Market Outlook — Gold Faces Downside on Strong Durable Goods & Consumer Confidence

Today’s markets are bracing for further downside in gold prices following robust U.S. data points:

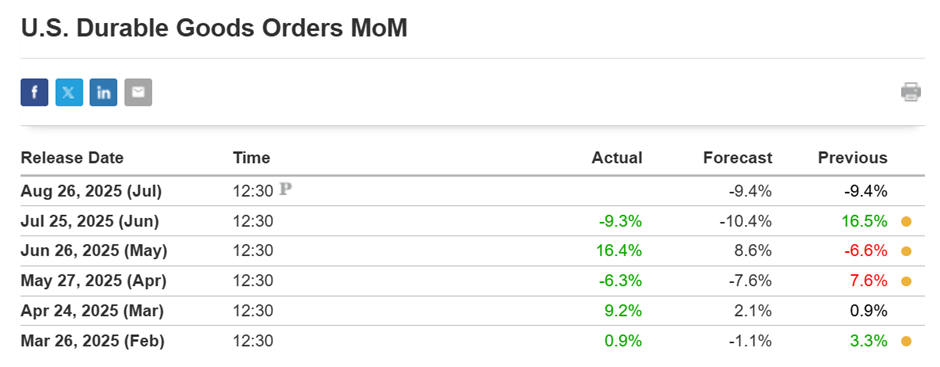

- Durable Goods Orders beat forecasts: July showed a smaller-than-expected decline of –9.3%, outperforming the –10.4% forecast.

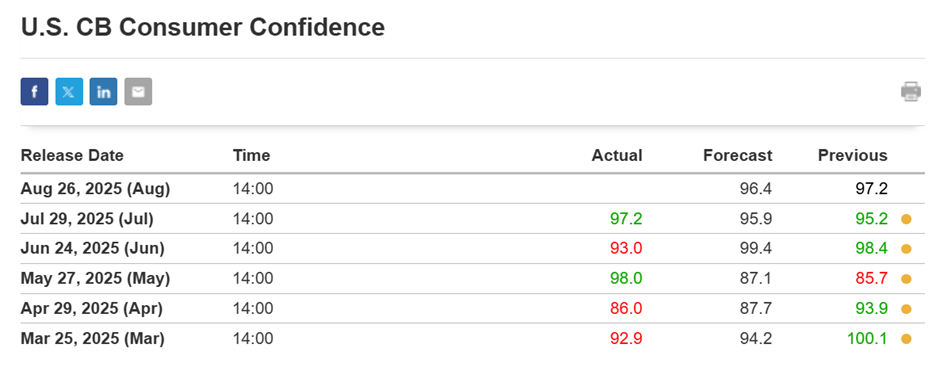

- Consumer Confidence rose, signalling economic optimism — a trend typically inversely correlated with gold.

Today’s given signal : https://t.me/calendarsignal/20121

Why These Indicators Weaken Gold

- Durable Goods Orders measure manufacturing strength. Higher figures suggest businesses are investing, indicating economic momentum and dampening demand for gold as a hedge.

- Consumer Confidence reflects improving household sentiment and spending expectations. As consumers grow more confident, they move away from safe-haven assets like gold.

The latest U.S. figures signal renewed economic vigor, pressuring gold (XAU/USD). Durable Goods Orders for July declined by –9.3%, but crucially less than the anticipated –10.4%. This suggests manufacturers remain willing to invest, reinforcing economic momentum and weakening investor demand for gold.

Meanwhile, the Conference Board’s Consumer Confidence Index rose, reflecting growing household optimism. When consumers feel secure, spending rises, reducing the appeal for gold as a safe-haven asset. Although the negative correlation between confidence and gold is not strong statistically (correlation coefficient roughly –0.15), when paired with other economic signals, it compounds downward pressure on gold.

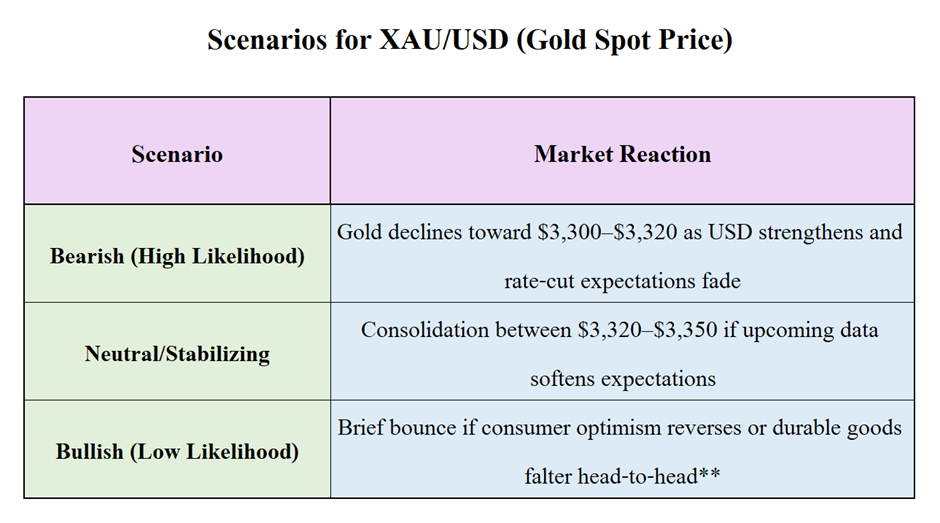

Scenario-wise:

- In the bearish case, these data reinforce expectations of delayed or no Fed rate cuts. Real rates may stay elevated, prompting selling interest in gold. A drop toward $3,300–$3,320 seems plausible if momentum continues.

- If future data softens (e.g., weak jobs or inflation figures), we might see neutral consolidation with gold trading..

- A bullish turnaround is less likely but possible if economic optimism reverses fast or data misses expectations, triggering a short-lived gold rebound.

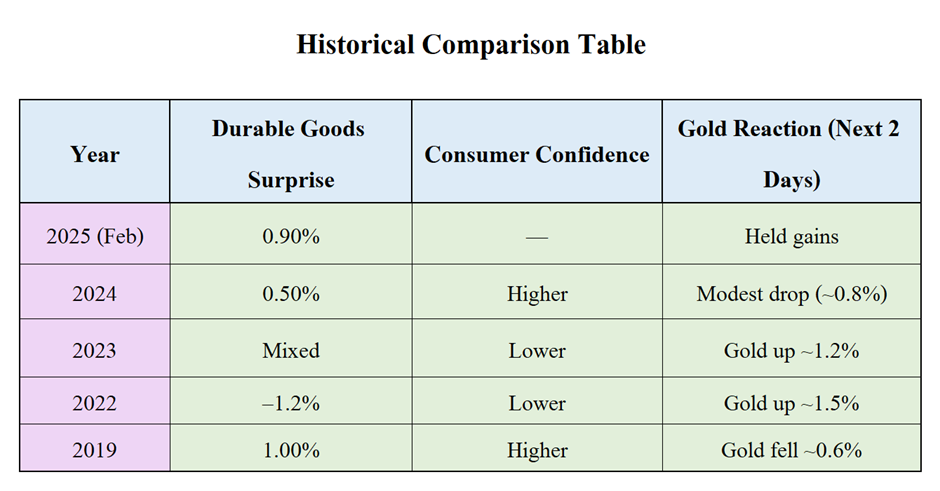

Previous released data results :

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11