Gold, a non-yielding asset, often reacts to shifts in U.S. economic indicators and monetary policy expectations. On January 7, 2025, the release of robust Non-ISM Manufacturing data and elevated JOLTS job openings can set the tone for near-term gold price movements. Here’s a detailed analysis.

Today’s given signal : https://t.me/calendarsignal/16501

Reasons for Downward Pressure on Gold Prices

- Strong Economic Performance Strengthens the U.S. Dollar

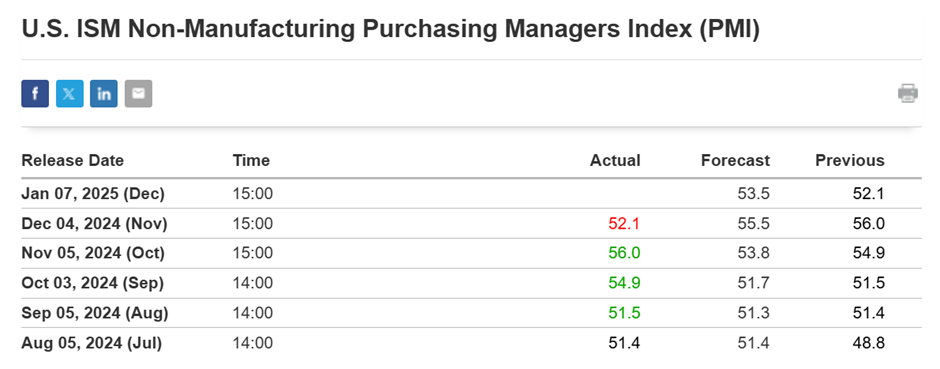

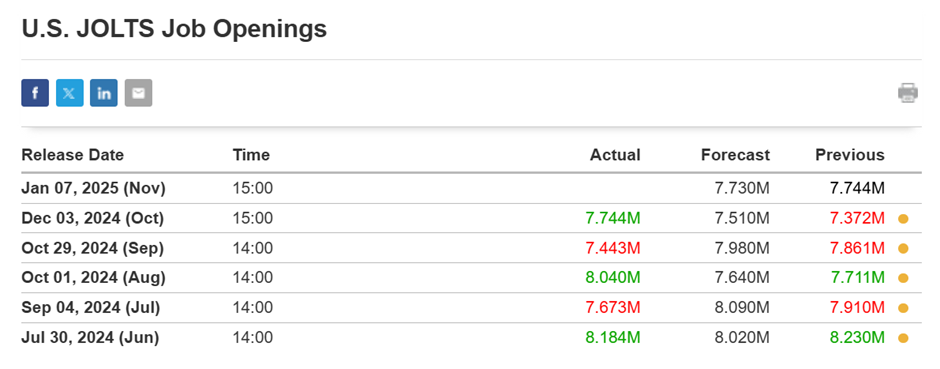

Non-ISM Manufacturing data reflects the health of the U.S. manufacturing sector. A higher-than-expected reading (e.g., above 55) signals robust business activity. Simultaneously, elevated JOLTS job openings (e.g., surpassing 10.5 million) imply a resilient labor market with strong hiring prospects. Such data instills confidence in the U.S. economy, bolstering the U.S. dollar.

Since gold is priced in dollars, a stronger dollar makes gold more expensive for buyers holding other currencies, reducing global demand.

- Hawkish Federal Reserve Expectations

The Federal Reserve closely monitors manufacturing and employment data for monetary policy decisions. Strong Non-ISM Manufacturing and JOLTS figures suggest persistent economic momentum, possibly fueling inflationary pressures. The Fed is more likely to maintain or increase interest rates under these conditions.

Higher interest rates make alternative yield-bearing assets like bonds and treasuries more attractive than gold, which does not provide any yield.

- Reduced Safe-Haven Demand

Gold thrives in uncertain economic conditions as a hedge against risk. Strong manufacturing and labor market data reduce concerns about economic slowdown, shifting investor sentiment toward riskier assets like equities. As risk appetite grows, gold’s demand wanes, pressuring its price downward.

Example Scenario

Imagine the Non-ISM Manufacturing Index rises unexpectedly to 58, far surpassing the forecast of 54. Simultaneously, the JOLTS job openings come in at 11 million, signaling ongoing labor market strength. These metrics indicate economic resilience, prompting the Federal Reserve to suggest potential rate hikes in upcoming meetings.

As a result, gold prices could decline over the week. This trend would be further exacerbated if additional economic data or Federal Reserve commentary aligns with these hawkish signals.

Previous released data results :

On last Non ISM Manufacturing data (4-12-2024) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 29 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/16230 Performance : https://t.me/calendarsignal/16242

On last Non ISM Manufacturing data (3-12-2024) we predicted higher data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 50 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/16209

Performance : https://t.me/calendarsignal/16226

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11