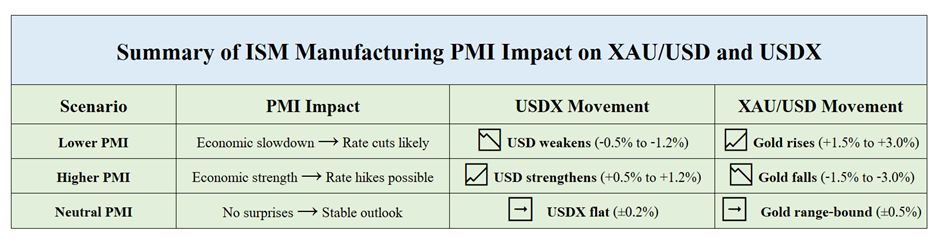

The Institute for Supply Management (ISM) Manufacturing Purchasing Managers’ Index (PMI) is a key indicator of the economic health of the U.S. manufacturing sector. A PMI reading below 50 signifies contraction, while above 50 indicates expansion.

Today’s given signal : https://t.me/calendarsignal/17267

Reasons for the Release of Bad US ISM Manufacturing Data:

- Weak Demand: Persistent weak demand has led to reduced new orders and production levels, contributing to the manufacturing sector’s contraction.

- High Interest Rates: Elevated borrowing costs have dampened business investments and consumer spending, negatively impacting manufacturing activities.

- Global Economic Slowdown: Sluggish global economic growth has reduced export opportunities for U.S. manufacturers, further straining the sector.

Impact on XAU/USD (Gold Prices):

Gold is often considered a safe-haven asset, attracting investors during economic downturns or periods of uncertainty. A contraction in the manufacturing sector can signal broader economic challenges, influencing gold prices.

Specific Example:

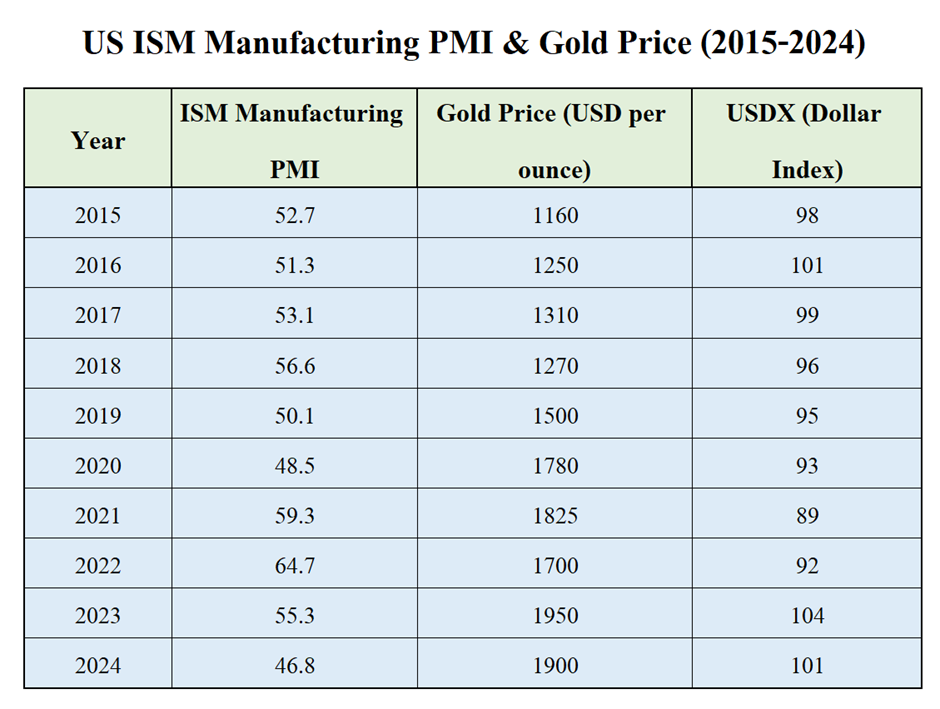

In July 2024, the ISM Manufacturing PMI declined to 46.8, indicating a significant contraction. This downturn led to increased investor concerns about economic stability, prompting a shift towards safe-haven assets like gold. Consequently, the XAU/USD pair experienced an uptick during this period.

Previous released data results :

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11