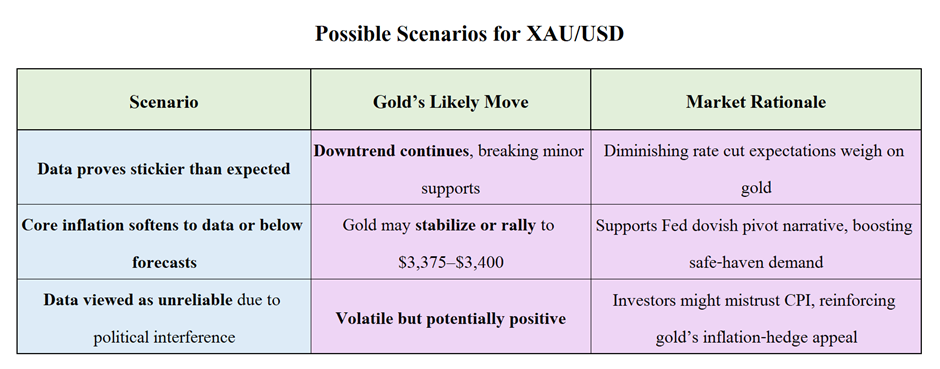

Today’s U.S. CPI report shows inflation remains above target, reducing rate-cut expectations and putting pressure on gold. While gold initially fell, the rebound suggests markets remain watchful for any hints of a dovish monetary shift. Traders should stay alert to upcoming Fed commentary and data for clarity on the path forward.

Today’s given signal : https://t.me/calendarsignal/19940

Good U.S. Inflation Data: Impact on Gold Prices – 12 August 2025

On August 12, 2025, the U.S. reported higher-than-expected inflation data:

- CPI rose ~0.2% month-over-month and around 2.8% year-over-year, indicating inflation remained durable.

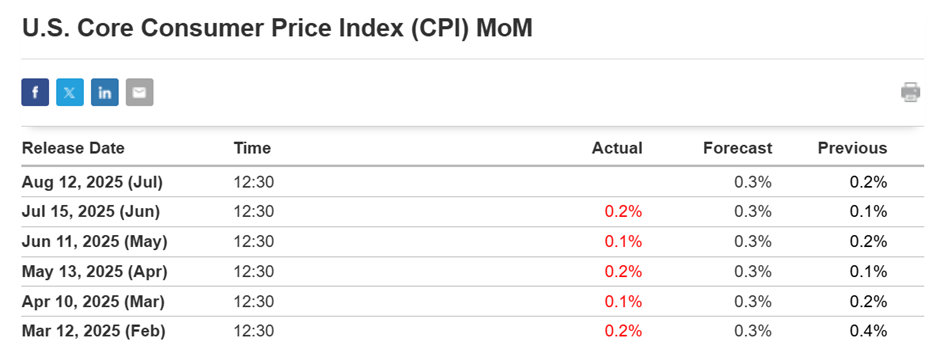

- Core CPI, which excludes volatile food and energy prices, climbed 0.3%, pushing its annual rate toward 3%.

- Heightened scrutiny of data integrity followed the firing of the BLS director, raising concerns about the reliability of CPI calculations.

Why This Matters for Gold (XAU/USD)

Higher inflation = reduced chances of rate cuts

Persistent inflation pressures suggest the Fed may remain cautious, keeping interest rates elevated. Higher interest rates typically mean stronger real yields and less demand for non-yielding assets like gold.

Immediate Market Reaction

Gold fell sharply on Monday, with spot prices dropping ~1.6%, as markets priced out immediate rate cut hopes. However, as of Tuesday, gold has rebounded modestly by ~0.3–0.4%, as some traders anticipate that softened core inflation might support a rate cut in September.

Technical Outlook

- Gold has lost momentum under pressure from stronger inflation.

- Recent dip broke below technical supports, though slight rebounds are evident.

- Key resistance zones: $3357-$3380

- If inflation fears persist, we could see testing of $3,310–$3,330.

Previous released data results :

On last CPI data (15-7-2025) we predicted higher data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 73 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/cpi-report-shakes-the-gold-market-us-inflation-update-15-07-2025/

Check last given signal : https://t.me/calendarsignal/19495

Performance : https://t.me/calendarsignal/19515

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11