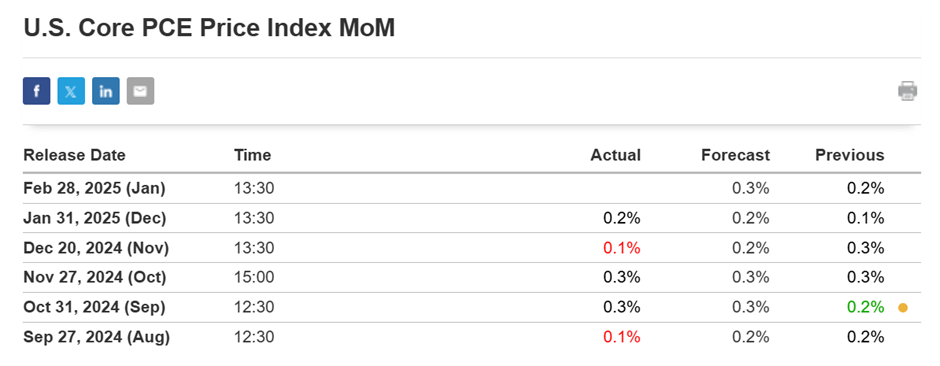

On February 28, 2025, the U.S. Bureau of Economic Analysis released the Personal Consumption Expenditures (PCE) Price Index data for January 2025. The PCE Price Index, the Federal Reserve’s preferred inflation gauge, measures changes in the prices of goods and services consumed by households. In January, the PCE Price Index rose by 0.3%, with a year-over-year increase of 2.5%, slightly down from December’s 2.6%. The Core PCE Price Index, which excludes volatile food and energy prices, increased by 0.2% month-over-month and 2.6% annually, down from 2.8% in December.

Today’s given signal : https://t.me/calendarsignal/17245

Reasons for the PCE Data Release:

- Monitoring Inflation Trends: The Federal Reserve closely monitors the PCE Price Index to assess inflationary pressures and guide monetary policy decisions.

- Economic Policy Formulation: Accurate inflation data inform policymakers in adjusting interest rates to achieve the Fed’s 2% inflation target.

- Market Expectations: Investors and analysts rely on PCE data to anticipate potential shifts in monetary policy, influencing financial markets.

Impact on XAU/USD (Gold Prices):

Gold prices are sensitive to inflation data and monetary policy expectations. The release of the PCE data had the following effects on XAU/USD:

- Immediate Reaction: The slight cooling in inflation led to a modest decline in gold prices, as lower inflation reduces gold’s appeal as an inflation hedge. Additionally, expectations that the Federal Reserve might delay interest rate cuts contributed to the downward pressure on gold. barrons.com

- Market Dynamics: The U.S. dollar strengthened following the PCE release, making gold more expensive for holders of other currencies, which further weighed on gold prices. marketwatch.com

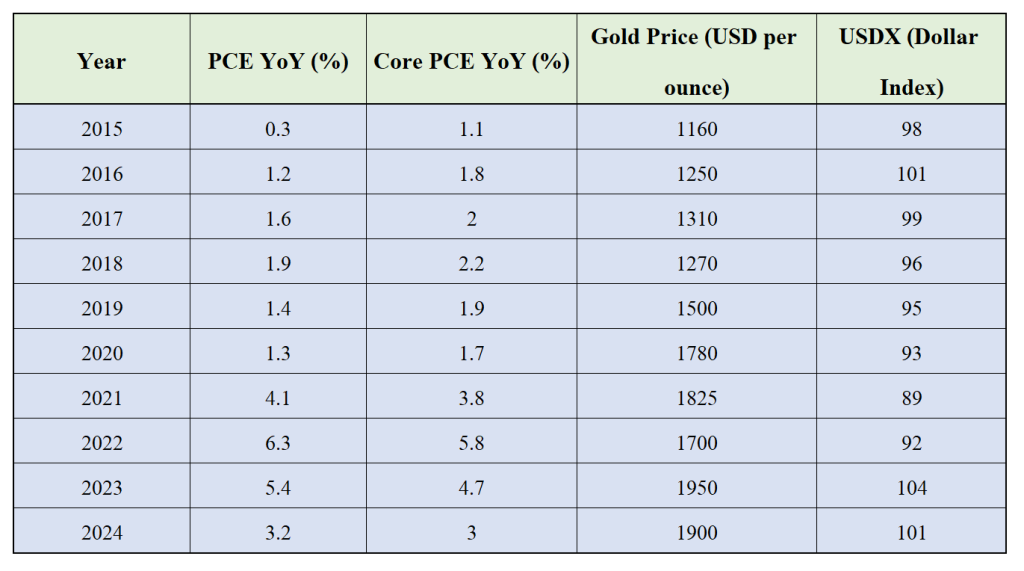

Historical Context:

Over the past decade, similar PCE data releases have influenced gold prices:

- December 2024: A PCE increase of 2.6% led to a slight dip in gold prices, as markets anticipated steady monetary policy.

- August 2024: The PCE Price Index rose by 0.2%, aligning with expectations and resulting in stable gold prices.

- December 2023: A higher-than-expected PCE reading prompted a surge in gold prices due to increased inflation concerns.

In summary, the January 2025 PCE data release indicated a modest easing in inflation, leading to a decrease in gold prices as investors adjusted their expectations regarding inflation and Federal Reserve policy. This event underscores the sensitivity of gold to inflation metrics and monetary policy signals.

Previous released data results :

On last PCE data (31-1-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 53 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/the-us-pce-data-will-influence-todays-gold-price-31-1-2025/

Check last given signal : https://t.me/calendarsignal/16818

Performance : https://t.me/calendarsignal/16835

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11