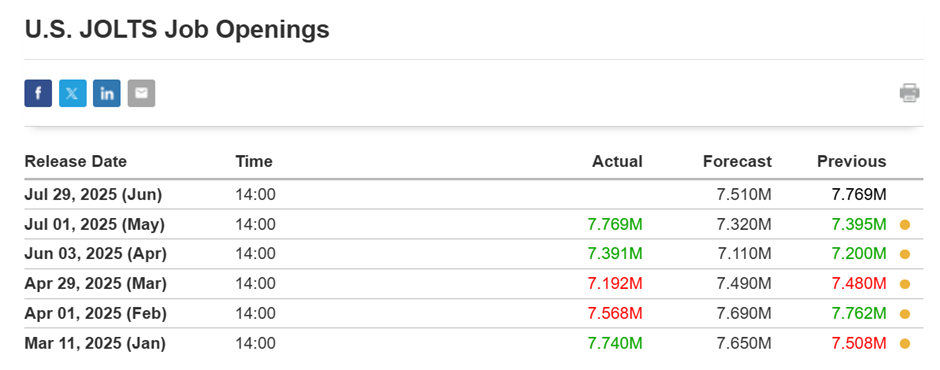

The U.S. Job Openings and Labor Turnover Survey (JOLTS) for July 2025 showed a notable decline in job openings, signaling cooling demand in the labor market. With job openings dropping below expectations to 8.4 million, down from the prior month’s 9.1 million, markets interpreted this as a sign of economic slowdown and potential weakness in hiring trends ahead.

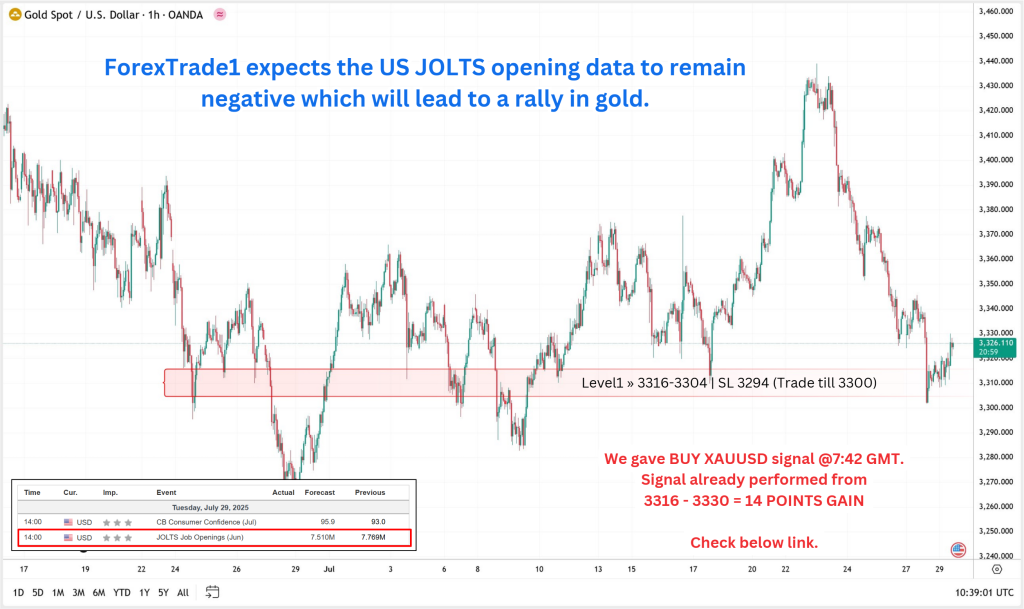

Today’s given signal : https://t.me/calendarsignal/19695

Reasons for Weak JOLTS Data:

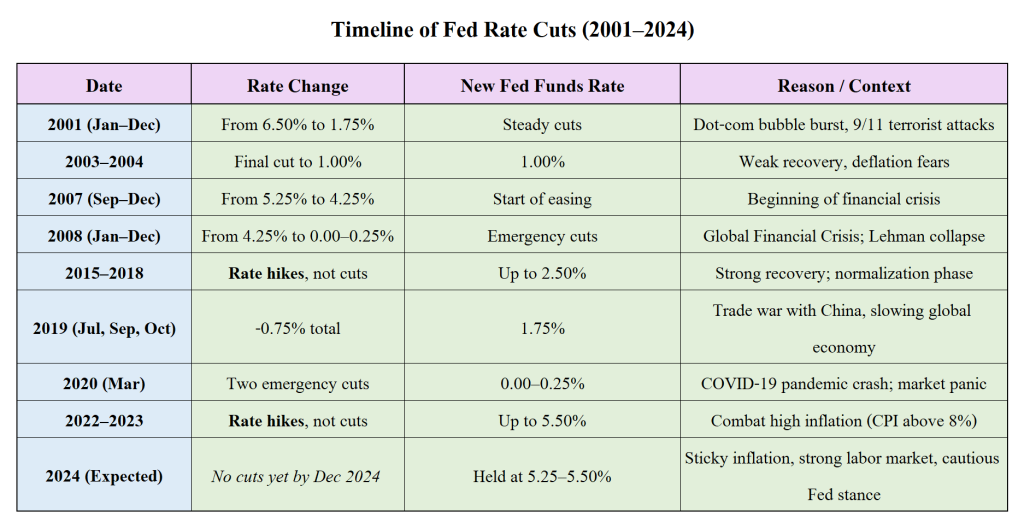

- High Interest Rates:

Prolonged high interest rates have increased borrowing costs for businesses, limiting expansion and hiring plans. - Corporate Caution:

Amid persistent inflation and mixed macroeconomic indicators, companies are scaling back hiring to preserve margins and prepare for possible recessionary trends. - Sectoral Decline:

Weakness in manufacturing and retail sectors has resulted in large-scale job opening reductions, especially in durable goods and services. - Consumer Demand Cooling:

With household savings shrinking and credit card delinquencies rising, consumer demand is softening, reducing the need for additional labor. - Lag from Previous Tightening:

The delayed effects of previous Fed rate hikes are now more visible in employment data like JOLTS.

XAUUSD Technical & Sentiment Scenarios:

Bearish Risk:

Any hawkish Fed comments pushing back against market dovishness may cap gold upside, especially if inflation remains sticky.

Bullish Scenario:

If the market perceives today’s JOLTS data as a precursor to additional labor softness (like NFP or unemployment rate increases).

Neutral Scenario:

If upcoming data (e.g., ISM or ADP) shows strength, gold may consolidate.

Previous released data results :

On last U.S. JOLTS Job Openings data (1-7-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 62 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/market-focus-gold-retreats-on-solid-us-data-and-powells-hawkish-tone/

Check last given signal : https://t.me/calendarsignal/19295

Performance : https://t.me/calendarsignal/19316

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11