Here’s a blog-style breakdown of how strong US JOLTS job openings and robust factory orders data released today (4 Nov 2025) could push XAU/USD (gold) higher in certain scenarios—despite the “good” data—because strong data affect policy expectations. I’ll cover the reasons, the scenarios for gold, and a historical comparison table.

Today’s given signal : https://t.me/calendarsignal/21372

Gold Could Rise After “Good” Data — Why It Matters

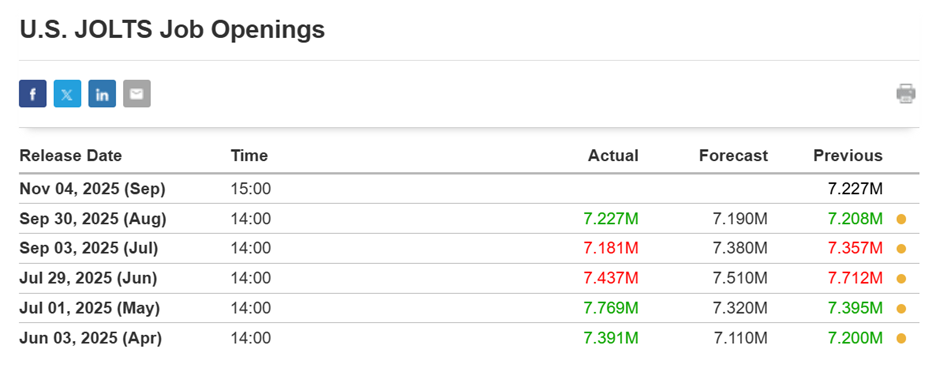

Today’s U.S. data delivered surprising strength: The JOLTS Job Openings survey reported higher-than-expected vacancies, and the Factory Orders release showed solid growth in business investment. Normally “good” data might hurt gold by reinforcing hawkish central-bank policy, but in this case the context might flip that logic:

Why these data are important:

- JOLTS job openings: A high number of job vacancies signals strong labor-demand. That implies employment pressure and potential wage growth. For the central bank (e.g., Federal Reserve) this means inflation risk may remain, delaying cuts.

- Factory orders: Growth in factory orders indicates firms are investing, output is building, and the industrial cycle is alive. This boosts demand-side momentum and may translate into inflationary input-cost pressure.

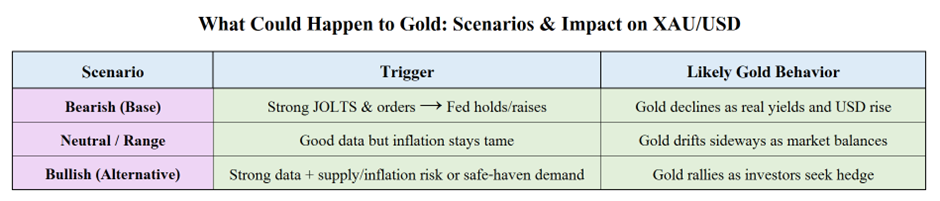

- Inflation & policy linkage: Strong labor and business-investment data suggest the economy has less slack than some expect. This reduces the odds of the Fed cutting interest rates soon. Since gold benefits when cuts happen or real yields fall, reduced cut odds can press gold lower. But—if strong data create fears of overheating and spark safe-haven flows (or collateral worries like supply-chain bottlenecks, war, etc.), gold can unexpectedly rise.

Impact on XAU/USD

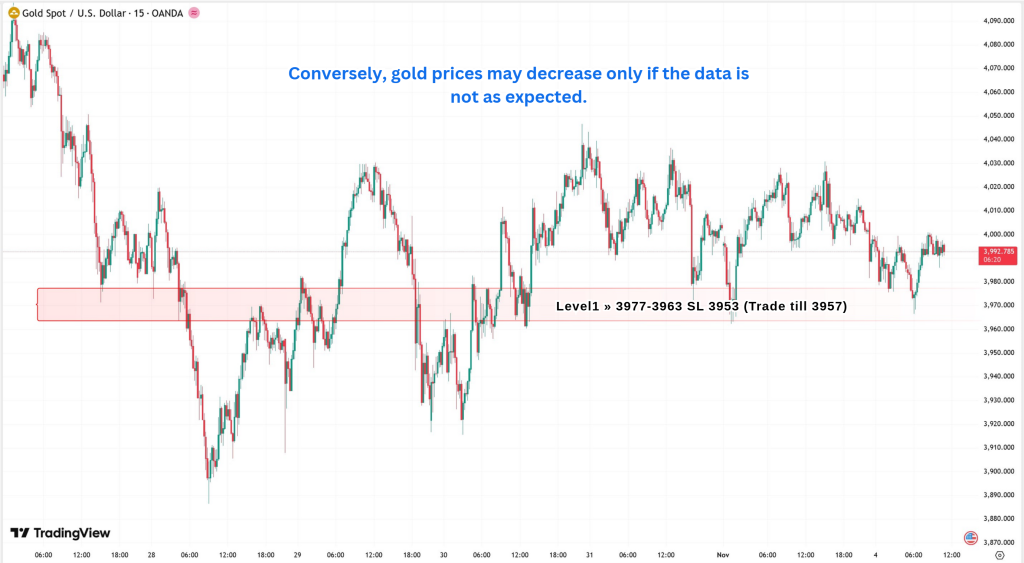

With today’s “good” JOLTS and factory orders, the likely base case: markets push the Fed into a wait-and-see/hawkish stance. That typically elevates U.S. real yields and the dollar, creating headwinds for gold. XAU/USD may drop from current levels, retesting support zones. However, if the strong data hint at overheating, supply constraints or geopolitical risk amplify, gold may pivot and rise as a hedge. In short: good data can hurt gold, but context matters.

Previous released data results :

On last US JOLTS opening data (30-9-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 89 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/xau-usd-analysis-gold-faces-pressure-from-todays-us-economic-data-30-9-2025/

Check last given signal : https://t.me/calendarsignal/20660

Performance : https://t.me/calendarsignal/20676

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11