The Michigan Inflation Index is a widely used metric that measures changes in consumer prices for a basket of goods and services. It is widely used by economists and policymakers to gauge inflationary pressures in the economy. When the Michigan Inflation Index shows higher than expected numbers, it suggests that inflation is on the rise, which can lead to increased investor demand for gold as a store of value.

Today’s given signal : https://t.me/calendarsignal/13024

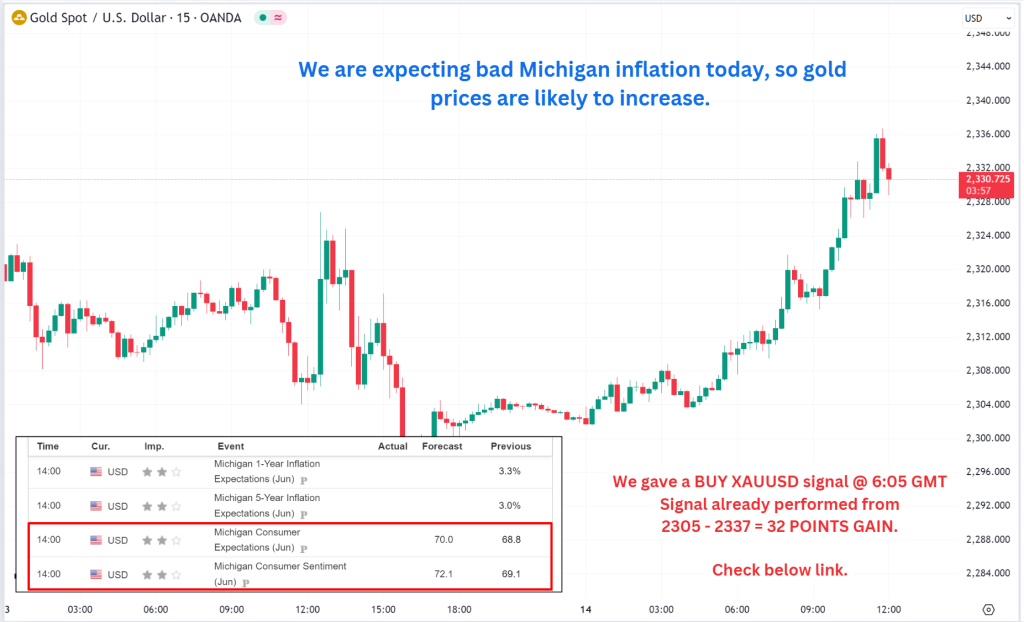

Impact on Gold Prices

Bad Michigan Inflation data typically has a positive impact on gold prices. When inflation rises, the value of money decreases, and investors seek alternative assets to preserve their wealth. Gold, being a precious metal with limited supply and a long history of holding value, becomes an attractive investment option.

Increased Demand and Higher Prices

When bad Michigan Inflation data is released, investors tend to bid up gold prices. This increased demand pushes prices higher, making it a more attractive investment for those seeking protection from inflation. Higher prices encourage gold miners to mine more gold to meet this demand, further supporting the price rise.

Bad Michigan Inflation data has a substantial impact on the price of gold. It triggers increased demand, pushes prices higher, and creates opportunities for gold miners. Investors should consider gold as a hedge against inflation and consider investing in gold ETFs or gold-backed financial instruments to gain exposure to this precious metal.

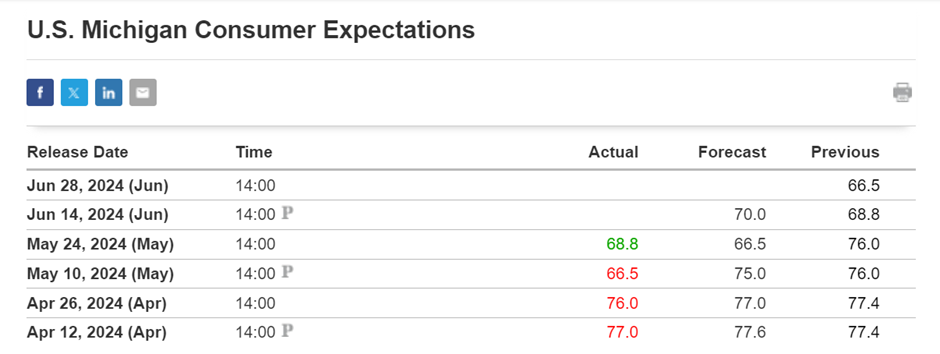

Previous released data results :

On last data (14-5-2024) we predict to BUY XAUUSD as for bad Michigan Data, GOLD price eas raised.

Check the previous blog : https://blog.forextrade1.co/impact-of-the-usd-todays-data-on-the-gold-pair-24-5-2024/

Check last given signal : https://t.me/calendarsignal/12421

Performance :