On May 23, 2024, investors will be closely monitoring the release of two important economic indicators, US jobless claims and S&P PMI data, which could potentially affect the price of gold. The expectation among analysts is that gold may witness bullish momentum ahead of these releases, as investors seek a safe haven amidst economic uncertainty.

Today’s given signal : https://t.me/calendarsignal/12372

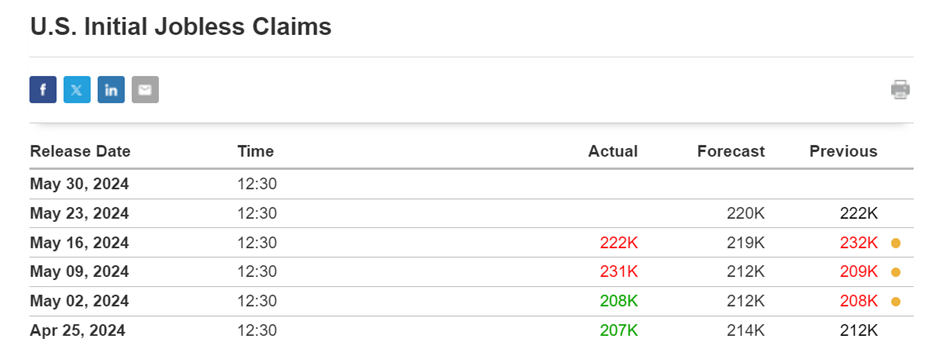

US jobless claims serve as a barometer of the health of the job market, and the latest figures could have an impact on the overall sentiment in the market. A higher-than-expected increase in jobless claims may indicate weaker economic conditions, which could potentially drive investors towards gold as a hedge against inflation and uncertainty.

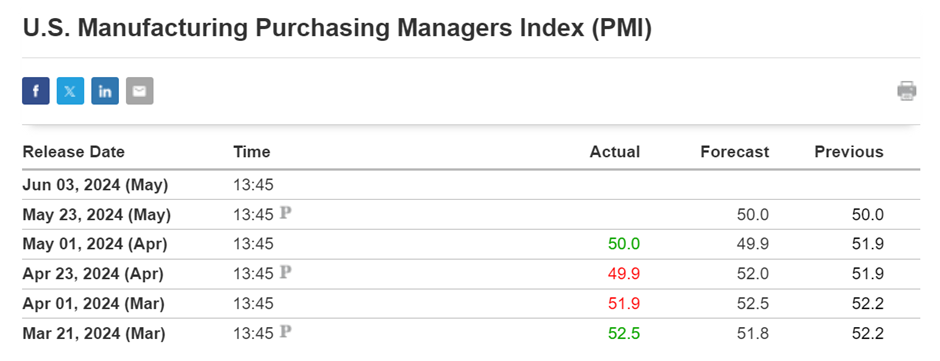

On the other hand, S&P PMI data provides insights into the prevailing business conditions across different sectors. A weaker than expected reading could indicate a slowdown in economic growth, which could also drive investors towards gold as a store of value.

The combination of these factors could lead to increased interest in gold, as investors seek to protect their portfolios against potential market volatility. Additionally, geopolitical tensions and economic uncertainties around the world may also contribute to a stronger demand for gold as a safe-haven asset.

Previous released data results :

On last data (16-5-2024) we predict to SELL XAUUSD as lower Jobless claims number, GOLD price was fall.

Check the previous blog : https://blog.forextrade1.co/us-jobless-claims-data-will-impact-the-price-of-gold-16-5-2024/

Check last given signal : https://t.me/calendarsignal/12177

Performance :

On last data (1-5-2024) we predict to BUY XAUUSD as for Bad ISM Manufacturing Data, GOLD price was raised.

Check the previous blog : https://blog.forextrade1.co/the-negative-adp-and-ism-manufacturing-data-in-the-us-could-have-an-impact-on-the-price-of-gold-1-5-2024/

Check last given signal : https://t.me/calendarsignal/11804

Performance :