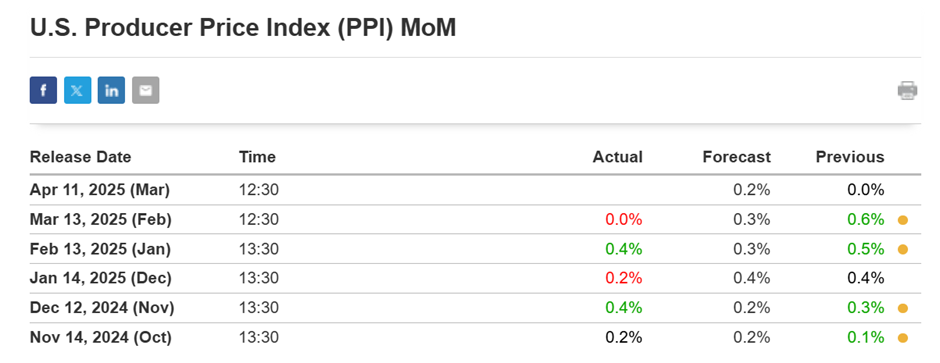

On April 11, 2025, the U.S. Producer Price Index (PPI) data indicated a 0.2% month-over-month increase for March, aligning with forecasts and suggesting persistent inflationary pressures. Concurrently, gold prices surged past the $3,200 per ounce mark, reaching a record high of $3,219.84, driven by a weakening U.S. dollar and heightened safe-haven demand amid escalating U.S.-China trade tensions.

Today’s given signal : https://t.me/calendarsignal/17924

Factors Influencing Gold Prices:

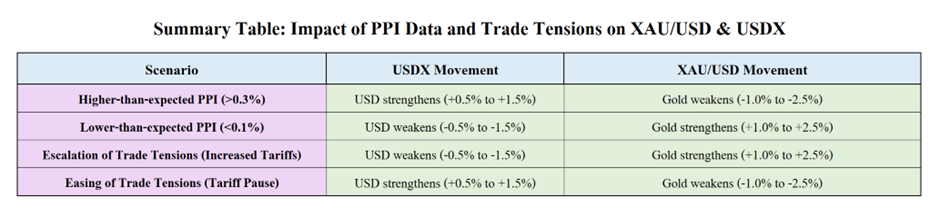

- Higher PPI Data: The increase in producer prices signals ongoing inflationary pressures, which can enhance gold’s appeal as an inflation hedge.

- Trade Tensions: President Trump’s decision to raise tariffs on Chinese imports to 145% intensified trade disputes, prompting investors to seek refuge in gold.

- Weaker U.S. Dollar: The dollar declined nearly 1% against major currencies, making gold more affordable for international buyers and boosting demand.

- Technical Indicators: Despite the rally, technical analysts suggest that gold is in overbought territory, with indicators like the Relative Strength Index (RSI) exceeding 75, hinting at potential short-term corrections.

The combination of persistent inflationary pressures, as indicated by the higher PPI data, and escalating trade tensions has propelled gold prices to record highs. While technical indicators suggest potential short-term corrections, the underlying macroeconomic factors continue to support gold’s appeal as a safe-haven asset. Investors should monitor upcoming economic data releases and geopolitical developments to navigate the gold market effectively.

Previous released data results :

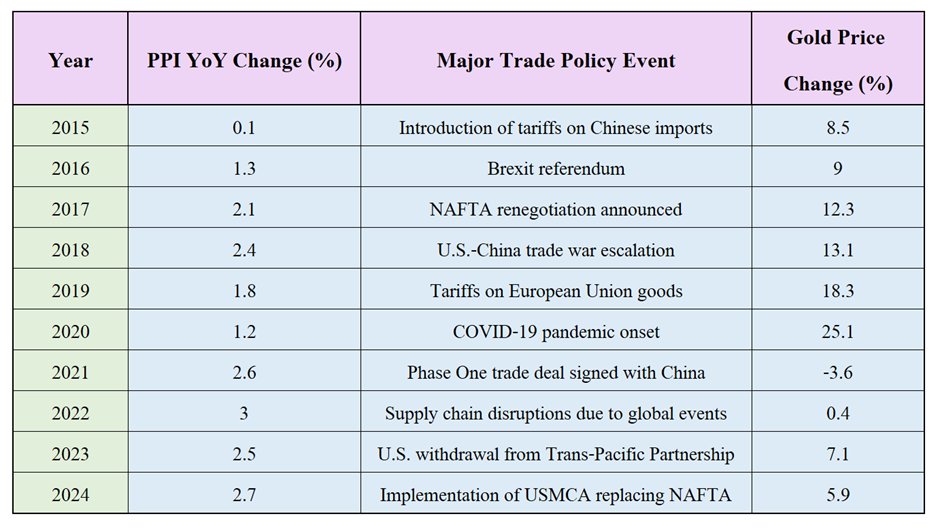

Historical Context:

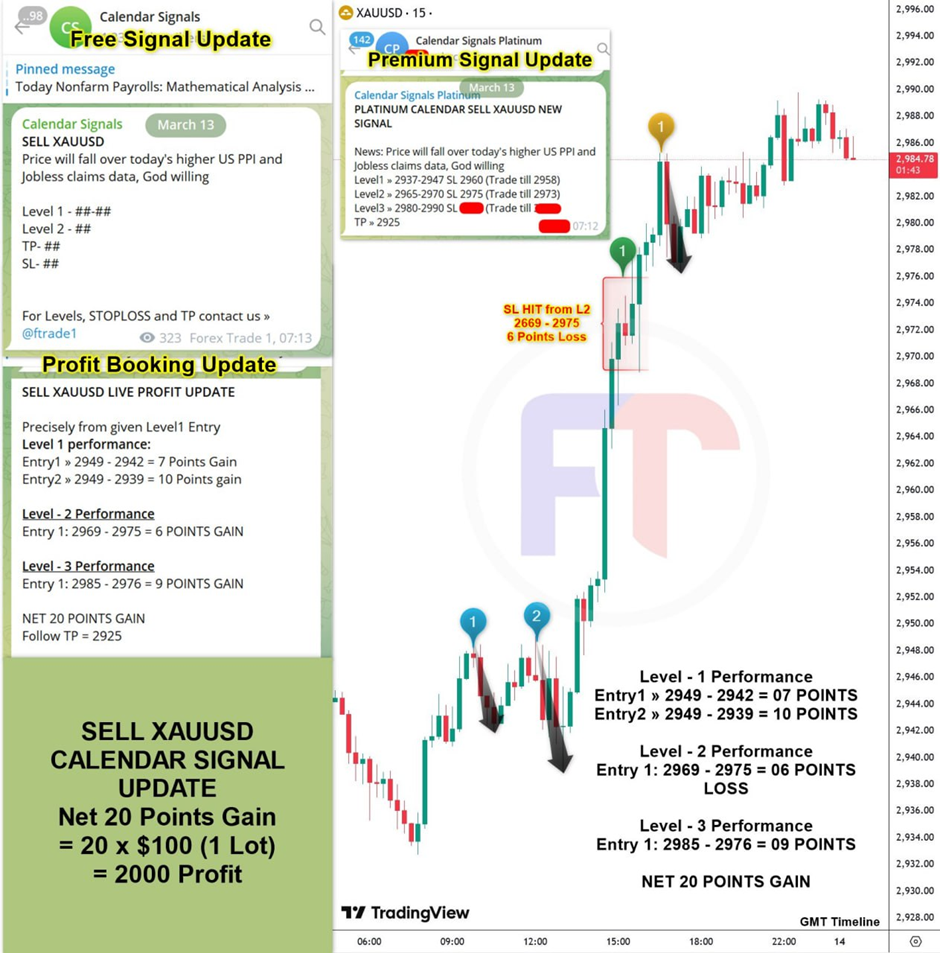

On last U.S. PPI data (13-3-2025) we predicted higher data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 20 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/u-s-ppi-and-jobless-claims-data-for-gold-13-3-2025/

Check last given signal : https://t.me/calendarsignal/17446

Performance : https://t.me/calendarsignal/17456

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11