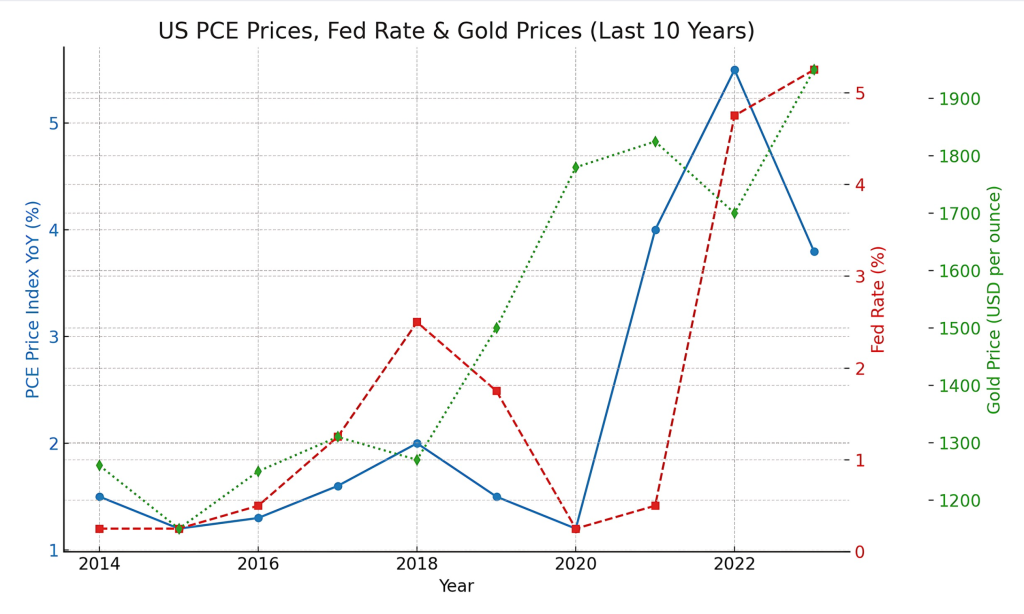

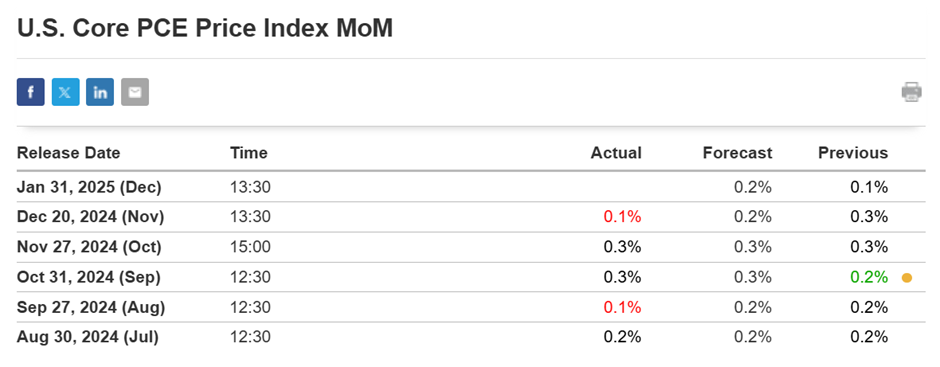

A higher PCE Price Index means rising inflation, which reduces the probability of Federal Reserve rate cuts as the Fed prioritizes controlling inflation. When inflation is high, the Fed tends to keep interest rates elevated or even hike them, making borrowing more expensive and strengthening the US dollar while weakening gold.

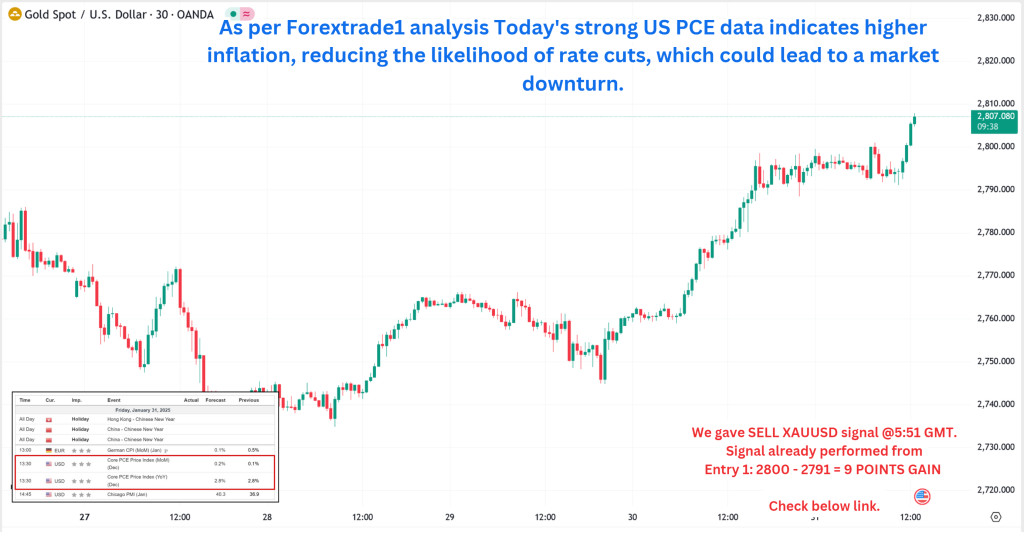

Today’s given signal : https://t.me/calendarsignal/16818

Reasons Why Higher PCE and Fewer Rate Cuts Cause Gold Prices to Fall

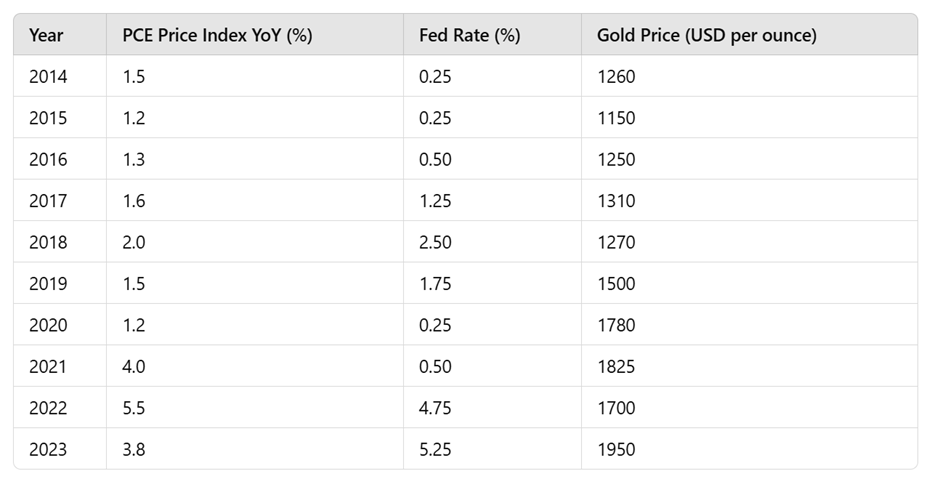

- Persistent Inflation Means Higher Interest Rates

- A rise in PCE Price Index (5.5% YoY) signals ongoing inflationary pressures.

- The Federal Reserve responds by keeping interest rates high (5.25%) to control inflation.

- Higher interest rates increase bond yields, making gold less attractive since it doesn’t generate interest.

- Stronger US Dollar Reduces Gold Demand

- Higher PCE inflation supports a hawkish Fed stance, strengthening the US Dollar Index (DXY +0.7%).

- A strong dollar makes gold more expensive for foreign investors, leading to lower demand.

- Reduced Safe-Haven Demand for Gold

- Investors shift to yield-generating assets like bonds and Treasuries, reducing gold’s appeal.

Pros & Cons of Higher PCE on Gold & Markets

✅ Pros (For Economy, But Negative for Gold)

- Stronger USD and stable economy support stock markets.

- Higher bond yields attract investors.

❌ Cons (Negative for Gold & Rate Cuts)

- Higher rates = Less gold demand as investors seek yield-bearing assets.

- Stronger USD makes gold expensive for global buyers.

Historical Trend Analysis (Last 10 Years)

Previous released data results :

On last core PCE Data (20-12-2024) we predicted higher data, & as per that we suggest to BUY XAUUSD & as a result, we made a profit of 38 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/gold-prices-rally-following-weak-us-pce-price-index-data-december-20-2024/

Check last given signal : https://t.me/calendarsignal/16456

Performance : https://t.me/calendarsignal/16474

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11