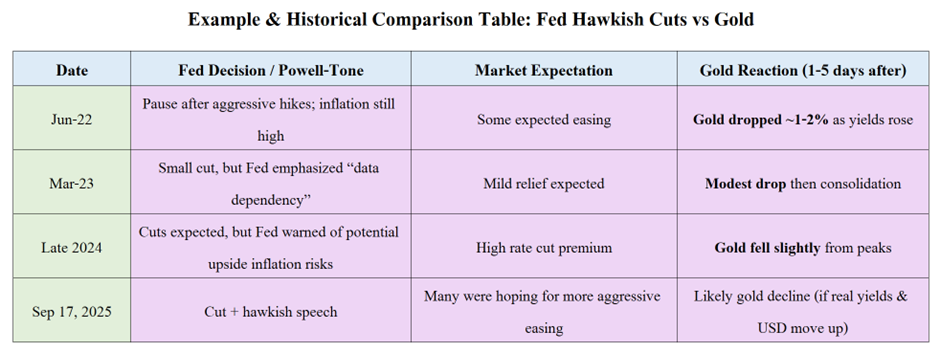

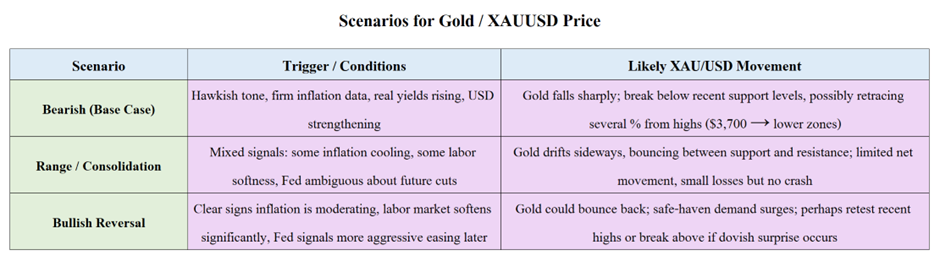

Here is a analysis of what likely happened on 17 September 2025, when the Fed decision + Powell’s speech came out, how that would impact XAU/USD (gold), and a historical comparison to help put things in context.

Today’s given signal : https://t.me/calendarsignal/20464

Gold Under Pressure: Fed Decision & Powell’s Hawkish Tone

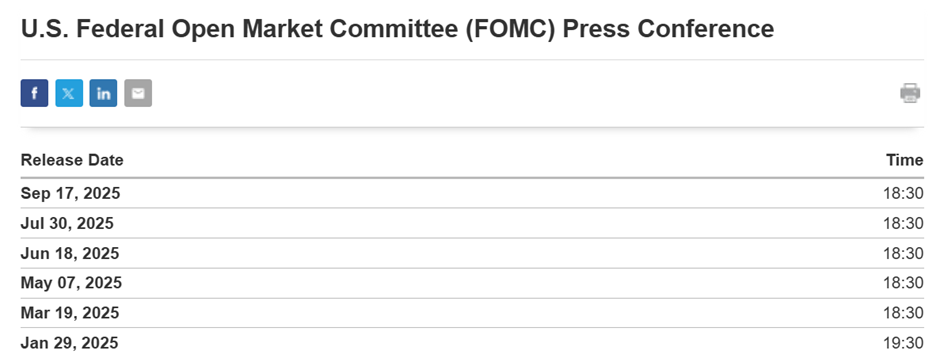

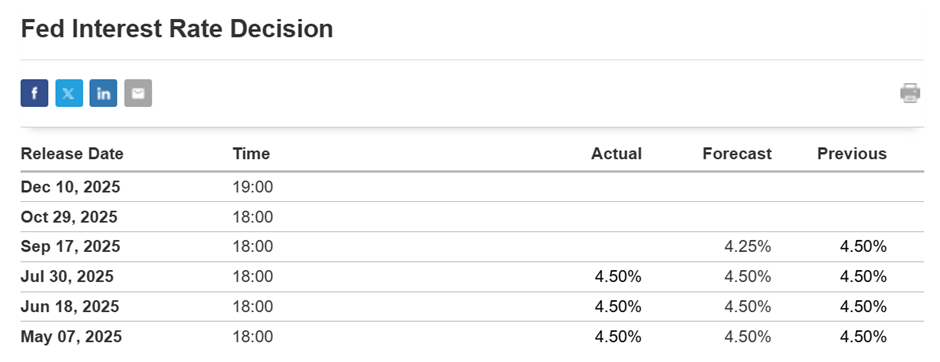

On 17 September 2025, the U.S. Federal Reserve made its rate decision amid high market expectations and economic uncertainty. While markets broadly forecasted a 25 basis-point rate cut, Chair Jerome Powell’s speech leaned more hawkish than many anticipated. The message suggested that although there was a cut, it would come with caution; upcoming policy projections and dot-plot showed that future cuts might be slower and more conditional than earlier hopes.

Fed’s policy meeting impacts market expectations

Investors are anticipating a 25-basis-point rate cut from the Federal Reserve, with markets pricing in further easing by year-end. The focus is on whether policymakers considered a larger cut amid concerns about the Fed’s independence.

What Were the Key Reasons & Factors Behind the Fed’s Hawkish Decision

Here are the main reasons and underlying factors:

- Sticky Inflation

Inflation remains above target for both headline and core measures. Even though some readings have cooled, enough data has shown persistent upward pressures (shelter, input costs, tariffs) that the Fed is wary of letting inflation re-accelerate. - Strong Consumer & Economic Activity

Recent U.S. data (e.g., retail sales, durable goods, services) has shown resilience. Spending is up, business orders look stable, which weakens arguments for aggressive easing. - Labor Market Not Fully Broken

While job growth has slowed, employment remains relatively strong and wage pressures are still present. The Fed must balance between supporting cooling labor market and avoiding overheating. - Expectations Management & Dot Plot Projections

The Fed’s Summary of Economic Projections (SEP) and dot-plot likely showed that many officials believe only modest cuts are appropriate going forward — and that the neutral rate may be higher than currently estimated. - Political Pressure & Uncertainty

There is mention in reports that political pressure (from the administration) and concerns about Fed credibility are influencing communication. Powell’s tone may have been calibrated to convey that cuts will happen but not too aggressively, maintaining readiness for residual inflation risks.

Previous released data results :

On last FED decision and Powell speech (30-7-2025) we predicted dovish speech & rate cut, & as per that we suggest to BUY XAUUSD & as a result, we made a profit of 72 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/gold-price-outlook-amid-us-adp-gdp-data-fed-pressure-and-trumps-influence-30th-july-2025/

Check last given signal : https://t.me/calendarsignal/19713

Performance : https://t.me/calendarsignal/19737

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11