As of writing, the U.S. PCE Inflation, GDP, and S&P Global Services PMI data are yet to be released (13:30 GMT). Markets are positioning cautiously. Based on current expectations of strong U.S. macroeconomic data and easing geopolitical risk, our bias suggests potential downside pressure on XAUUSD.

Today’s given signal : https://t.me/calendarsignal/23733

Why We Anticipate Downside Pressure in Gold

1️⃣ Strong PCE Inflation Data

The PCE index is the preferred inflation gauge of the Federal Reserve. If PCE prints firm or above expectations, it reinforces the “higher-for-longer” rate narrative. Elevated interest rate expectations push U.S. Treasury yields higher, strengthening the dollar. Since gold is a non-yielding asset, higher yields typically reduce its attractiveness.

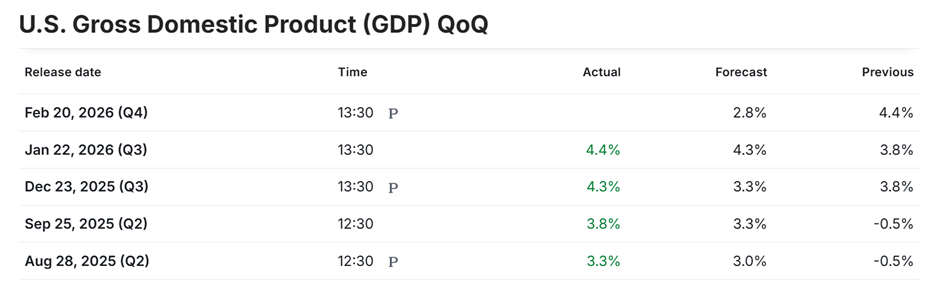

2️⃣ Robust GDP Growth

A strong GDP figure signals economic resilience. When growth remains solid, recession fears ease and capital rotate into equities and risk assets rather than safe havens like gold.

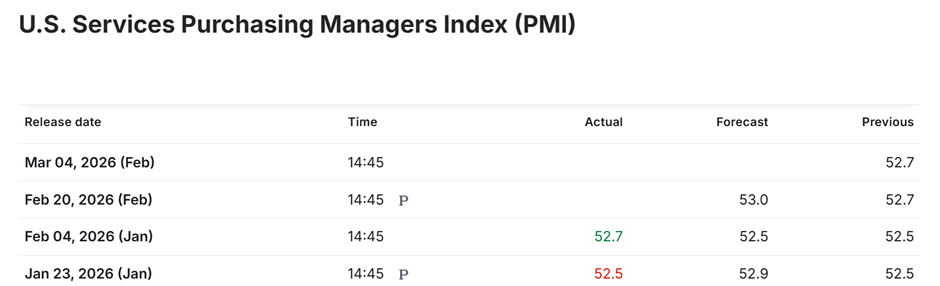

3️⃣ Strong S&P Global Services PMI

The U.S. economy is heavily service-driven. A strong services reading confirms continued expansion, supporting USD strength and pressuring precious metals.

4️⃣ Geopolitical Risk Premium Fading

Recent rhetoric involving Iran and the United States—including statements from Donald Trump—appears more political signaling than imminent military escalation. If markets perceive low probability of conflict, safe-haven demand may unwind, removing a key support pillar for gold.

Post-Release Scenarios for Gold & XAUUSD

Post-Release Scenarios for Gold & XAUUSD

🔻 Scenario 1: Data Beats Expectations (Bearish Gold Case)

- USD strengthens sharply

- Bond yields rise

- Rate-cut expectations pushed further out

- Risk sentiment improves

Impact on XAUUSD:

Gold could experience a swift decline. For example, if XAUUSD trades near $2,020 before release, strong data could push prices toward $1,980 initially, with extended downside toward $1,950 if momentum accelerates.

This would reflect a classic macro-driven selloff: stronger growth + sticky inflation = stronger dollar = weaker gold.

🔺 Scenario 2: Data Misses Expectations (Bullish Gold Case)

- USD weakens

- Yields fall

- Rate-cut bets increase

- Safe-haven demand rises

Impact on XAUUSD:

Gold could rally aggressively. A move from $2,020 toward $2,050–$2,070 becomes possible if markets interpret weak data as economic slowdown risk.

Example of Market Reaction

If PCE prints above forecast while GDP surprises to the upside, traders may immediately price out near-term Fed cuts. In such a case, algorithmic selling could trigger a $25–$40 intraday drop in gold within minutes of the 13:30 GMT release.

Previous released data results :

On last US core PCE & GDP data (22-1-2026) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 137 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/u-s-gdp-pce-data-in-focus-as-trump-signals-soft-approach-on-greenland-22-1-2026/

Check last given signal : https://t.me/calendarsignal/23094

Performance : https://t.me/calendarsignal/23123

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11