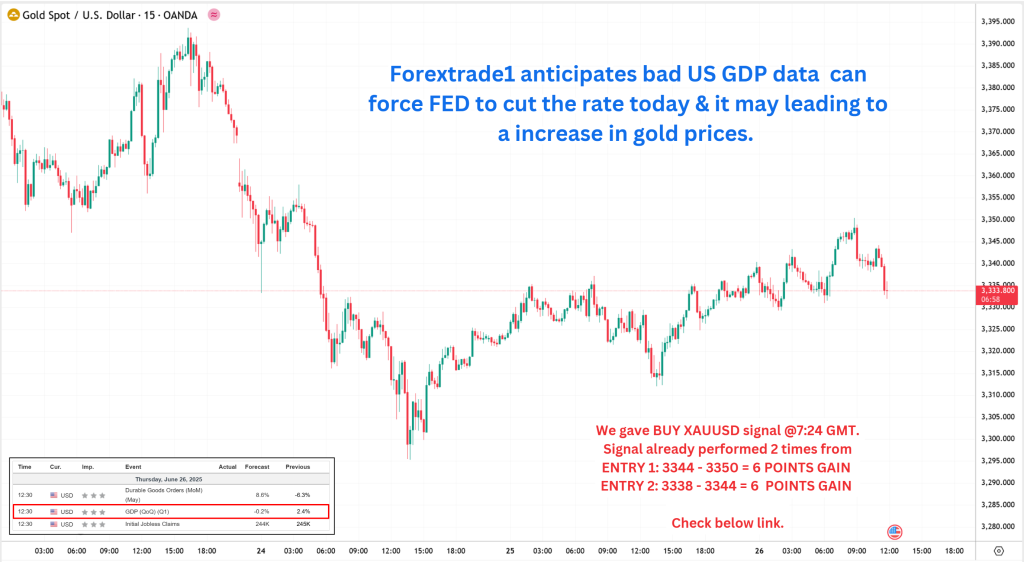

Gold prices are poised for a potential breakout on 26th June 2025, as the combination of weaker-than-expected US GDP data, growing pressure on the Federal Reserve to initiate rate cuts, and political signals from former President Trump regarding Fed Chair Jerome Powell’s position fuel strong bullish sentiment in the market.

Today’s given signal : https://t.me/calendarsignal/19227

Reasons for Today’s Bad US GDP Data

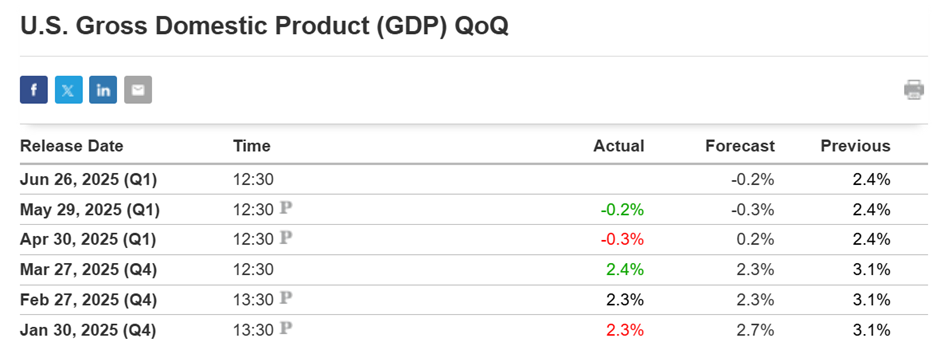

The final Q1 2025 GDP figures released today show a sharp slowdown in U.S. economic growth. The GDP expanded by just 0.9%, missing consensus estimates of 1.5%. This underperformance is driven by:

- Slowing Consumer Spending – Elevated interest rates have cooled household consumption, especially in durable goods and housing.

- Weak Business Investment – Corporations are holding back capital expenditures due to policy uncertainty and high financing costs.

- Trade Deficit Expansion – Imports outpaced exports due to weak global demand, further dragging on GDP.

- State-Level Fiscal Constraints – Austerity policies in several states have led to lower public sector investment.

Trump’s Influence & Powell’s Position

In a fiery campaign statement today, Donald Trump criticized Fed Chair Jerome Powell for “lagging on monetary easing” and implied that his reappointment is at risk unless the Fed acts to support economic growth. This adds political pressure on the Fed, already under scrutiny for maintaining high rates amid clear signs of slowdown.

Market participants interpret this as a signal for imminent policy shift—either through rate cuts or a potential leadership reshuffle that could usher in a more dovish Fed regime. Both scenarios are bullish for gold.

New & Interesting Developments in Today’s Data

- PCE Price Index for Q1 has been revised down to 2.3% from 2.5%, giving the Fed more room to ease policy.

- Real Final Sales to Domestic Purchasers fell to 0.6%, a metric seen as a better indicator of underlying demand.

- Atlanta Fed’s GDP Now forecast for Q2 has been downgraded to 1.1%, confirming continued softness.

Previous released data results :

On last GDP data (29-5-2025) we predicted bad data, & as per that we suggest to BUY XAUUSD & as a result, we made a profit of 60 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/todays-major-impact-on-gold-due-to-us-gdp-data-29-5-2025/

Check last given signal : https://t.me/calendarsignal/18764

Performance : https://t.me/calendarsignal/18781

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11