The U.S. Non-Farm Payrolls (NFP) and Unemployment data are among the most market-moving releases for both the forex market and Gold (XAUUSD). However, price reaction is not driven by the headline number alone, but by how far the actual data deviates from market expectations.

Today’s given signal : https://t.me/calendarsignal/22797

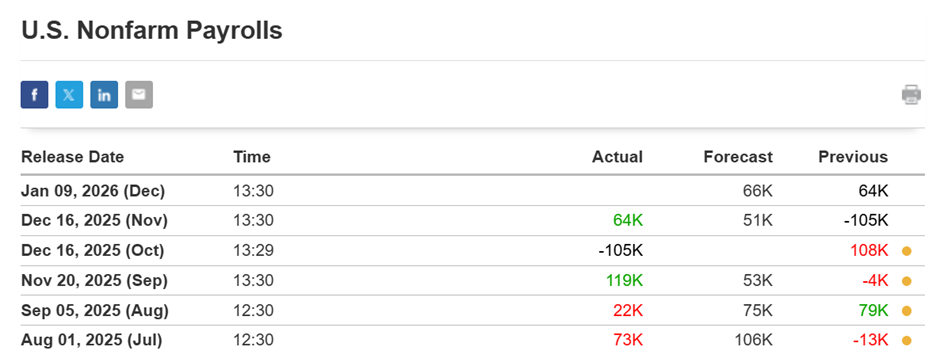

US NFP – Numbers Method Analysis

▪️NFP > Forecast by 66K+ → USD & yields strengthen → Gold faces downside pressure

▪️NFP near Forecast (±10K) → Market stays balanced → Gold remains range-bound / choppy

▪️NFP < Forecast by 66K+ → USD weakens, yields fall → Gold turns bullish

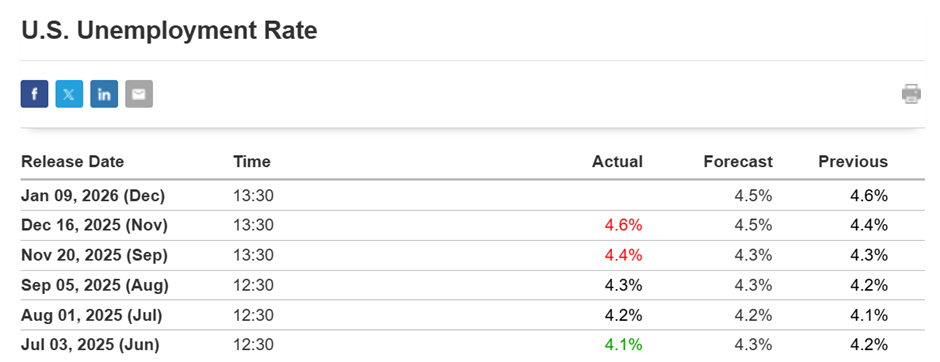

Confirmation Checks

▪️Rising Unemployment Rate = adds Gold support

▪️Strong Wage Growth (AHE) = limits Gold upside

▪️Lower Unemployment Rate = adds Gold Weakness

Key takeaway:

Gold reacts to the gap vs forecast, not the headline — the bigger the deviation, the stronger the move.

Previous released data results :

On last US NFP data (16-12-2025) we predicted bad data, & as per that we suggest to BUY XAUUSD & as a result, we made a profit of 87 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/gold-in-focus-as-nfp-disappoints-key-implications-for-xau-usd-traders/

Check last given signal : https://t.me/calendarsignal/22386

Performance : https://t.me/calendarsignal/22430

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11