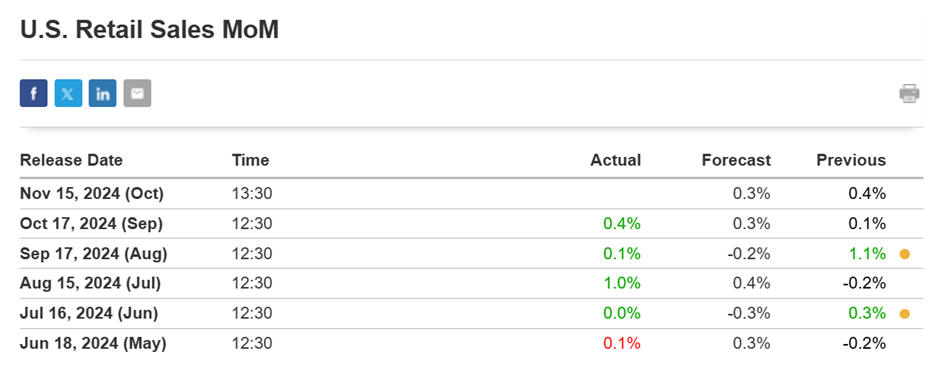

Recent US retail sales data released today has been unfavorable for the gold market, resulting in a decline in prices. However, based on various economic indicators and market trends, analysts predict that the gold price will recover on 15th November 2024. This document explores the key factors that support this forecast.

Today’s given signal : https://t.me/calendarsignal/15995

When US Retail sales data disappoints, investors tend to flock to gold as an inflation hedge and portfolio diversification tool. This is because gold has historically performed well during periods of economic instability and market volatility. The precious metal’s role as a store of value and protection against inflation makes it an attractive investment in times of economic uncertainty.

On 15th November 2024, if the US Retail sales data disappoints, it is likely to impact the stock market and the overall sentiment towards risk assets. Investors may sell stocks and other risky assets in favor of gold, driving its price higher in response. This increased demand for gold, coupled with limited supply, could result in a significant price increase for XAUUSD.

Scenarios for XAUUSD Price Movement on 15th November 2024

Based on historical data and market conditions, the following scenarios could unfold on 15th November 2024:

1. Bearish Scenario: If the US retail sales data disappoints and indicates a contraction in consumer spending, the stock market may experience a selloff. Investors may seek refuge in safe-haven assets like gold, driving up demand for XAUUSD. In this scenario, XAUUSD could experience substantial price gains, as investors seek to protect their portfolios against market instability and a potential economic downturn.

2. Neutral Scenario: Conversely, if the US retail sales data surprises to the upside and indicates stronger than anticipated consumer spending, it could boost investor sentiment and weaken the demand for gold. In this scenario, XAUUSD may experience a decline, as risk appetite increases and traders move away from defensive assets.

3. Bullish Scenario: In a scenario where the US retail sales data meets or exceeds market expectations, it could lead to a positive reaction in the stock market, boosting investor confidence and driving risk-on sentiment. In this scenario, XAUUSD may face selling pressure as investors rotate out of gold and into riskier assets.

Previous released data results :

On last Retail sales data (17-10-2024) we predict good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 51 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/15589

Performance : https://t.me/calendarsignal/15606

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11