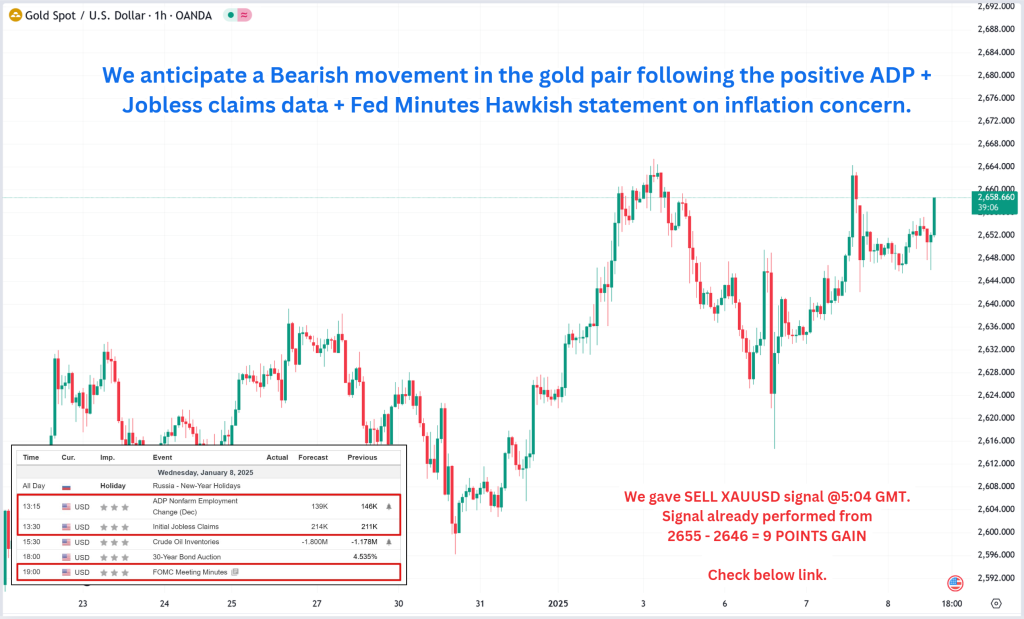

On January 8, 2025, gold prices (XAUUSD) faced downward pressure following the release of strong US ADP Employment Data, better-than-expected Jobless Claims data, and a hawkish tone from the Federal Reserve’s Minutes Statement. These indicators pointed to a resilient US labor market and reduced expectations for imminent rate cuts, strengthening the US dollar and Treasury yields, both of which weigh on gold prices.

Today’s given signal : https://t.me/calendarsignal/16515

Impact of US ADP, Jobless Claims Data, and Fed Minutes

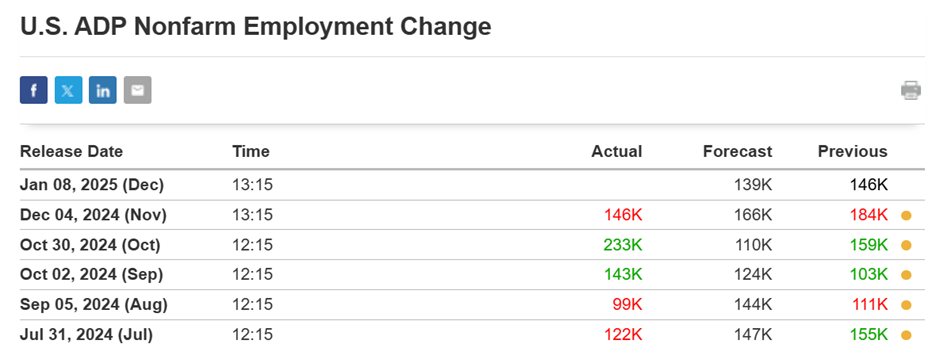

- US ADP Employment Report:

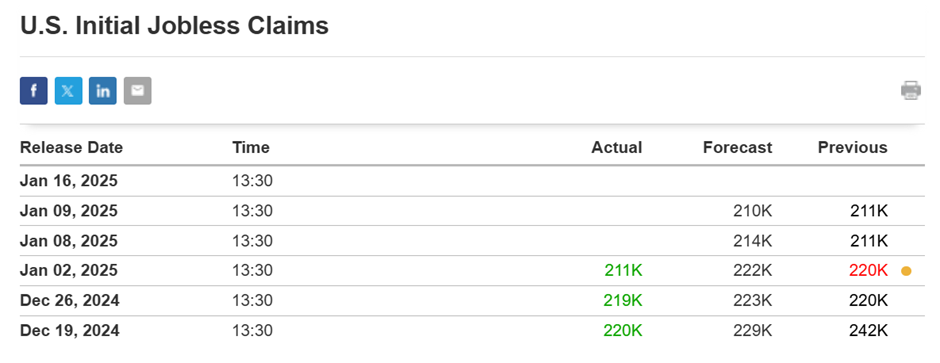

The stronger-than-expected US ADP private payroll data suggests a robust labor market, indicating resilience in employment despite tightening monetary policy. This signals continued strength in the U.S. economy, likely leading to expectations of sustained higher interest rates by the Federal Reserve. For gold, this creates downward pressure as higher rates increase the opportunity cost of holding non-yielding assets like gold. - Jobless Claims Data:

Lower-than-anticipated initial jobless claims further reinforce a solid labor market. Fewer layoffs imply sustained wage growth and consumer spending, fueling expectations of inflation staying near target levels. With persistent labor market strength, the Fed could maintain a hawkish tone, reducing gold’s appeal as an inflation hedge or safe-haven asset in this environment. - Fed Minutes Statement:

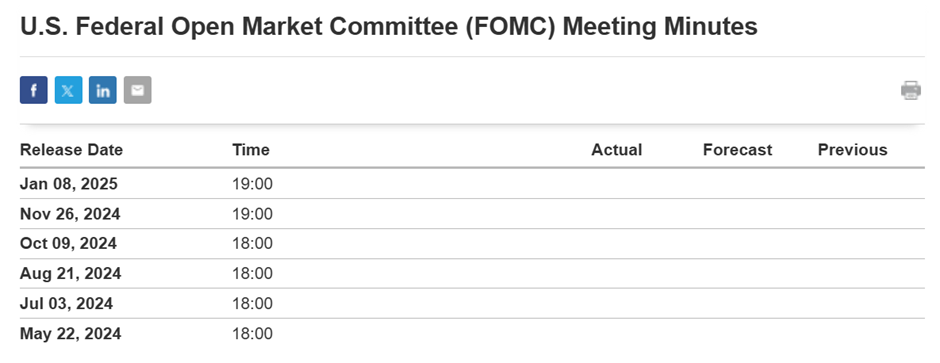

The Federal Reserve’s December minutes pointed toward policymakers remaining cautious about cutting rates in 2025. The minutes emphasized the importance of ensuring inflation is decisively controlled before loosening monetary policy. This stance supports a stronger dollar and rising yields, both of which act as headwinds for gold.

Summary:

The combination of strong ADP payroll data, low jobless claims, and hawkish Fed minutes suggests that U.S. interest rates will remain elevated. This drives the U.S. dollar and Treasury yields higher while reducing demand for gold, causing its price to decline. The outlook for gold is bearish in the near term, as investors focus on economic strength and tighter monetary policy.

However, geopolitical uncertainties or weaker inflation readings in the future could provide limited support for gold prices. For now, gold’s price remains under pressure due to the robust U.S. economic data and firm Federal Reserve stance.

Previous released data results :

On last ADP Data (4-12-2024) we predicted GOOD data, as per that we suggest to SELL XAUUSD & as a result, we made a profit of 29 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/16230

Performance : https://t.me/calendarsignal/16242

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11