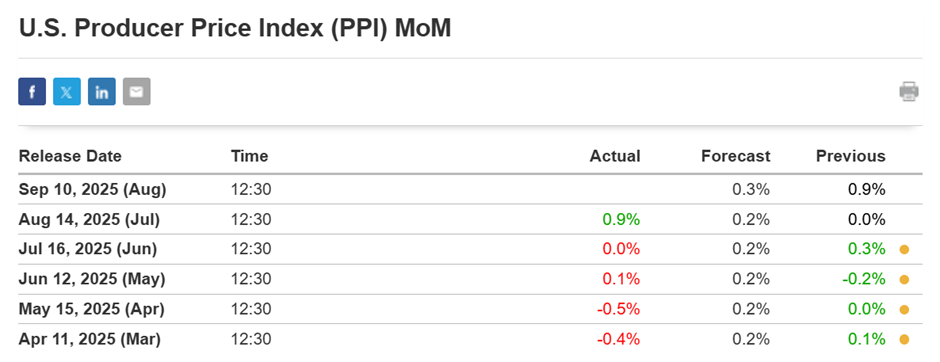

The release of the U.S. Producer Price Index (PPI) for October 2025 on November 10 revealed a surprising uptick of 0.9% month-over-month, significantly surpassing the anticipated 0.2% increase. This unexpected rise in wholesale inflation has implications for gold prices, as markets adjust expectations regarding future Federal Reserve policies.

Today’s given signal : https://t.me/calendarsignal/20347

Here are the main necessary factors behind good U.S. Producer Price Index (PPI) data:

- Strong Consumer Demand: Higher demand for goods and services leads to increased production costs, which producers pass on to consumers.

- Supply Chain Constraints: Disruptions or bottlenecks in supply chains increase costs for producers, raising prices.

- Rising Input Costs: Increases in raw material costs (e.g., oil, metals) can drive up production costs and push up PPI.

- Labor Costs: Higher wages and benefits in manufacturing and services can contribute to higher production costs.

- Inflationary Pressures: Persistently high inflation forces producers to increase prices to maintain profit margins.

- Strong Economic Growth: A booming economy often leads to higher production levels, more employment, and greater demand, resulting in price increases.

- Tariffs and Trade Barriers: Higher tariffs on imports can increase costs for producers, contributing to higher PPI data.

Impact on Gold Prices (XAU/USD)

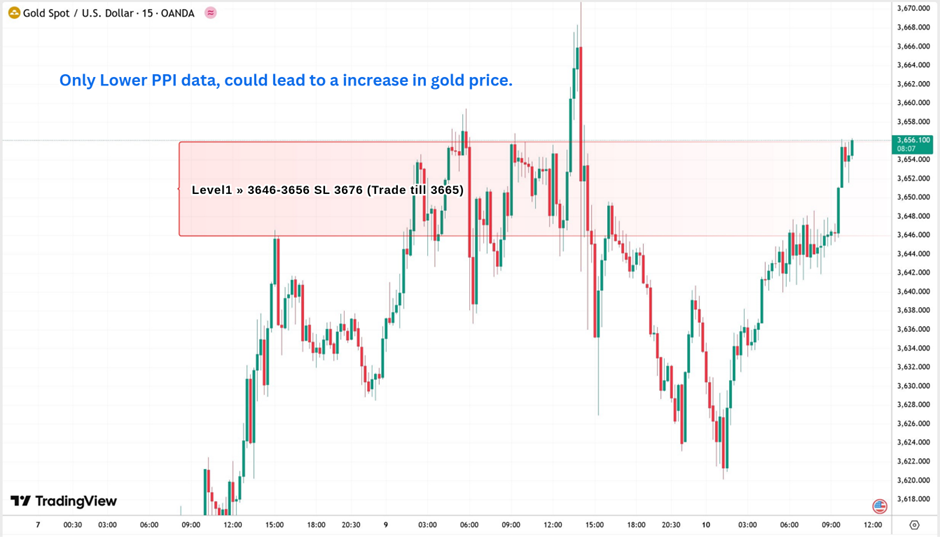

Gold, traditionally viewed as a hedge against inflation, often reacts to economic data that signals potential changes in interest rates. The stronger-than-expected PPI data could lead to the following scenarios for gold prices:

- Bearish Scenario: If the Federal Reserve interprets the PPI increase as a sign of sustained inflation, it may delay or reconsider any planned interest rate cuts. Higher interest rates typically strengthen the U.S. dollar and increase the opportunity cost of holding non-yielding assets like gold, leading to a potential decline in gold prices.

- Neutral Scenario: If the Fed views the PPI rise as a temporary fluctuation and maintains its current policy stance, gold prices may experience limited movement, trading within a narrow range.

- Bullish Scenario: If the Fed’s response is dovish, indicating concerns over economic growth despite higher inflation, gold could benefit from expectations of lower interest rates, leading to price increases.

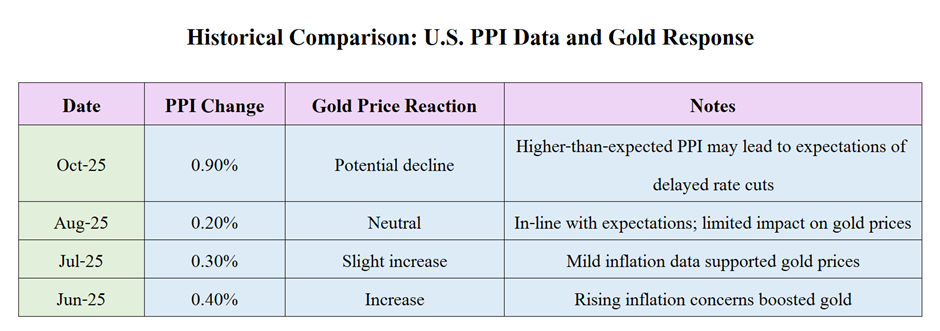

Previous released data results :

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11