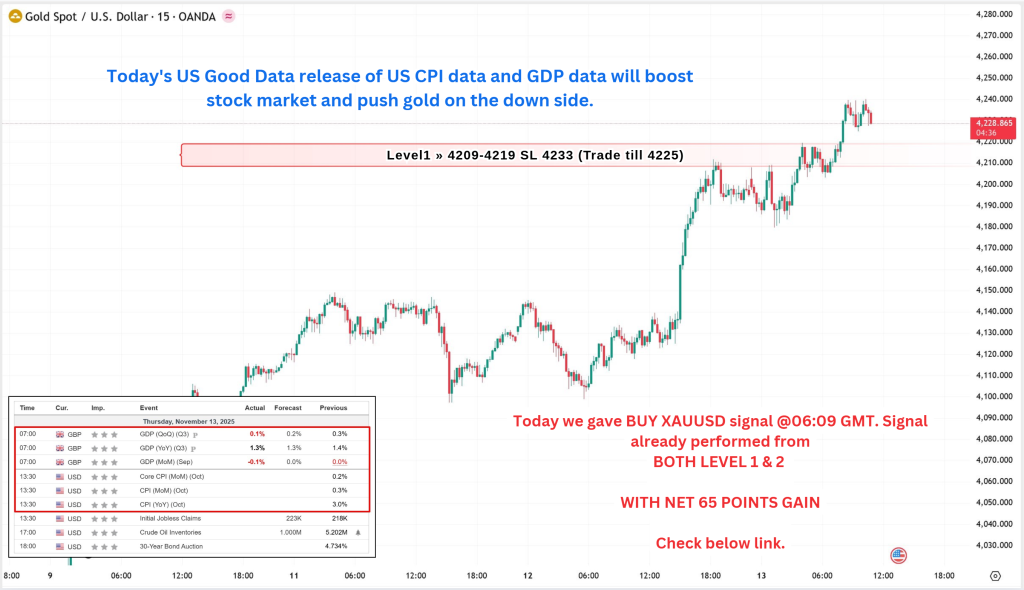

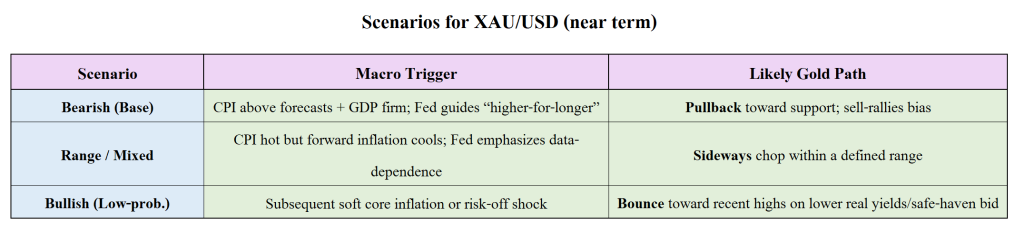

Today’s strong US CPI (inflation firmer than markets hoped) alongside solid GDP growth reinforces a “higher-for-longer” interest-rate path. That typically lifts the USD and real Treasury yields, increasing the opportunity cost of holding non-yielding assets like gold. Net effect: bearish pressure on XAU/USD unless a risk-off shock intervenes.

Today’s given signal : https://t.me/calendarsignal/21577

Why Today’s CPI and GDP Look “Good”

CPI (Inflation) drivers

- Sticky services inflation: Shelter, health, insurance and education prices still rising faster than goods.

- Energy & transport pass-through: Recent fuel and freight costs flowed into consumer prices.

- Wage support: A still-firm labor market keeps unit labor costs elevated, buoying services inflation.

- Demand resilience: Consumers continue to spend on experiences and durables, enabling firms to pass costs.

- Base effects: Softer prints a year ago mechanically lift YoY comparisons.

GDP (Growth) drivers

- Consumer strength: Real consumption remains positive, especially in services and big-ticket categories.

- Business investment: Factory orders/capex and inventories contribute to topline growth.

- Public outlays: Infrastructure and industrial-policy spending underpin activity.

- Exports: Better global demand/supply-chain normalization help net trade.

How Strong CPI & GDP Transmit to Gold

- Real yields ↑ → Gold ↓: Hot CPI + firm GDP reduce rate-cut odds; real yields rise, hurting gold.

- USD ↑ → Gold ↓: Strong US data supports the dollar, making USD-priced gold costlier for non-USD buyers.

- Risk appetite ↔: If growth looks healthy, safe-haven demand for gold fades—unless a shock revives it.

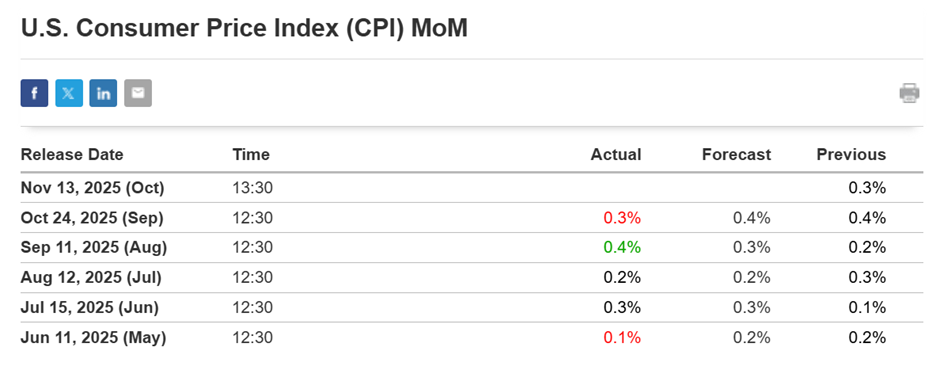

Previous released data results :

On last CPI data (24-10-2025) we predicted bad CPI data, & as per that we suggest to BUY XAUUSD & as a result, we made a profit of 183 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/gold-in-turmoil-cpi-report-rocks-the-market-11-september-2025/

Check last given signal : https://t.me/calendarsignal/21140

Performance : https://t.me/calendarsignal/21178

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11