Here’s a blog-style analysis of how higher U.S. CPI data today (11 September 2025) can affect gold prices, including reasons, scenarios, and a historical comparison.

Today’s given signal : https://t.me/calendarsignal/20372

Gold in the Crosshairs: Effects of Strong U.S. CPI on XAU/USD – 11 September 2025

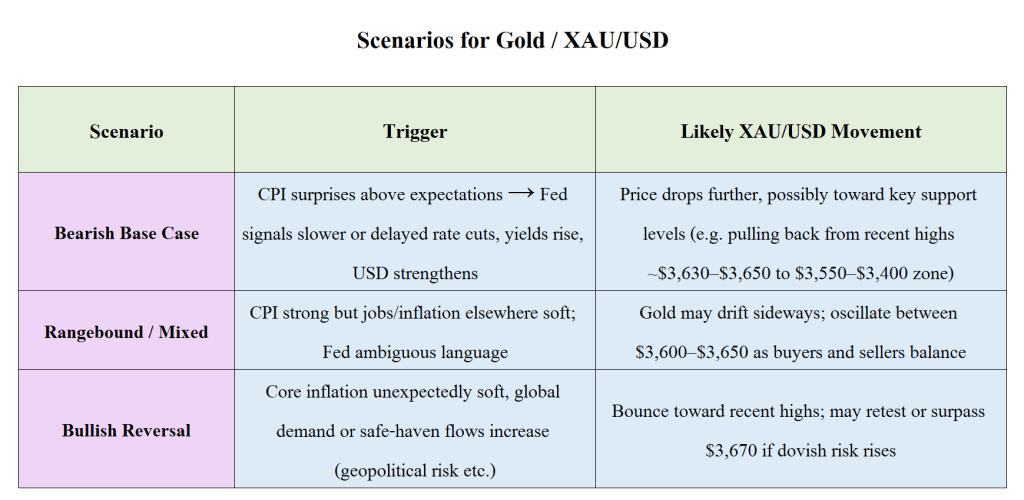

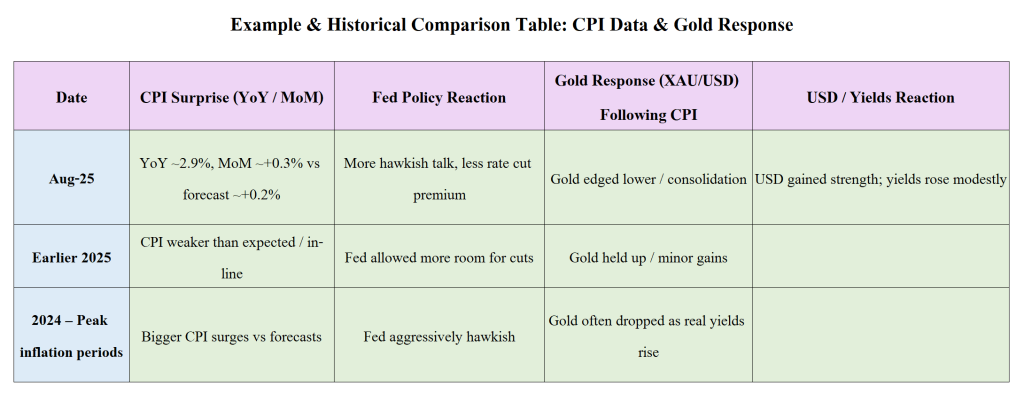

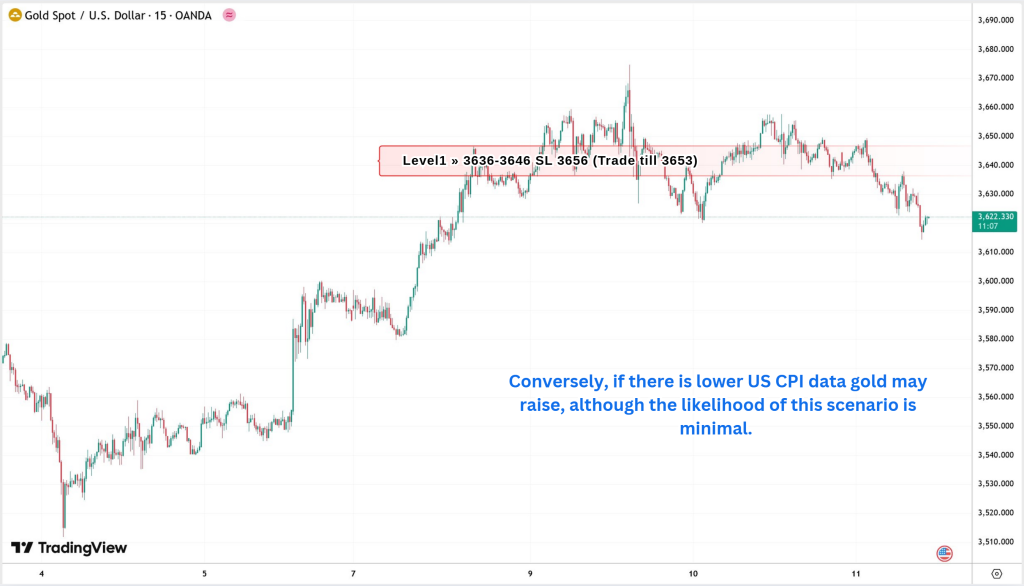

Gold prices have come under pressure following today’s higher-than-expected U.S. Consumer Price Index (CPI) release, which is being interpreted by markets as confirmation that inflation remains elevated. This puts renewed focus on potential Federal Reserve policy tightening and diminishes gold’s appeal as a non-yielding asset. Reuters notes that gold is consolidating after record peaks, while the upcoming CPI data showing about a 0.3% monthly and 2.9% annual increase could further boost dollar strength.

What’s Driving Today’s Higher CPI Data

Here are the key reasons and factors behind the CPI being stronger than market expectations:

- Tariff Pass-Through Effects

Recent tariffs on imported goods have started feeding into consumer prices. Goods manufacturers facing higher import costs pass those onto consumers, contributing to inflation in consumer durable goods and other items. - Rising Energy Prices and Gasoline

Fuel costs have ticked up, impacting transportation and goods pricing. Even modest increases in energy tend to have outsized effects on core inflation when supply or geopolitical risks weigh. - Strong Goods & Services Demand

Despite some weak spots in employment and wholesale prices, consumers continue spending across many sectors. Hotels, home goods, utilities, and other services are seeing inflation pressures. - Supply Chain and Labor Costs

Labor costs, shelter costs, and supply constraints (in transportation, housing, etc.) are contributing to upward price pressures. With wage pressures persistent, producers and retailers are pushing up prices. - Sticky Core Inflation

Core CPI (excluding food and energy) remains elevated in many readings. Because volatile food and energy are excluded, core inflation is a better indicator of underlying inflationary trends. High core inflation often leads Fed voters to maintain hawkish or less accommodative stances.

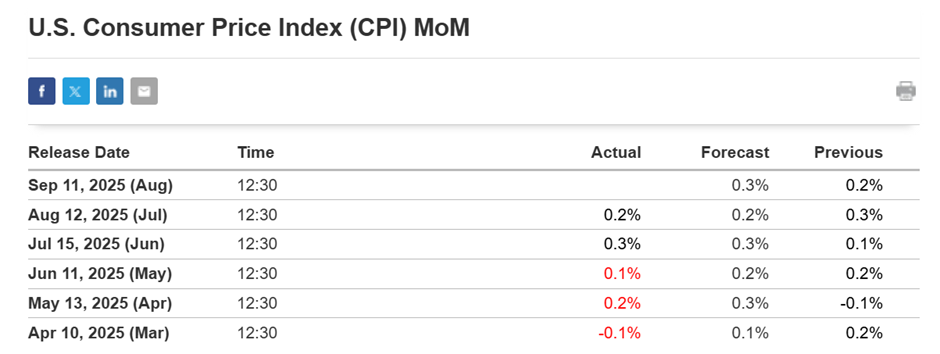

Previous released data results :

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11