Gold Faces Headwinds — Strong ISM Manufacturing and a Likely Fed Pause on Cuts

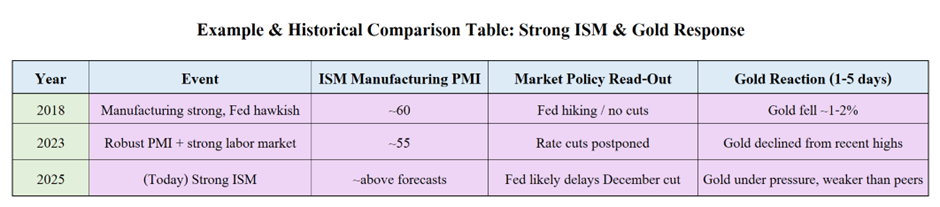

Today’s ISM Manufacturing PMI came in better than expected, suggesting that the U.S. manufacturing sector is showing surprising resilience. Coupled with commentary that the Federal Reserve may halt or delay its December rate cut, this creates a challenging environment for gold. With higher interest-rate durability on the table, the dollar and real yields push higher — leaving gold, a non-yielding asset, under pressure.

Today’s given signal : https://t.me/calendarsignal/21346

Why Today’s ISM Manufacturing Data Were “Good”

1. New Orders & Production Pick-Up

The new orders component rose meaningfully, signalling that demand is not subsiding. Manufacturers are receiving more orders and ramping up production — signs of economic life beyond services. Source: preliminary PMI movements show new-orders strength.

2. Continued Price Pressures

The prices paid index within the ISM remained elevated, meaning input costs remain high and inflation pressures persist. This heightens Fed vigilance.

3. Labor/Employment Stability

Even if employment sub-index is weaker, the fact that manufacturing is holding up supports the narrative that the economy is not yet ready for full policy easing. Manufacturers are cautious but still expanding.

4. Fed Policy Implications

Strong manufacturing data reduce the odds of a rate cut in December. A resilient sector implies inflation risk remains, so the Fed may hold off on easing — this is the key linkage to gold. Markets now lean toward “higher-for-longer” rates.

Previous released data results :

On last ISM data (1-10-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 56 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/20682

Performance : https://t.me/calendarsignal/20700

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11