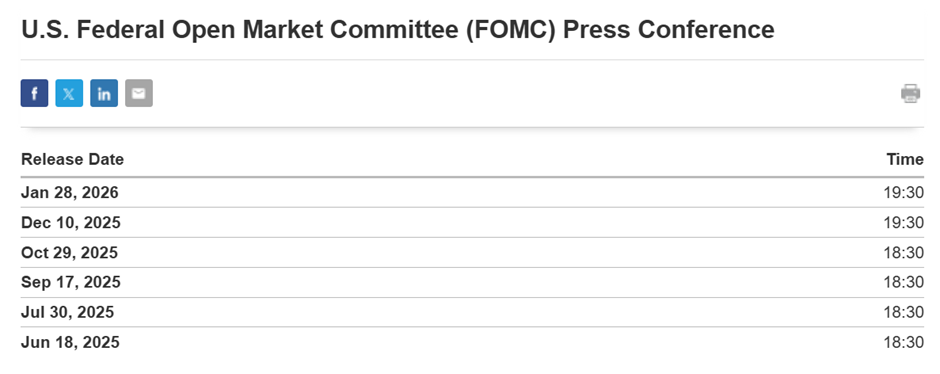

As markets head into today’s Federal Reserve rate decision and Jerome Powell’s press conference at 19:00 GMT, traders are positioning for a hawkish outcome, even if interest rates remain unchanged. Importantly, no official data has been released yet, and all price expectations are based on market assumptions, Fed communication trends, and macro positioning.

Gold (XAUUSD) is particularly sensitive to Fed events because it reacts not only to interest rates, but to future expectations, U.S. dollar strength, and real yields. If the Fed maintains a hawkish stance and Powell reinforces a “higher for longer” narrative, downside pressure on XAUUSD becomes likely.

Today’s given signal : https://t.me/calendarsignal/23231

Why Today’s Fed Decision Is Expected to Remain Hawkish

1. Inflation Risks Still Linger

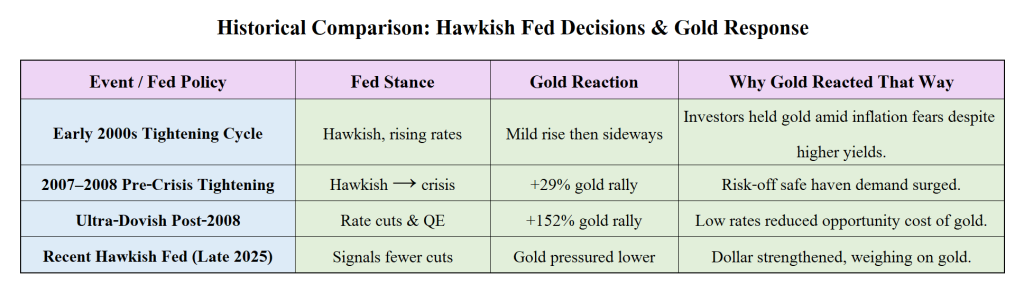

Although inflation has cooled from prior peaks, it remains above the Fed’s long-term target. The Fed has repeatedly emphasized that premature easing could reignite price pressures. As a result, policymakers are likely to signal patience rather than urgency, reinforcing a hawkish bias.

2. Economic Resilience

Recent economic trends suggest that growth and employment remain relatively resilient. This gives the Fed room to stay restrictive, reducing the need for aggressive rate cuts in the near term.

3. Credibility & Financial Conditions

The Fed is cautious about loosening financial conditions too early. A hawkish tone helps:

- Keep bond yields elevated

- Prevent excessive risk-taking

- Support the U.S. dollar

All three factors are negative for gold.

Why Powell’s Speech Matters More Than the Rate Decision

Even if rates are left unchanged, Powell’s language will guide expectations. A hawkish speech may include:

- Emphasis on inflation risks

- Data-dependent and slow future cuts

- Pushback against market optimism

If Powell downplays rate-cut expectations, U.S. yields may rise and the dollar could strengthen, putting immediate pressure on XAUUSD.

Gold Price Scenarios After the Fed Event

🔴 Scenario 1: Hawkish Hold (Most Bearish for Gold)

- Rates unchanged

- Powell signals limited or delayed cuts

- USD strengthens, real yields rise

➡ XAUUSD likely falls, possibly after a brief spike

🟡 Scenario 2: Neutral Outcome

- Balanced language, no strong guidance

- Markets remain uncertain

➡ XAUUSD consolidates in a range

🟢 Scenario 3: Unexpected Dovish Shift

- Powell acknowledges economic slowdown

- Signals future easing

➡ Dollar weakens, gold rallies

Previous released data results :

On last FED decision and Powell speech (10-12-2025) we predicted Hawkish speech & rate cut, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 160 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/22228

Performance : https://t.me/calendarsignal/22273

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11