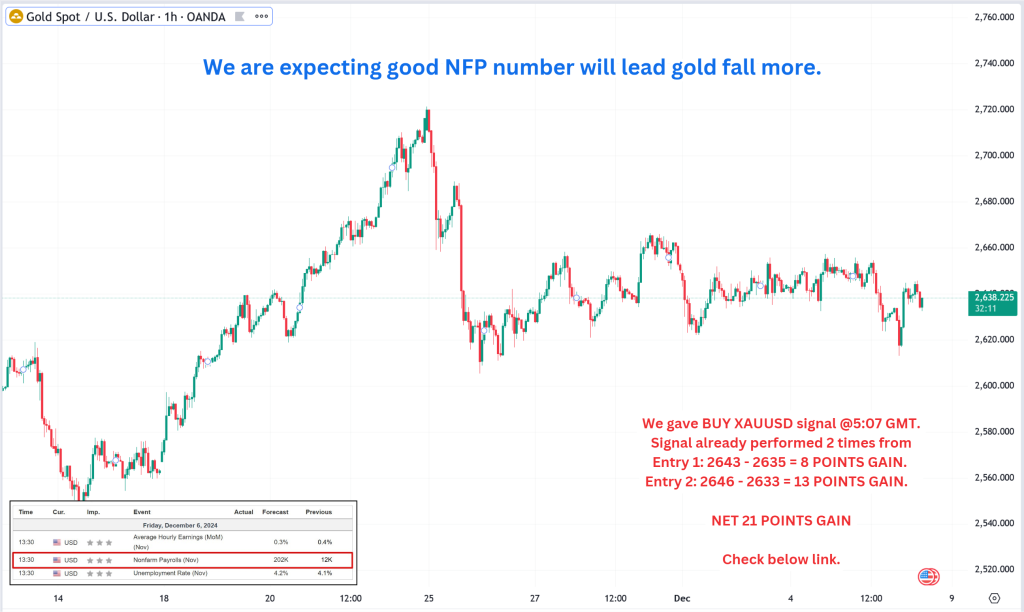

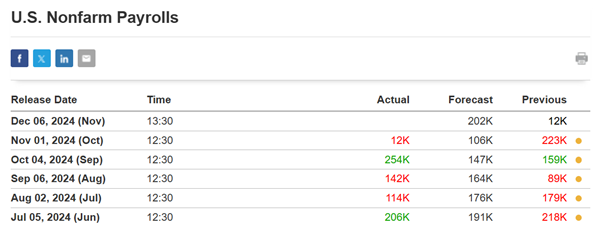

US Nonfarm Payrolls (NFP) are expected to rise by 200,000 in November, rebounding from October’s modest 12,000 gain, which was impacted by hurricanes and a Boeing strike. The Bureau of Labor Statistics (BLS) will release this key report on Friday at 13:30 GMT, crucial for assessing the Federal Reserve’s (Fed) rate cut plans and the US Dollar’s direction.

Economists predict the Unemployment Rate will edge up to 4.2% from 4.1% in October, while Average Hourly Earnings (AHE) are forecast to increase by 3.9% year-over-year, slightly down from 4.0% in October. Fed Chair Jerome Powell recently emphasized a cautious approach to rate cuts, citing steady economic growth and a solid labor market. Analysts at TD Securities expect job additions of around 75,000 as prior distortions subside, with wage growth likely slowing to 0.2% month-over-month from October’s 0.4% increase.

Today’s given signal : https://t.me/calendarsignal/16268

The US Non-Farm Payrolls (NFP) data for December 2024 will be released today at 13:30 GMT. Being the final NFP data of the year, this release holds significant importance, as it may directly influence the upcoming Federal Reserve’s December interest rate decision.

Market Impact Expectations

» A strong NFP report could confirm a 0.25% rate cut, signaling a dovish stance by the Federal Reserve.

»Conversely, weak data may prompt the Fed to reconsider or delay the anticipated rate cut.

Key Scenarios and Their Expected Impact

Scenario 1: Strong NFP Data

NFP: Above 250k

Unemployment Rate: Below 4.1%

Average Hourly Earnings (AHE): Above 0.4%

Market Impact:

»Gold (XAU/USD): Strong bearish movement due to higher USD strength.

US Dollar Index (DXY): Bullish momentum as strong labor data boosts confidence in the USD.

Scenario 2: Weak NFP Data

NFP: Below 190k

Unemployment Rate: Above 4.2%

Average Hourly Earnings (AHE): Below 0.3%

Market Impact:

Gold (XAU/USD): Strong bullish movement as USD weakens.

US Dollar Index (DXY): Bearish movement reflecting weaker economic outlook.

Scenario 3: Mixed or Neutral NFP Data

NFP: Near 200k

Unemployment Rate: Around 4.2%

Average Hourly Earnings (AHE): Between 0.3% and 0.4%

Market Impact:

Gold (XAU/USD) and DXY: Choppy movements as markets seek clarity on Federal Reserve actions.

Volatility Alert

As this is the final NFP release of 2024, heightened volatility is expected in Gold (XAU/USD) and major USD currency pairs. Traders should anticipate large price swings and plan their strategies accordingly.

Opportunity for Traders

This event offers a significant opportunity to achieve 10% or more profit with calculated risk. However, prudent risk management is crucial due to potential market unpredictability.

Previous released data results :

On last US PCE Data (01-11-2024) we predict good NFP data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 53 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/nfp-trends-whats-next-for-gold/

Check last given signal : https://t.me/calendarsignal/15798

Performance : https://t.me/calendarsignal/15817

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11