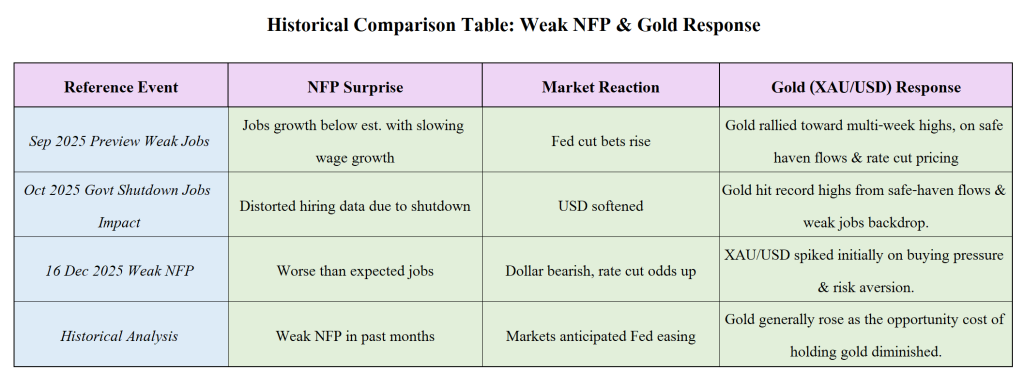

Below is a **blog-style analysis explaining how bad U.S. NFP data on 16th December 2025 could push gold higher (XAU/USD), the reasons behind the weak jobs numbers, key factors driving the reaction, scenario analysis, and a historical comparison table showing past gold reactions to weak payrolls.

Today’s given signal : https://t.me/calendarsignal/22386

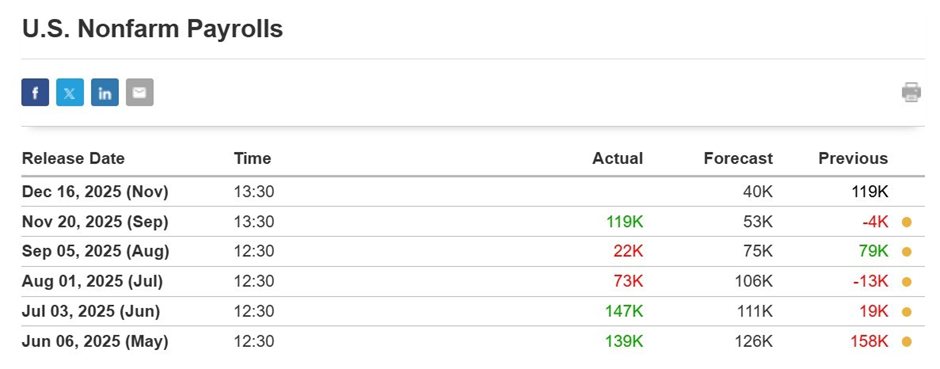

US NFP Data – Key Numbers

• Nonfarm Payrolls (Nov):

40K (vs 119K expected)

• Unemployment Rate:

4.5% (vs 4.4% prior)

• Average Hourly Earnings(MoM):

0.3% (vs 0.2% expected)

• Participation Rate:

62.4%

How NFP Influences Gold (XAU/USD) — Key Mechanics

The connection between jobs data and gold can be understood through several channels:

• USD and Interest Rates

When NFP is weak, the U.S. dollar tends to weaken as traders price a more dovish Federal Reserve. Since gold is priced in dollars, a weaker USD makes gold cheaper for foreign buyers, often boosting demand.

• Safe-Haven Demand

Slowing job growth signals economic risk. Thus, institutional and retail investors often move into safe-haven assets like gold when growth prospects dim.

• Carry Cost and Opportunity Cost

Lower interest rates (or expectations of cuts) reduce the opportunity cost of holding a non-yielding asset like gold. This typically lifts gold’s appeal relative to bonds or cash holdings.

Quick Interpretation

- Jobs growth came in much weaker than expected — only 40K vs 119K forecast — signaling a slowing labour market.

- Unemployment ticked up, confirming cooling employment conditions.

- growth surprised to the upside, but this wasn’t strong enough to offset the weak headline jobs number.

Gold Price Action on Lower NFP & Higher Unemployment data:

The weak NFP headline outweighed firm wages, leading to USD weakness and lower bond yields. This shift boosted Gold buying interest, as traders priced in stronger odds of Fed rate cuts ahead.

Possible Scenarios for XAU/USD After Bad NFP

Below are three potential scenarios that could unfold in gold markets:

⛅ Scenario 1: Fed Shifts to Dovish Bias

If the weak jobs data drives markets to price in Fed rate cuts, yields fall, the dollar softens further, and gold surges above key resistance levels as traders chase high-momentum safe assets.

🟡 Scenario 2: Mixed Data & Consolidation

Gold might temporarily retrace gains if later economic indicators (like CPI or retail sales) show unexpected strength. Here, XAU/USD could remain range-bound before trending up again when macro trends clarify.

🔴 Scenario 3: Macro Pivot Reversal

If upcoming reports unexpectedly improve (strong inflation or jobs rebound), dollar strength may resume, putting downward pressure on gold despite today’s weak NFP.

Previous released data results :

On last US NFP data (20-11-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 164 points according to the signal we gave.

Check the previous blog :https://blog.forextrade1.co/xauusd-under-pressure-market-reacts-to-robust-us-nfp-report/

Check last given signal : https://t.me/calendarsignal/21752

Performance :https://t.me/calendarsignal/21788

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11