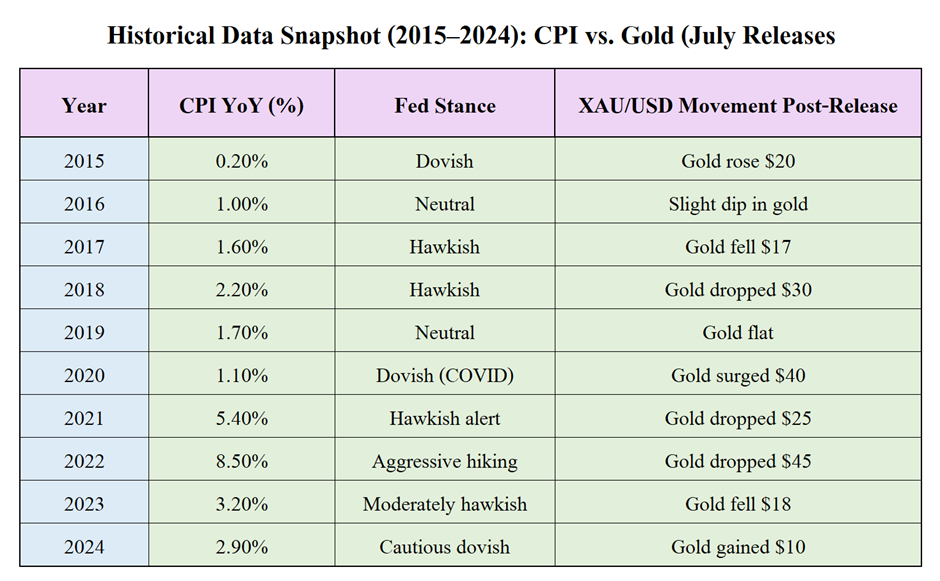

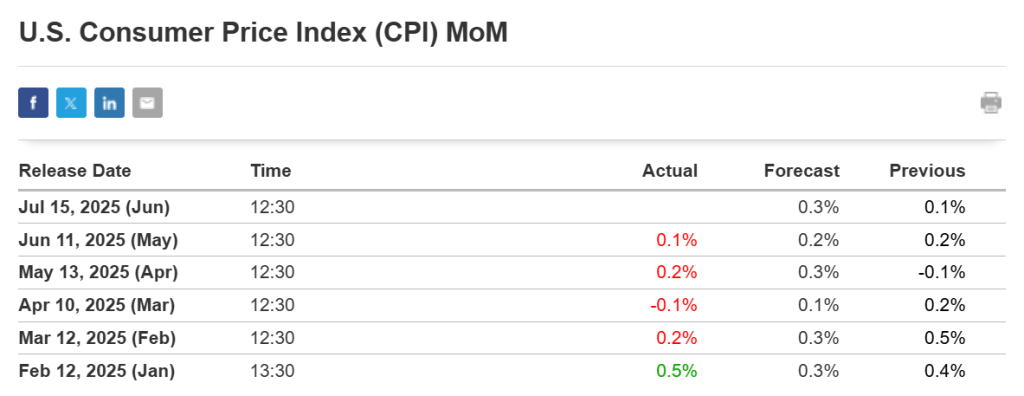

The release of higher-than-expected US Consumer Price Index (CPI) data on 15th July 2025 has caught the attention of global financial markets, especially gold traders. CPI, a key measure of inflation, rose more than market forecasts, indicating that inflationary pressures remain persistent in the US economy.

Today’s given signal : https://t.me/calendarsignal/19495

Reasons Behind Higher CPI Data:

- Sticky Core Inflation: Core CPI (excluding food and energy) remained elevated, driven by housing, medical services, and transportation costs.

- Energy Prices Recovery: Crude oil and gas prices rose due to supply disruptions in major oil-producing countries, adding to headline inflation.

- Strong Consumer Spending: Consumer demand remains robust despite higher borrowing costs, supporting price increases in multiple sectors.

- Wage Growth: Labor market strength led to increased wages, which businesses passed on to consumers through higher prices.

- Global Supply Chain Bottlenecks: Lingering disruptions from geopolitical tensions (e.g., China-Taiwan, Russia-Ukraine) added cost pressures.

What It Suggests:

Higher interest rates boost the US dollar and bond yields, which typically makes gold (a non-yielding asset) less attractive to investors.

A hot CPI reading increases the likelihood that the Federal Reserve will maintain or even raise interest rates, as it signals the economy isn’t cooling fast enough to curb inflation.

Scenarios for Gold Price (XAU/USD):

- If inflation stays elevated for consecutive months, gold could enter a prolonged correction phase until a clear Fed pivot occurs.

- Short-Term Bearish Pressure: As inflation stays high, expectations of further rate hikes rise. This leads to USD strength and higher yields, creating downward pressure on gold.

- Key Support Break Watch: If gold breaks under key support zones (e.g., $2,375–$2,365), it could open further downside to $2,340 or below.

- Volatility from Fed Commentary: Any hawkish tone from Fed officials in response to this CPI print may accelerate gold’s fall.

- Medium-Term Outlook: If inflation stays elevated for consecutive months, gold could enter a prolonged correction phase until a clear Fed pivot occurs.

Check the previous blog :

On last CPI data (11-6-2025) we predicted bad data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 96 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/18976

Performance : https://t.me/calendarsignal/18994

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11