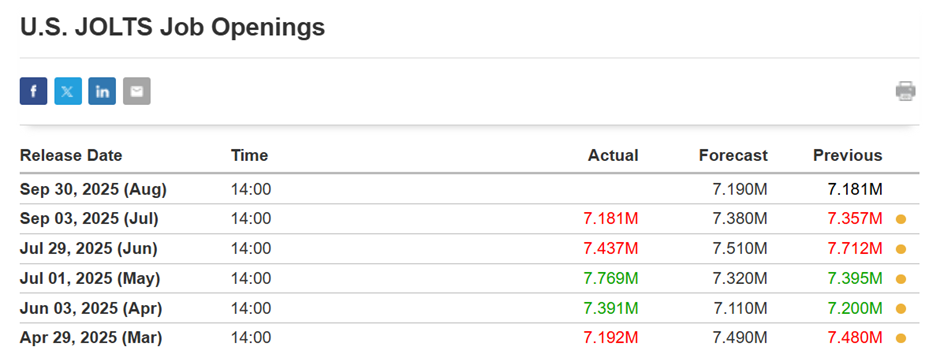

Today’s release of good US JOLTS job openings data and strong Chicago PMI figures points to continued strength in the US labor market and manufacturing sector. These upbeat signals strengthen the case for the Federal Reserve to keep interest rates higher for longer, pushing US Treasury yields and the dollar up. As a result, XAU/USD (gold) is under pressure, with investors shifting toward yield-bearing assets instead of safe-haven gold.

Today’s given signal : https://t.me/calendarsignal/20660

Reasons Behind Good JOLTS & Chicago PMI Data

- Resilient Labor Market (JOLTS):

- Job openings remain elevated, suggesting strong demand for workers.

- Key industries such as healthcare, professional services, and construction continue to add vacancies.

- Strong labor demand supports wage growth, fueling consumer spending.

- Chicago PMI Strength:

- A reading above 50 signals expansion in Midwest manufacturing.

- New orders and production levels remain strong, showing confidence in business conditions.

- Supply chains have eased compared to the pandemic years, lowering cost pressures.

- Underlying Drivers:

- Robust consumer demand and higher capital spending.

- Government infrastructure spending supporting industrial activity.

- Export resilience despite global uncertainty.

Impact on XAU/USD

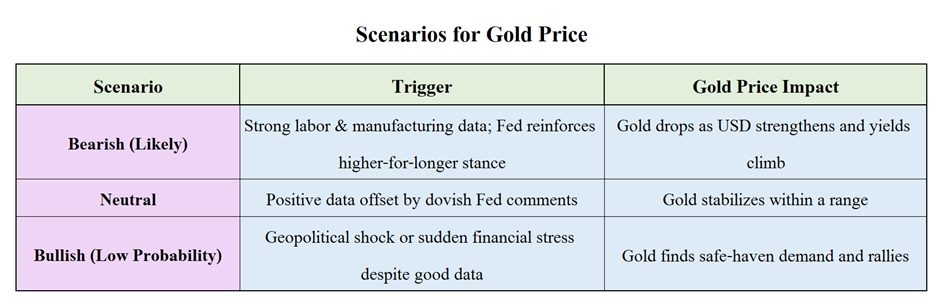

- The combination of robust JOLTS and Chicago PMI data today signals that the US economy remains resilient, even in the face of tighter monetary policy. For markets, this suggests the Federal Reserve has little immediate reason to cut rates. In fact, sticky labor demand and expanding manufacturing increase inflationary pressures, strengthening the argument for maintaining or even tightening policy.

- For gold, this environment is challenging. Rising US Treasury yields, driven by expectations of prolonged high rates, increase the opportunity cost of holding gold, a non-yielding asset. Simultaneously, the US dollar tends to strengthen on positive economic surprises, making gold more expensive for international buyers and further weighing on XAU/USD.

- Traders often use JOLTS as an early labor market barometer ahead of Nonfarm Payrolls (NFP). Strong job openings today could increase expectations for another strong NFP print, amplifying bearish momentum in gold. Similarly, the Chicago PMI serves as a proxy for national ISM data; a robust number here supports the idea of broad economic resilience, reinforcing bearish sentiment for gold.

- Technically, gold faces risk of testing lower support levels if selling pressure persists. Intraday dips may attract bargain hunters, but without dovish Fed commentary or a geopolitical spark, sustained rallies are unlikely. Instead, markets may adopt a “sell-the-rally” strategy until incoming inflation data softens or Fed rhetoric changes.

- In historical context, gold has consistently struggled in periods of strong US economic data combined with hawkish Fed policy. For example, in September 2018, strong PMI and labor data coincided with gold dropping below $1,200 as the Fed maintained its hiking cycle. A similar dynamic could play out today if economic resilience persists into Q4 2025.

- Bottom line: Today’s strong JOLTS and Chicago PMI reinforce the view of a resilient US economy. That boosts the dollar and yields while weighing on gold. Unless offset by dovish Fed signals or external risk shocks, XAU/USD is likely to remain under bearish pressure.

Previous released data results :

On last US JOLTS opening data (3-9-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 111 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/20231

Performance : https://t.me/calendarsignal/20252

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11