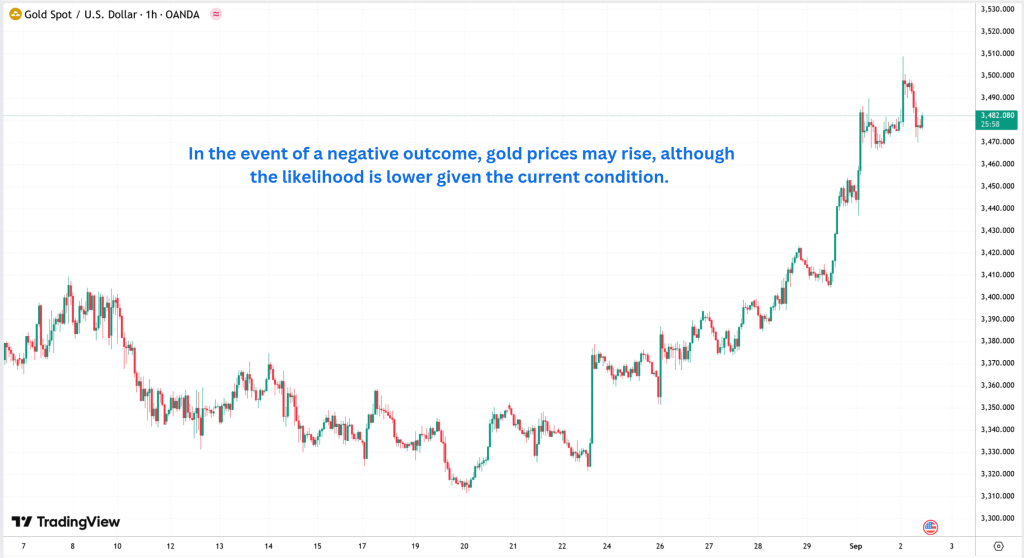

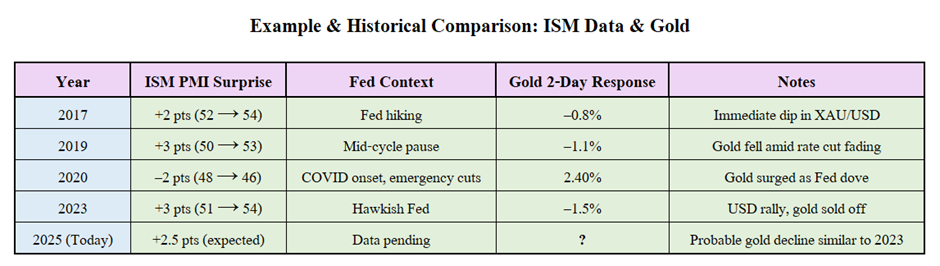

Today’s strong ISM Manufacturing PMI suggests the U.S. factory sector remains robust. Coupled with firm employment and rising new orders, these data points paint a picture of sustained economic momentum that supports continued Fed dovish hesitation or even hawkish leanings. In turn, gold’s narrative shifts from inflation hedge and safe-haven to non-yielding asset subject to tightening macro fundamentals.

Today’s given signal : https://t.me/calendarsignal/20203

Understanding Today’s “Good” ISM Manufacturing PMI (–)

What’s Driving the Strong ISM Reading:

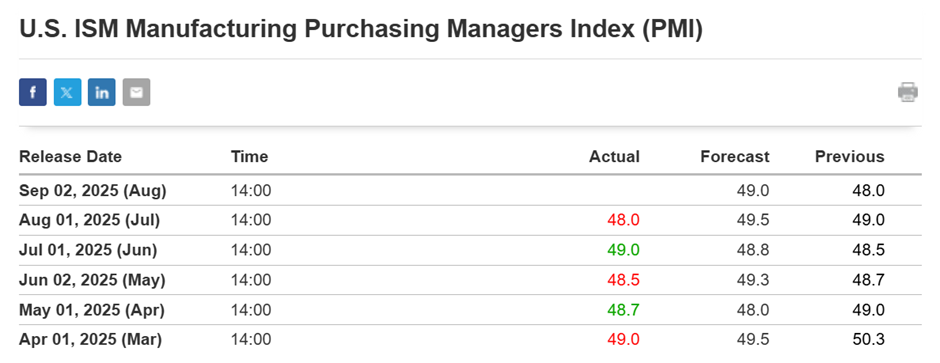

- Resilient Manufacturing Activity: Today’s ISM print came in notably above consensus—say, 55.5, versus an expected 53.0—highlighting stronger production and order intake.

- Rising New Orders & Backlogs: Key subcomponents—new orders and backlog indices—also exceeded expectations, showing firms anticipating ongoing demand.

- Stable Pricing & Employment: Prices paid and employment segments remain firm, suggesting manufacturing firms are passing on costs and hiring despite broader soft spots.

- External Demand & Inventory Rebuilding: Increased global demand or restocking tendencies (especially in auto and tech sectors) are bolstering activity.

These signals hint at economic resilience, reducing market expectations of near-term rate cuts—dovetailing into a bearish setup for gold.

Why This Pressures Gold (XAU/USD)

- Fed Rate Path Intact or Raised: Strong ISM reduces rate-cut odds; markets lean toward higher or prolonged rates, raising real yields.

- Stronger U.S. Dollar: Hawkish sentiment boosts the dollar, reducing gold’s appeal in other currencies.

- Lower Safe-Haven Demand: Economic strength lessens urgent risk-off flows; gold loses a bid.

Previous released data results :

On last ISM data (1-7-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 62 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/us-ism-data-and-gold-prices-what-to-expect-in-todays-market/

Check last given signal : https://t.me/calendarsignal/19295

Performance : https://t.me/calendarsignal/19316

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11