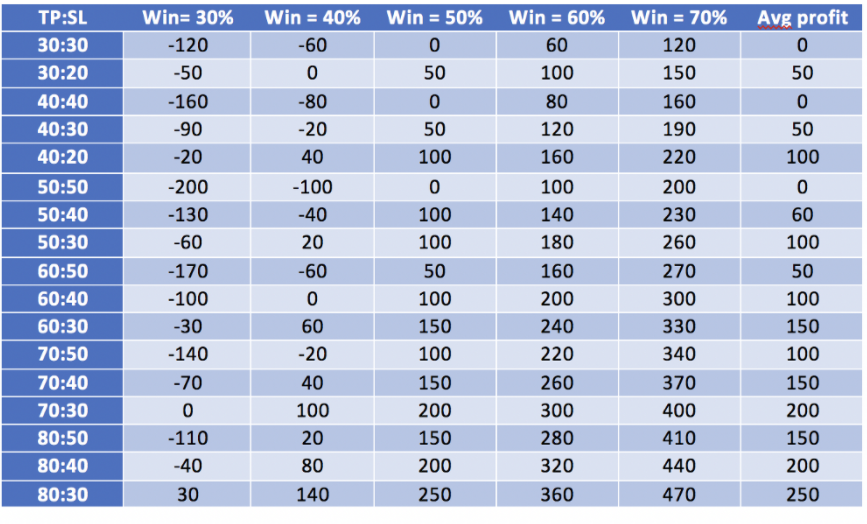

Exactly how can you be profitable in Forex trading? Consider this table and study it well– it might change your trading permanently! In it, you have earnings and losses in pips for different combinations of TP: SL (take revenue target and stop loss range, in pips) for different win rates. The profits are given in pips for a total amount of 10 professions. When you have checked out it enough, read on for very crucial insights on how to become profitable in foreign exchange trading. A must review!

The win rate and your trading edge

It is possible to become systematically profitable in Forex trading with MANY strategies and systems. Some trade 10 times per day and stare at the screen all the time so that they get very tight entries, others place 10 trades per week, others 10 trades per month. Some use indicators, others watch for “patterns” (head and shoulders, double top/bottom, pennant, etc.), others use pure price action, others use moving averages, some trade the news, some are macro position traders, and so on. In ALL these “styles” there are systematic winners, occasional winners, and systematic losers. One thing is sure: it takes NO skill to place one profitable trade, or even one week of profitable trades. What we want is to become systematic…

Obviously, what we would prefer is to have a better-than 50% win rate. Ideally this is indeed the case, but what is likely to happen is that your win rate will vary per week. One week, you may have a 30% win rate (3 winners out of 10) and another week, you will have a 70% win rate. What you want is to 1) be profitable, on average; 2) survive losing streaks to have money to benefit from the Law of Large Numbers and the power of probabilities.

Your trading strategies must allow for generally good entries, which means they improve the probability of the trade moving into profit after entering and hitting your profit target relative to a coin toss and they limit losses relative to profits. The 80:30 system seems like a miracle: you are in profit even with a 30% win rate… the problem is that setting 30 pip stop losses and “far-away” profit targets (relative to SL) increases the probability of price hitting your SL before it hits your TP (even it indeed goes “in your desired direction” in the end!), so you may indeed get an average of 30% win rate in the long run, or even worse… unless you become very good at entries, which IS possible, of course. This means you use multiple time frames (daily, h4 and h1, for example), you identify trades in the upper time-frames and your market analysis and you “fine tune” down to h1 and even more precise, perhaps the 30 min chart. This is fine — it is all a matter of style and preferences.

Feel in one’s bones that these numbers are not “magic”: whatever you do, if the SL is “much closer” than your revenue target, you are lowering your standard win price. The lessons to obtain from this simple table are vital and crucial.

Worst case and averages

One thing to look for is what will happen to your account when your win rate is low. Here I put 30% as the worst case, but of course it could be as low as 0 winners out of 10 on the worst days or weeks. This can happen if you have a rigid strategy that you try to apply in all market conditions. For example range trading and “picking tops and bottoms” in trending markets or vice versa. Trying to “capture” the market with one overriding strategy is not a good idea. Stay open, curious, and flexible.

Looking at the “worst” weeks (intending worst is 30%), we see that it is worse when SL and TP distances are similar, which indicates reduced reward-to-risk. Once more, this appears like magic, but it is not that simple: possibilities of striking an offered cost target is a function of range (as well as other points). Note that a number of successful techniques by hedge funds utilize further-away SL than TP targets, often massive differences, like 200 SL and also 100 TP. They do this since their probabilistic designs recommend that this approach is a champion, generally, as a result of low-probabilities of striking the SL. Yet they have the funds to survive the draw downs and losses– you possibly don’t;-RRB-.

So. Offered this reality of retail traders, we most likely desire 1) further-away TP than SL, bearing in mind that way too much distinction tilts the odds towards the SL being struck because of natural “wiggle area” throughout a longer open trade period, and also 2) a method that turns the chances of rate going in the direction of the profit target quickly after entering the trade and copulating to it. You require some kind of prejudice that a minimum of matches a coin throw (50% win rate), DESPITE HAVING SL more detailed than TP. There are several feasible strategies to such an approach.

I favor simplicity and also no indications. I utilize weekly, daily, h4, and also h1 graphs. Each week, I develop a market prejudice per money based upon a mix of chart analysis, macroeconomic analysis, and also what I call “flavour of the week” story (what is the marketplace focused on currently?).

Markets move from fixation to fixation. They panic over something one day, then 1 week later, they couldn’t care less… Like I tell my Forex students on my online program and associated private Forex trading fb page, markets are like a teen with serious attention deficit issues and compulsive-erratic-emotional behavior. One week or month it is Euro risk and French elections, then it is Trump woes, then jobs, then the brightening picture in the UK, then they remember that Brexit has not even “really started yet” and they freak out about that, only to forget all about it until it resurfaces due to negotiations or other events… then it’s oil… the supply glut will make oil plummet… no global growth and OPEC will make oil skyrocket… Oh and look at the Fed that is talking about the balance sheet… is the jpy now on a long run trend of depreciation because BOJ is printing to increase inflation?… and on and on and on… it’s hilarious! LOL… I call these “flavour of the week” and they drive short run sentiment, which is one layer on top of the more fundamental macro picture and macro news. In the end, all these mood swings are visible in the charts, trends, and so on. When you get all this and you can analyze charts properly by “seeing” bull or bear market control and potential for reversal or continuation, you can always understand what is going on and place good trades.

OK. We want the worst case to be tolerable, so that seems to leave us with 30:20, 50:30, 60:30, 70:40, 70:30, 80:50, 80:40 approx. If you are a day trader who wants to enter several trades per day, you will go 30:20 or lower. For traders wanting to place trades that are open for approx 3 hours to 3 days, you will go with the others. If you want to do macro position trading which requires more macro-financial analysis, you will go in the higher ranges, perhaps 150:70, 300:100, etc. Note that these are approximations… you should set SL “on the other side” of support / resistance levels and your profit targets “before” them, which are seen visually and also on round numbers, main MAs (14, 21, 50, 100) in h1, h4, and d1 charts, etc.

I personally do both turn trading and also macro placement trading and I locate that the wonderful area for me for swing trading is approx 70:40. Currently note that 70 pips of traveling is a great distance that can often take as little as one hour or as high as a full week, when the array is extremely limited and the market is undecided. The 30% win rate productivity of a 70:40 strategy is -70 pips, while the standard is +150 as well as the best weeks are +370 pips. Keep in mind that you can play with your system to adapt to the market as things occur. Constantly be open and flexible. For example, when I see that the market is moving highly in favor of my profession as well as I think the short run macro fundamentals and also “flavor of the week” support the momentum, I sometimes put the profession at recover cost or a little in earnings and also I set a massive earnings target, like 200 or 300 pips, based on graph evaluation. It then ends up being a low-probability bet with high possible revenue and absolutely no danger. Yet don’t do this constantly, since your win rate will certainly endure as well as your standard success will certainly go down! It’s an art!

Remember that stop loss ranges of 20 pips or less are extremely revealed to quit searching. Place those professions just in very liquid markets (weekday early mornings, New York city time and all day 8 to 5 for Europe). When market volume is higher, there is much less danger of cost manipulation as well as stop hunting. Like and share to show appreciation!