On April 10, 2025, two significant developments influenced financial markets: the release of favorable U.S. Consumer Price Index (CPI) data and President Donald Trump’s announcement of a 90-day pause on new tariffs, excluding those on China. These events had notable implications for gold prices (XAU/USD) and the U.S. Dollar Index (USDX).

Today’s given signal : https://t.me/calendarsignal/17899

U.S. Consumer Price Index (CPI) Data:

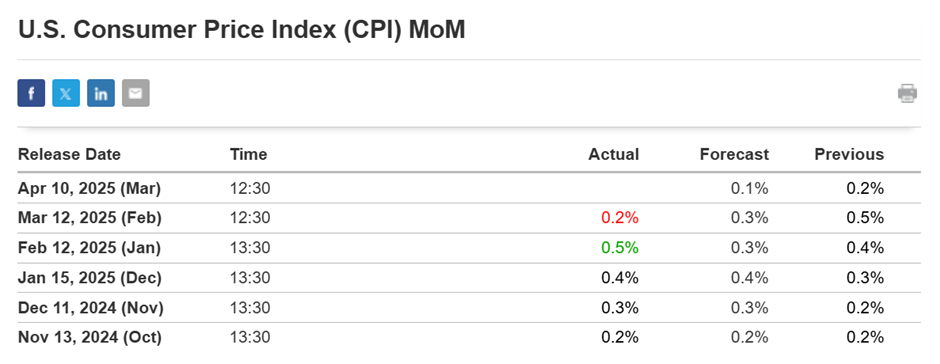

The CPI measures the average change over time in the prices paid by urban consumers for a basket of goods and services, serving as a primary indicator of inflation. The Bureau of Labor Statistics reported that in February 2025, the CPI increased by 0.2% on a seasonally adjusted basis, following a 0.5% rise in January. Over the last 12 months, the all-items index increased by 2.8% before seasonal adjustment.

Trump’s 90-Day Tariff Pause:

Amid escalating trade tensions, President Trump announced a 90-day suspension of new tariffs on most U.S. trading partners, aiming to alleviate market concerns and provide a window for negotiations. However, tariffs on Chinese imports were increased to 125%, reflecting ongoing trade disputes between the U.S. and China.

Impact on Gold Prices (XAU/USD):

Gold prices are influenced by a myriad of factors, including inflation data and geopolitical developments:

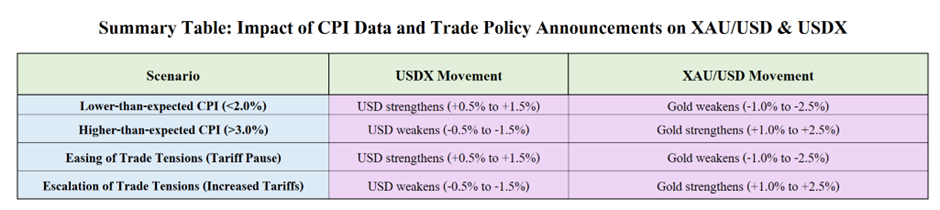

- Inflation Data: Lower-than-expected CPI figures can reduce gold’s appeal as an inflation hedge, potentially leading to a decrease in its price.

- Trade Policy Announcements: Easing trade tensions, such as the tariff pause, can boost investor confidence, leading to a stronger USD and exerting downward pressure on gold prices. Conversely, heightened tariffs on China may increase demand for gold as a safe-haven asset.

Key Takeaways:

- Lower CPI figures can lead to USD appreciation and gold depreciation due to reduced inflationary pressures.

- Easing trade tensions may bolster the USD and weaken gold prices, while escalating disputes can have the opposite effect.

Understanding these dynamics assists traders and investors in anticipating potential movements in XAU/USD and USDX following economic data releases and geopolitical events.

Previous released data results :

On last CPI data (12-3-2025) we predicted higher data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 47 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/17421

Performance : https://t.me/calendarsignal/17439