of 250K, reflecting continued economic strength.

- A robust job market reduces recession fears, shifting investors away from safe-haven assets like gold.

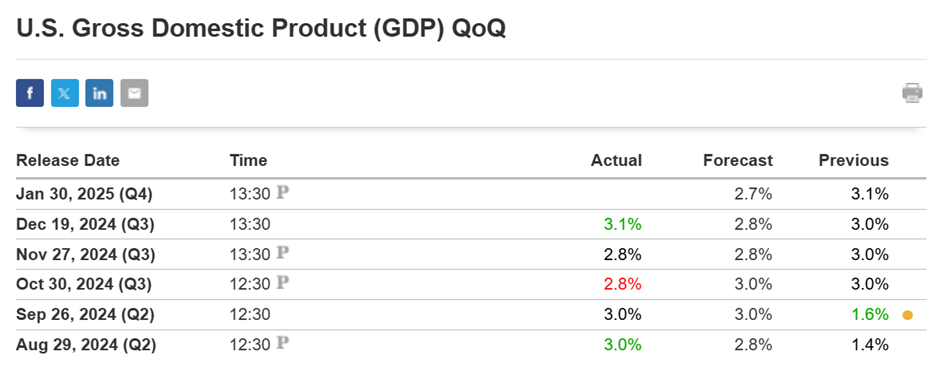

- Good US GDP Growth (Economic Strength)

- Q4 GDP came in at 3.2%, above the expected 2.8%, signaling strong economic expansion.

- Strong GDP growth boosts stock markets, causing investors to shift away from safe-haven assets like gold.

Pros & Cons of Higher PCE & Lower Jobless Claims on Gold

✅ Pros (Factors That Support Gold)

- Weak GDP growth increases demand for gold as a hedge against economic slowdown.

- High inflation (PCE 5.5%) can push investors toward gold as a store of value.

❌ Cons (Factors That Weigh on Gold)

- Strong labor market and GDP growth reduce the need for safe-haven assets.

- High interest rates and strong US dollar make gold less attractive as a non-yielding asset.

Previous released data results :

On last US Initial Jobless claims Data (23-1-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 40 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/the-us-initial-jobless-claims-data-will-influence-todays-gold-price-23-1-2025/

Check last given signal : https://t.me/calendarsignal/16720

Performance : https://t.me/calendarsignal/16727

On last US GDP (19-12-2024) we predicted good GDP data, & as per that we suggest to BUY XAUUSD & as a result, we made a profit of 27 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/the-us-initial-jobless-claims-data-will-influence-todays-gold-price-23-1-2025/

Check last given signal : https://t.me/calendarsignal/16439

Performance : https://t.me/calendarsignal/16448

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11